In the great tide of market narratives, where stories of triumph and partnership are spun with the ease of a loomworker crafting silken threads, there lies a tale of quiet neglect. ON Semiconductor (NASDAQ: ON), once heralded as a beacon of innovation in silicon carbide (SiC) chips, now finds itself adrift in the murky waters of investor indifference. Its name, alongside that of Navitas Semiconductor (NASDAQ: NVTS), was inscribed in the annals of Nvidia’s partnerships for the development of next-generation data centers-yet while Navitas’ stock soars like a gilded phoenix, ON Semiconductor’s shares have plummeted, as if weighted by leaden chains.

A Forgotten Legacy

Why does this company, with its storied history and robust valuation, fail to capture the imagination of those who wager fortunes on the caprices of the market? The answer is not to be found in malice or incompetence but rather in the cold calculus of perception. Navitas, though still unprofitable and unlikely to see profitability until 2027, dazzles investors with promises of future glory-a mirage shimmering on the horizon. Meanwhile, ON Semiconductor, burdened by the very tangibility of its achievements, suffers under the yoke of an unforgiving present.

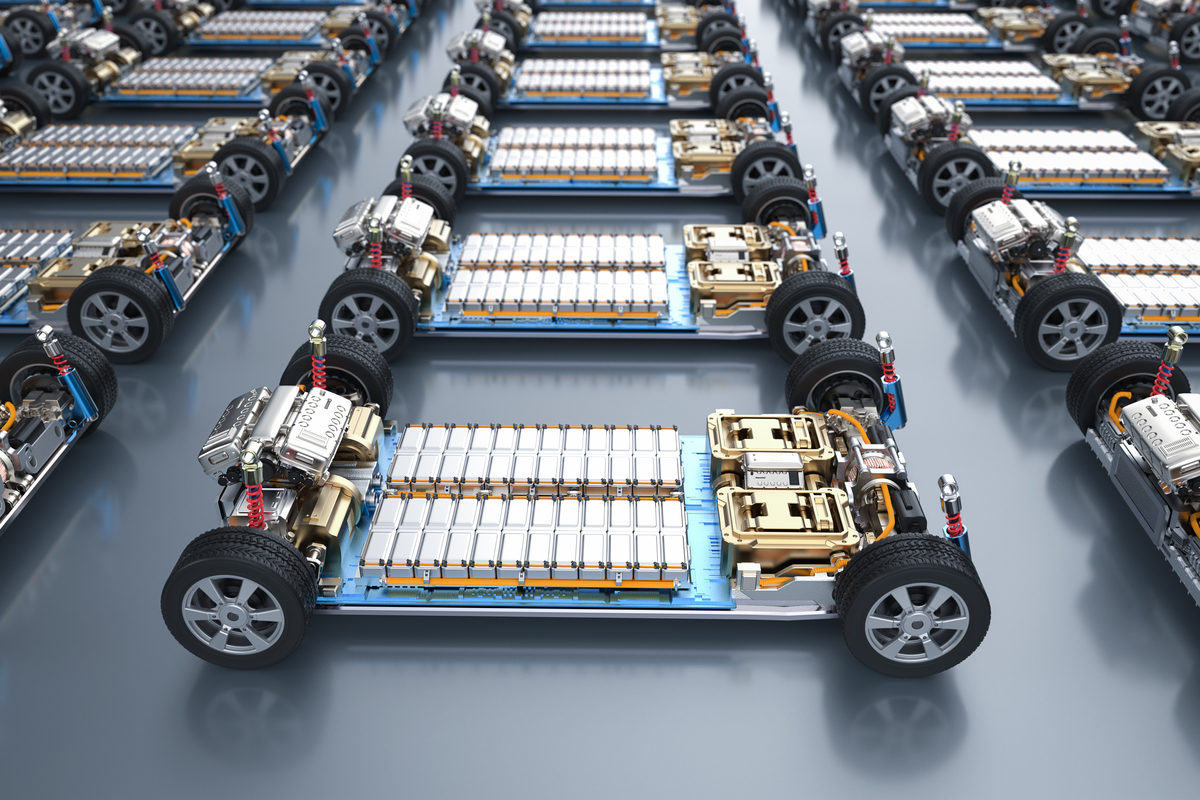

The truth of ON Semiconductor’s plight lies buried beneath layers of systemic neglect. Its core market, tethered to the electric vehicle (EV) industry, has become a casualty of broader economic forces. High interest rates, which render automobiles prohibitively expensive, coupled with automakers’ cautious production cuts, have conspired against it. These forces, impersonal yet inexorable, grind down even the most resilient of enterprises.

The chart below reveals the grim reality: year-on-year declines in automotive-related revenue persist, a testament to the fragility of markets built upon shifting sands.

Flickers in the Darkness

And yet, amidst this desolation, faint glimmers of hope emerge-though they are obscured by the prevailing gloom. First, CEO Hassane El-Khoury, ever the cautious steward, speaks of “signs of stabilization” across end markets. Sequential growth, though modest, hints at the possibility of recovery. Automotive revenue, too, defies expectations, suggesting that the tide may yet turn.

Second, the Nvidia partnership, though overshadowed by the clamor over EV woes, underscores the latent potential in ON Semiconductor’s industrial-based sales. As El-Khoury himself declared, the company stands alone among U.S. power semiconductor suppliers in addressing the burgeoning demand for AI infrastructure-a domain where intelligent power semiconductors reign supreme.

Third, despite the tempest raging around it, ON Semiconductor remains a paragon of operational discipline. Management’s commitment to converting 25% of revenue into free cash flow by 2025 speaks volumes about the company’s resilience. Analyst forecasts suggest a valuation of just 14.5 times FCF in 2025-a figure incongruous with the long-term prospects of such a stalwart enterprise.

A Redemption Deferred

To invest in ON Semiconductor today is to embrace uncertainty, to walk the razor’s edge between despair and redemption. The EV market, beset by challenges, will one day awaken from its slumber, ushering in a new wave of investment that could revive the company’s fortunes. Yet for now, the narrative remains mired in pessimism, a victim of the market’s cruel myopia.

There is a certain irony in the fact that a partnership with Nvidia-a titan of innovation-has been relegated to the periphery of discourse. Were the company’s story untethered from its EV associations, perhaps its stock would bask in the same radiance as others. Wall Street, ever fickle, projects earnings growth of 29% in 2026-a prophecy whose fulfillment could elevate the stock to heights unseen. But until then, ON Semiconductor must endure its purgatory, a silent sufferer in a world deaf to its cries.

And so, we bear witness to the quiet tragedy of a company caught between the gears of circumstance and perception. In time, the scales may tip in its favor-but until then, let us remember that even the mightiest trees can bend beneath the weight of storms unseen. 🌳

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-16 10:53