The year unfolds, a restless spirit stirring within the markets. Barely a month passed, and already the geopolitical winds buffet us, a familiar dance of anxiety and speculation. Yet, beneath the surface tumult, a peculiar current is taking hold – a rotation, a shifting of affections. It is as if the very soul of investment is undergoing a crisis of conscience.

For some time now, the so-called ‘Magnificent Seven’ – those darlings of the artificial intelligence boom – have held court. But even empires built on the promise of boundless innovation are susceptible to the gnawing doubts of reality. The whispers have begun: are these valuations merely phantoms, inflated by an insatiable appetite for the new? Is the infrastructure required to sustain this digital fever dream consuming itself, a monstrous engine devouring its own fuel? Perhaps, after all, there is a limit to the returns of the purely ethereal.

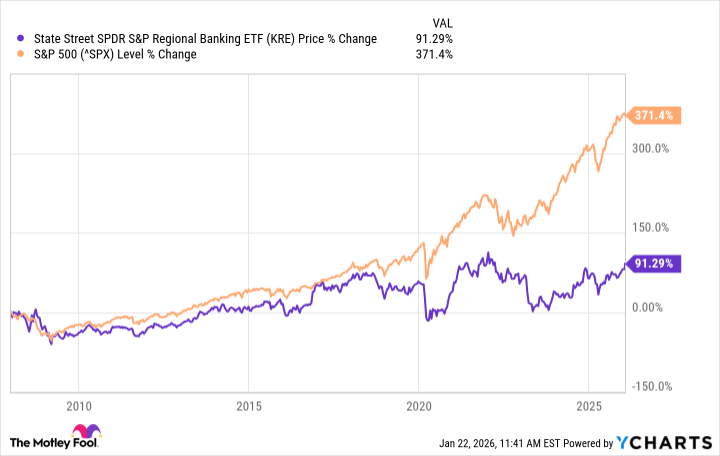

And so, the gaze of capital, ever fickle, has turned toward a sector long relegated to the shadows – banking. A sector, it must be said, that has endured nearly two decades of quiet suffering, a purgatory of underperformance. A strange irony, is it not, that the very institutions entrusted with the lifeblood of commerce should themselves appear so…anemic?

A Flicker of Redemption?

For those who have long borne the weight of bank stocks in their portfolios – years of languishing returns, of watching others prosper while they merely endured – this nascent rally must appear as a mirage in the desert. A cruel trick of the light, perhaps? Or something…more?

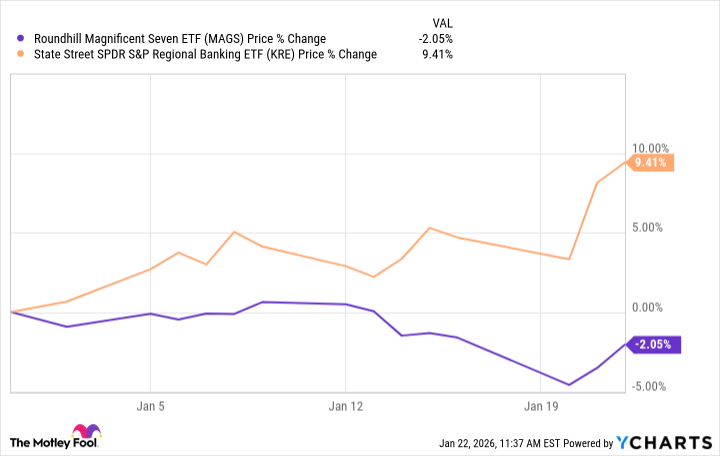

The State Street SPDR S&P Regional Banking ETF (KRE 3.32%) has, indeed, begun the year with a vigor that shames the Roundhill Magnificent Seven ETF (MAGS +1.06%). It is as if investors, weary of the speculative heights of the digital realm, are seeking refuge in the seemingly solid foundations of…well, banks. But is this merely a temporary flight from fancy, or a genuine re-evaluation of value?

The scars of the past run deep. The Great Recession, of course, remains a haunting specter. And the subsequent scandals – the phantom accounts of Wells Fargo, the sudden collapse of Silicon Valley Bank – have served only to deepen the public’s distrust. The sector has, in a sense, become burdened by its own history, a pariah haunted by its past transgressions.

Yet, there is a curious stillness surrounding the banks now. They have retreated from the limelight, no longer the targets of political outrage. And the current administration, in a move that borders on the audacious, has signaled a willingness to embrace mergers and acquisitions, and even to relax regulatory constraints. A dangerous game, perhaps? Or a calculated gamble to unleash the forces of capital?

The yield curve, too, is offering a subtle encouragement. As the Federal Reserve cautiously lowers interest rates, longer-term bond yields have remained stubbornly high, creating a steeper curve. A signal, perhaps, that the market anticipates a period of sustained economic growth, even at the risk of rising inflation. A desperate attempt to outrun the mounting debts of the nation?

Banks, after all, thrive on this disparity. They borrow at the short end of the curve and lend at the long end, profiting from the difference. A seemingly simple equation, yet one that has eluded them for far too long. Is this, then, the moment they finally reclaim their rightful place in the financial order?

The Illusion of Stability?

To predict the future with any certainty is, of course, a fool’s errand. But the conditions appear, at least for the moment, to be aligned in favor of a continued banking resurgence. There are no immediate signs of distress in bank credit, and the sector, as a whole, is in far better shape than it was during the depths of the Great Recession. They may even, dare we say, embrace the very technologies that once threatened them, automating their operations and harnessing the power of artificial intelligence.

But let us not be lulled into a false sense of security. A sudden recession could shatter this fragile equilibrium. The markets are fickle creatures, and the allure of artificial intelligence may prove too strong to resist. The pendulum, after all, always swings back.

For those investors seeking to capitalize on this potential shift, I would suggest looking beyond the larger, more established bank stocks. Their valuations are already stretched, and the potential for further gains is limited. Instead, focus on the smaller, mid-cap banks – those that have been forgotten, overlooked, and left to languish in the shadows. They may hold the greatest potential for consolidation and growth. A quiet revolution, perhaps, unfolding beneath the surface of the financial world.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-26 10:52