- Behold the wonder of Bitcoin: now outperforming U.S. 30-year Treasury Bonds—an undeniable macro signal.

- U.S. Senator Lummis and former Treasurer Rios have backed Bitcoin as a reserve asset, further fueling its bullish streak.

Oh, the marvel of modern finance! Bitcoin, the charming rogue of the currency world, has now outstripped the venerable 30-year U.S. Treasury Bond in yield performance. Truly, what a delightful spectacle for the financial elite.

For those who believed Bitcoin was merely a fleeting fancy, this newfound ascent is a spectacle to behold. It suggests that the cryptocurrency might just be more than a speculative dalliance and could, heaven forbid, be evolving into something of substance.

As the once mighty bond yields trail behind, Bitcoin, the enfant terrible of investment, is becoming increasingly difficult for institutional investors to ignore. Who knew that the digital currency would eventually make even the most serious financiers sit up and take notice?

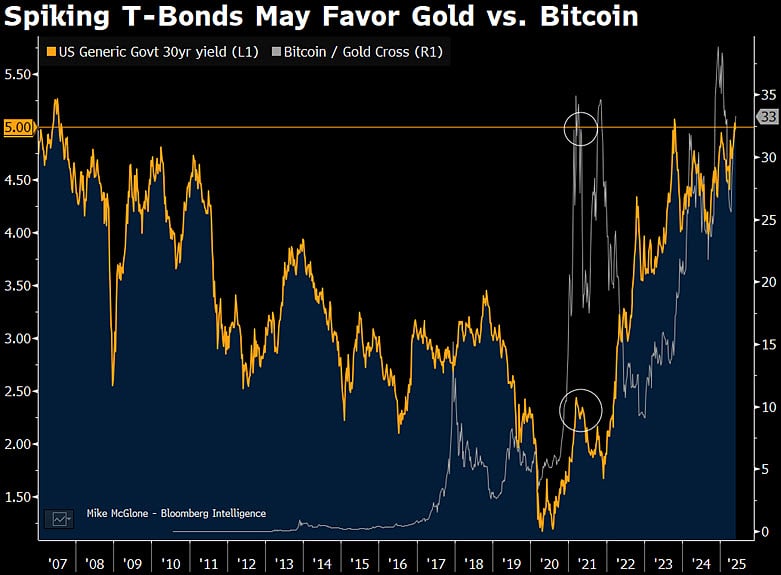

And it’s not merely about the numbers. Bitcoin’s price movements are increasingly echoing the glimmering stability of gold, a subtle nod to its rising status as “digital gold”—how precious!

Gold and Bitcoin Dance Together

The most delicious part of this narrative is Bitcoin’s growing affinity with gold, an asset that has long been a safe haven. Both now move with a certain synchrony, almost as if they are partaking in a financial waltz. But this is no coincidence—it’s the clever investor’s hand at work.

The appeal of Bitcoin as a hedge is no longer a mere whisper in the corridors of finance; it’s becoming a mainstream chorus. The world is waking up, and, oh, isn’t it amusing!

Senator Lummis and the U.S. Treasurer Sing Bitcoin’s Praises

The ever-daring Senator Cynthia Lummis made waves with her bold proclamation that the U.S. should hold 5% of the global Bitcoin supply, much like its gold reserves. A suggestion that seems almost too radical to be true—except, of course, it’s not.

And she was not alone in her musings. Former U.S. Treasurer Rosie Rios, ever the visionary, weighed in with her now-famous declaration:

“Bitcoin is here to stay… The train has left the station.”

Such statements from high-ranking officials are more than just curious remarks—they signal the growing recognition that Bitcoin might very well find itself included in national reserves, much like gold before it. How utterly fascinating, isn’t it?

Institutional Investors Jump Aboard the Bitcoin Train

Since the dawn of May, Bitcoin’s Open Interest has soared to impressive heights—an unmistakable sign that institutional demand is rising. How delightfully predictable that the big players are finally catching up.

With yields surpassing long-term bonds and increasing political backing, Bitcoin is swiftly positioning itself as a serious contender for the coveted title of reserve asset.

The stage is set for a potential bullish breakout, as macroeconomic shifts and ever-stronger legislative support combine to send Bitcoin’s price soaring. A future of untold riches, one might imagine.

So, What Does the Future Hold for Bitcoin?

As Bitcoin continues to outpace traditional assets and its bond with gold strengthens, the financial world is beginning to view it through a new lens. Could this be the dawn of a new era?

If politicians continue to champion Bitcoin’s inclusion in national reserves, it might just follow the path once trodden by gold—solid, reliable, and, most importantly, incredibly valuable. Truly, who would have thought?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-05-28 22:20