![]()

The earnings season descends, and with it, the usual frenzy. Yet, this time, the focus isn’t merely on numbers, but on a yearning, a desperate grasping for signs within the burgeoning realm of artificial intelligence. The market, a fickle beast, demands reassurance, a glimpse of substance beyond the shimmering illusion. And Taiwan Semiconductor Manufacturing – TSMC – has offered a fragment of it, a tantalizing whisper in the digital void.

Last week, TSMC released its report, a document freighted with implications. For those invested in Nvidia and Broadcom, it should be a moment of… not jubilation, precisely. More a quiet, uneasy relief. A temporary stay of execution in a market perpetually poised on the brink. The numbers, of course, are presentable. But it is the feeling behind them, the subtle shift in the tectonic plates of the industry, that truly captivates.

Let us delve into the details, not as mere accountants, but as observers of a strange, unfolding drama. A drama played out in silicon and code, where fortunes are won and lost on the whims of algorithms and the anxieties of men.

The Monster’s Yield: A Glimpse into the Machine

TSMC reported revenue of $33.7 billion for the quarter. A figure, in isolation, that means little. It is the context that matters. A sum exceeding expectations by a mere $300 million, yet representing a growth of 25% year over year. A growth that feels… unsustainable. A feverish climb that begs the question: how long can this ascent continue before the inevitable fall?

More intriguing still is the gross margin: 62%. A seemingly innocuous number, yet it speaks volumes about the company’s power. The ability to extract profit even as demand surges, to maintain control in a world spiraling towards complexity. It is a testament to their dominance, a quiet assertion of power that should not be ignored.

The company’s CEO, C.C. Wei, spoke of continued investment in next-generation foundries, framing it as a “multiyear AI megatrend.” A convenient narrative, perhaps. But also, undeniably, a self-fulfilling prophecy. The more they invest, the more they solidify their position, the more they attract capital, and the more they perpetuate the cycle. It is a game of mirrors, a hall of illusions where reality becomes increasingly difficult to discern.

The Pick and Shovel: TSMC’s Shadowy Role

TSMC is not a creator, not an innovator in the truest sense. They are the pick and shovel merchants of the AI gold rush. Nvidia and Broadcom dream up the fantastical machines, but it is TSMC who brings them to life. They are the silent engine driving the revolution, the unseen hand shaping the future.

With a market share hovering around 70%, they hold a suffocating grip on the industry. Nvidia and Broadcom are utterly dependent on their expertise, their ability to fabricate these increasingly complex chips. It is a precarious relationship, a delicate balance of power that could shift at any moment. One misstep, one disruption to the supply chain, and the entire edifice could come crashing down.

The hyperscalers – Microsoft, Alphabet, Amazon, Meta – are accelerating their AI infrastructure roadmaps, and TSMC’s results validate this trend. They are not simply building bigger data centers; they are constructing entire digital universes, powered by these silicon brains. And TSMC is at the heart of it all, the unseen architect of this new reality.

The ability to manufacture advanced processing nodes at scale – 5 nanometer, 3 nanometer – is crucial. It is not merely about shrinking the size of the chips; it is about unlocking new levels of performance, efficiency, and complexity. And TSMC is at the forefront of this technological leap, pushing the boundaries of what is possible.

Broadcom benefits from TSMC’s success in a different way. They design the networking gear, the custom silicon architectures, the connectivity chips that underpin the entire AI infrastructure. They are the plumbers of the digital age, ensuring that the data flows smoothly and efficiently. And TSMC is their indispensable partner, providing the raw materials for their creations.

TSMC’s booming business suggests that AI budgets are not solely consumed by GPUs. The hyperscalers are deploying capital across a broad suite of critical infrastructure, building a complete ecosystem of hardware and software. It is a sign that this infrastructure supercycle is different from the historical cyclicality of the semiconductor industry. Developers are investing beyond raw compute, opting for a full hardware stack to build out their AI systems.

The resiliency of TSMC’s business suggests that the current infrastructure supercycle differs materially from the historical cyclicality of the semiconductor industry. Developers are investing beyond raw compute and opting for a full hardware stack to build out their AI systems.

A Gamble Worth Taking? The Trader’s Dilemma

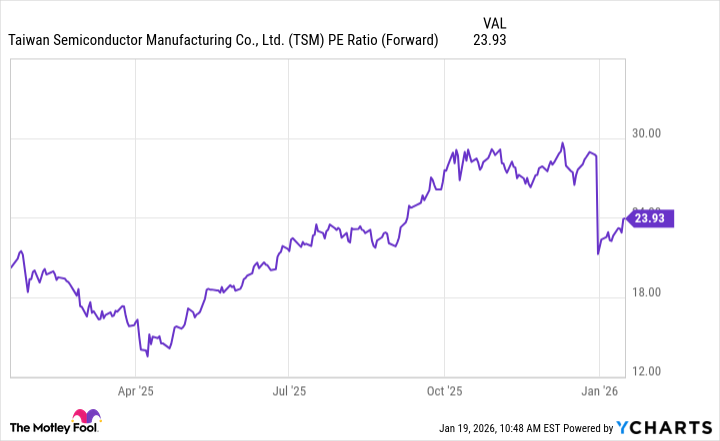

TSMC currently trades at a forward price-to-earnings (P/E) ratio of 24. A seemingly reasonable valuation, given the company’s growth prospects. Yet, it is also a reflection of the market’s skepticism. Investors are wary of the AI hype, fearful of a bubble that could burst at any moment.

The compression in the company’s valuation multiple suggests that investors have not yet priced in the entirety of TSMC’s growth prospects. Despite a strong earnings report and encouraging outlook, some remain unconvinced. They see the risks, the uncertainties, the potential for disruption. And they are right to be cautious.

But to me, TSMC’s latest report should mitigate those fears. The company’s growth is accelerating across the board, and management has been explicit about its expansion plans. It is a bet on the future, a wager on the transformative power of artificial intelligence. And I believe it is a bet worth taking. The price may not be cheap, but the potential rewards are immense.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 22:02