Many years later, as the algorithms began to weep digital melancholy, old Mateo, a man who counted dividends like rosary beads, would recall the peculiar stillness that settled over the markets in the late autumn of 2025. It wasn’t a silence of peace, but a premonition, a dampness in the air that tasted of metallic dust and forgotten promises. He remembered, as if it were yesterday, the scent of overripe guavas mingling with the sterile aroma of server farms, a strange confluence that signaled a reckoning was brewing. The world, seemingly flush with prosperity, had forgotten the rhythm of true scarcity, the ancient dance of feast and famine. The numbers, those cold, unfeeling deities, were beginning to whisper a different tune.

For months, the pulse of the American labor market had weakened, a subtle fading of vitality that went largely unnoticed amidst the clamor of quarterly reports and inflated valuations. The steady drumbeat of job creation – a hundred thousand souls added to the rolls each month, a rhythm as reliable as the trade winds – had become a hesitant stutter. From May to December of that year, a mere 93,000 new positions bloomed across the nation, an average of just 11,625 per month. A paltry harvest, really, considering the vast fields ripe for cultivation. Worse still, in three of those seven months – a cruel symmetry – the numbers had actually contracted, a chilling breeze sweeping through the ledger books.

| Month | Non-Farm Payroll Monthly Change |

|---|---|

| June 2025 | -13,000 |

| July 2025 | +72,000 |

| August 2025 | -26,000 |

| September 2025 | +108,000 |

| October 2025 | -173,000 |

| November 2025 | +56,000 |

| December 2025 | +50,000 |

Old Mateo, who had seen more cycles than he cared to remember, recognized this pattern. It was a signal, a ghostly echo of past misfortunes. This “three in seven” anomaly – a fleeting darkness in the statistical heavens – had only occurred three times in the preceding forty years, each instance preceding a period of considerable hardship. He recalled the whispers in the cantinas, the stories of fortunes lost and futures dimmed. September 1990 to November 1991, April 2001 to December 2003, and January 2008 to December 2010 – each a chapter in a long, sorrowful book.

And now, it was happening again. The fourth instance, a grim repetition of fate. A seasoned dividend hunter like Mateo knew this wasn’t merely about GDP growth or unemployment figures. It was about the erosion of confidence, the subtle shift in the collective psyche. It was a warning that the easy money was ending, that the tide was turning, and that the patient investor must prepare for leaner times.

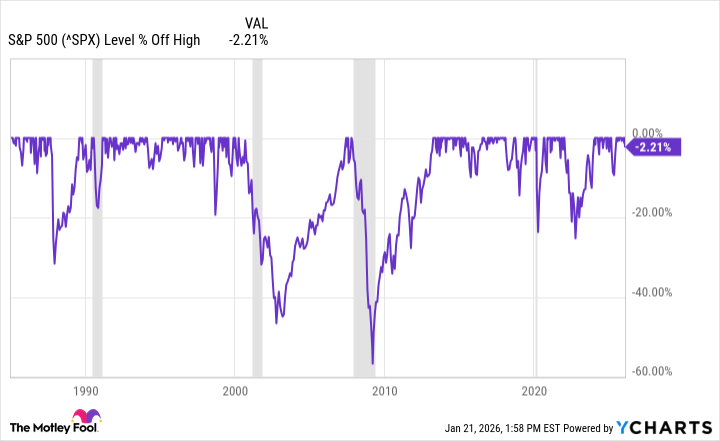

The previous recessions, each a unique tragedy, had inflicted their own wounds. The early 1990s, a relatively mild affair, saw the S&P 500 dip by a mere twenty percent. The tech bubble’s bursting, however, was a more brutal spectacle, the index plummeting nearly fifty percent, while the Nasdaq-100 suffered a far deeper collapse. But it was the financial crisis of 2008 that left the deepest scar, the S&P 500 losing more than half its value. Mateo remembered the faces of the men who had lost everything, the quiet desperation in their eyes.

Even now, with stocks still hovering near their peaks, and the economy seemingly robust, Mateo felt a growing unease. The surface tranquility masked a deeper turbulence. He knew that markets, like rivers, eventually change course. This signal, this fleeting darkness, wasn’t merely a statistical anomaly; it was a prophecy, a whisper from the ghosts of recessions past. A prudent investor, he thought, would begin to fortify his defenses, to seek shelter in those companies that consistently returned capital to shareholders, those steadfast beacons of value that weathered every storm. For the rain, he knew, was coming.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Where to Change Hair Color in Where Winds Meet

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-01-28 08:22