![]()

The fever dream of artificial intelligence…it descends upon us, doesn’t it? Not as a sudden revelation, mind you, but as a slow accumulation of promises, a creeping sensation that we stand upon the precipice of a new age. We’ve tasted such illusions before, haven’t we? The internet, once hailed as the great leveller, merely redistributed power and amplified the existing cacophony of human folly. This current surge…it feels different, yes, but the core human weakness – the insatiable hunger for novelty, the willingness to believe in miracles – remains stubbornly, tragically constant.

The markets, naturally, are gripped by a familiar mania. Optimism blossoms into speculation, a fragile flower easily withered by the cold breath of reality. To label this a ‘bubble’ is perhaps too simplistic. Bubbles pop. This feels more like a slow, agonizing inflation, a stretching of credulity until it threatens to tear. The technology itself is not the issue, understand. It is the valuation, the grotesque distortion of potential into present worth. A dangerous game, played with the fortunes of men.

Yet, amidst this swirling vortex of hope and delusion, there exists a singular entity, a quiet force that anchors the entire spectacle. Taiwan Semiconductor Manufacturing (TSM 2.66%)… it is not merely a company, but a necessary condition. A reluctant participant in our collective madness.

The Weight of Silicon: TSMC’s Role

Consider the tools of this new intelligence, these applications that promise to reshape our world. They are, at their heart, insatiable beasts, demanding a constant diet of data. This data is not ethereal; it resides within the cold, unforgiving architecture of data centers, within the intricate pathways of silicon. Graphics processing units, AI accelerators, central processing units… these are the organs of this new intelligence, and TSMC is the hand that crafts them.

Companies may design these components, yes, but they all, ultimately, rely on TSMC to manifest them. It is a virtual monopoly, not born of malice or conspiracy, but of sheer, unyielding competence. They possess the expertise, the scale, the relentless pursuit of precision that few others can match. It’s a lonely position, being the essential cog in a machine driven by irrationality.

Beyond the Hype: A Foundation of Reality

Should this artificial spring falter, should the hype dissipate and the markets correct, many companies will be left exposed, scrambling for survival. TSMC, however, will endure. Apple will still require chips for its sleek devices; Nvidia will continue to push the boundaries of graphical power; Tesla will pursue its dream of autonomous vehicles; Broadcom will maintain the infrastructure of our connected world. These are not fleeting trends; they are fundamental forces.

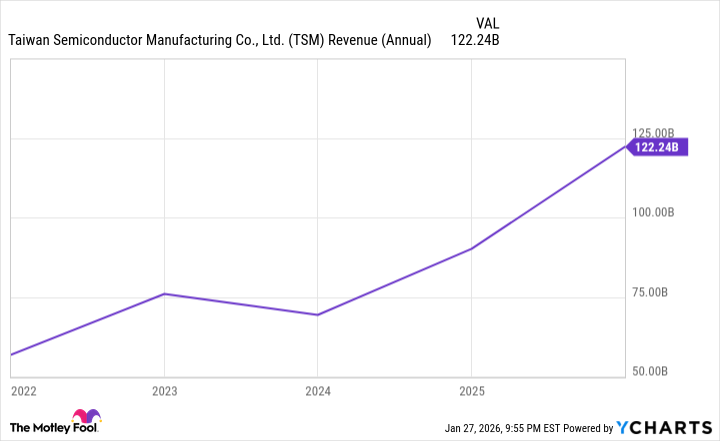

AI-related revenue has, undoubtedly, bolstered TSMC’s recent performance. 2025 was a record year, exceeding $122 billion in revenue – a nearly 36% increase. But to view TSMC solely through the lens of artificial intelligence is to misunderstand its true significance. It is a foundation, a bedrock upon which countless technologies are built.

A slowdown in the AI sector would undoubtedly impact TSMC’s growth trajectory. But it would not be a fatal blow. The demand for semiconductors will persist, driven by the relentless march of technological progress. As long as TSMC continues to invest in innovation and expand its capabilities, it will remain the dominant force in the industry. It is a sobering thought, isn’t it? That in a world obsessed with the ephemeral, the truly enduring qualities are those of competence, precision, and unwavering commitment to the mundane.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

2026-02-01 18:52