MP Materials (MP), that once stalwart of American industry, experienced a significant decline in its stock price-a dramatic 9% drop-by three in the afternoon this past Friday. The cause of this financial tremor? A report in the venerable Financial Times, which chronicled a new, unexpected threat to MP’s grand ambitions in revitalizing the American rare earth mining industry, and its ongoing attempts to produce magnets domestically.

The Coming Storm: Could Niron Usurp MP’s Position?

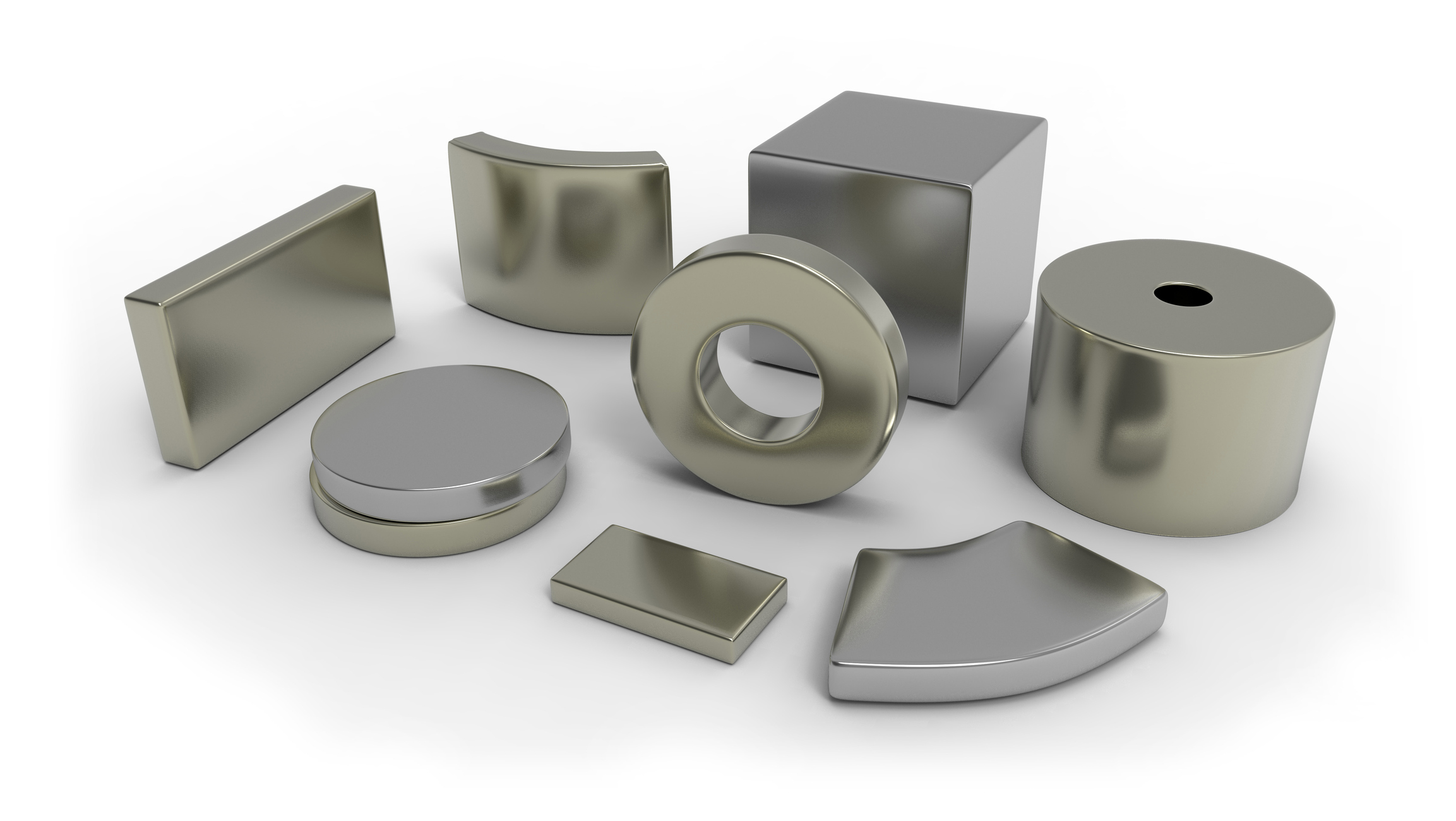

In the cold, calculating world of industry, competition does not announce its arrival with the fanfare of a grand parade. Instead, it creeps in like a shadow across a quiet dawn. Such is the case with Niron Magnetics, a fledgling enterprise poised to challenge MP’s grip on the rare earth magnet market. An ambitious coalition of Stellantis, General Motors, Volvo, and Samsung have seen fit to invest $150 million in Niron’s enterprise, which seeks to produce magnets from the mundane elements of iron and nitrogen, as opposed to the rare and elusive elements that MP Materials has so eagerly staked its future upon.

But here, the intrigue deepens: Niron has not only captured the attention of some of the world’s largest industrial players, but has also won the favor of government entities, securing nearly $70 million in tax incentives and subsidies. Their facility, soon to rise in Minnesota, will boast the ability to produce 1,500 tons of these iron-nitride magnets annually, promising to deliver a product 18% more powerful than rare earth magnets, yet at a fraction of the cost.

The Investor’s Dilemma: To Sell, or Not to Sell?

Yet, let us not be so quick to pass judgment on MP Materials, nor to abandon its stock in favor of the dazzling promise of Niron. The investor-seasoned and wise-does not act on impulse, but rather surveys the situation with the keen eye of one who has witnessed many such storms in the market. While Niron’s claims have ignited a spark of excitement, particularly in light of their superior magnet performance, these assertions are drawn from laboratory tests, not the trials of mass production. The future remains uncertain, and the question must be asked: can Niron scale its technology? Can it produce at the promised volumes and price points, and will the product live up to its heralded potential once it reaches the broader marketplace?

Moreover, let us not forget that MP Materials is no novice in the game. It has garnered significant support, not only from private industry but also from the U.S. government, which has seen fit to take an equity stake in the company. The company has already made considerable investments in its mining and manufacturing infrastructure, positioning itself as a leader in the field, far ahead of the mere spark of competition that Niron currently represents.

True, if Niron’s ambitions materialize, there could indeed be risk to MP. But the “if” remains a monumental question, and one which, for now, remains unanswerable. In the world of investment, as in life, the future is a mist, and to make a decision based on untested promises is an act of blind faith. In the absence of hard evidence, the prudent investor would do well to retain their position, for in the world of industry, nothing is ever as certain as it appears at first glance.

And thus, the story unfolds-an ongoing drama where ambition and risk intertwine, where fortunes rise and fall on the shifting tides of technological innovation. It is a story that has been told before, and will be told again. The only question that remains is whether MP Materials will emerge victorious or whether a new contender will seize the mantle. Time, as always, will tell. ⏳

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-09-26 23:17