As someone who has spent the better part of my career navigating the labyrinthine world of financial markets, I can’t help but be captivated by the current state of play with the U.S. Dollar Index (DXY). The DXY, as we all know, is more than just a bunch of numbers—it’s a barometer of global economic health, a mirror reflecting the ebb and flow of market sentiment.

Last December 23rd, I came across an insightful analysis by a pseudonymous expert named Marty Marty regarding the U.S. Dollar Index (DXY). He emphasized how fluctuations in this index might reverberate throughout the broader financial landscape, potentially affecting the performance of cryptocurrencies as well.

The current state of the DXY (Dollar Index) presents an intriguing scenario: It could either rebound to levels last seen in July 2023 around the 115 range, following a double bottom pattern, or it’s forming a rising wedge and setting a lower high. This week’s developments will have far-reaching implications for all markets, as they are tied to dollar valuation.

— MartyParty (@martypartymusic) December 23, 2024

The DXY index, which compares the U.S. dollar’s power against six prominent global currencies, is now at 107.84. This represents a substantial rebound from its lowest point this year, roughly 100 in July, indicating a consistent pattern of the U.S. dollar growing stronger.

As a researcher, I’ve observed that the U.S. dollar has been significantly reinforced in recent times, correlating closely with significant events such as the November 2024 U.S. presidential election victory by Donald Trump. His ‘America-first’ policy agenda, emphasizing domestic growth via extended tax cuts, potential trade tariffs, and infrastructure investments, has sparked market expectations of extensive fiscal reforms. These proposed measures might escalate government borrowing and inflationary tensions, resulting in higher interest rates and further fortifying the dollar. This perspective has bolstered the DXY as investors gravitate towards the perceived safety and stability offered by the world’s reserve currency.

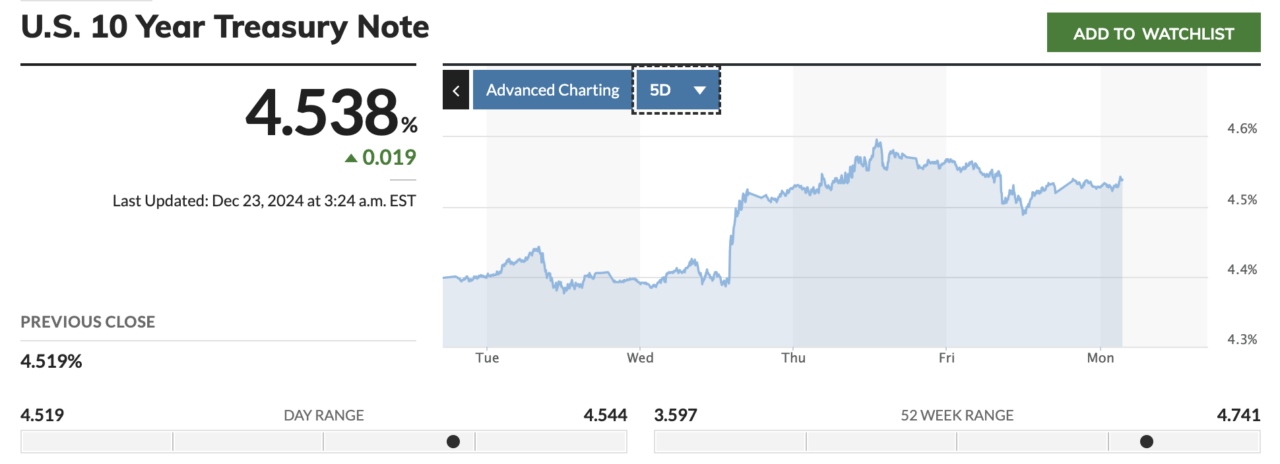

In addition to the intricate economic circumstances, the Federal Reserve made a decision to decrease interest rates by 0.25% on December 18, setting their target range at 4.25% – 4.50%. Normally, rate reductions cause bond yields to decline because borrowing costs become cheaper and markets anticipate more lenient monetary policies. But surprisingly, since the Fed’s announcement, the yield on the 10-year Treasury Note has increased to 4.54%.

The unexpected action taken can be understood as a result of the assertive stance taken during the FOMC press briefing.

2025 might see a deceleration in the rate cuts by Fed officials, given ongoing worries about inflation, which could result in a lengthier stretch of stricter monetary policies than initially anticipated by markets. Consequently, this stance has caused bond yields to climb up, as investors are asking for greater returns when holding longer-term debts amidst an environment with higher inflation rates.

The interaction among fiscal policy, monetary indicators, and forecasted inflation rates can greatly impact the cost of various assets. When the DXY (Dollar Index) increases, it generally puts a squeeze on risky investments like cryptocurrencies such as Bitcoin and Ethereum. This is due to the fact that a more powerful dollar diminishes global liquidity, making it less appealing to hold speculative ventures compared to keeping money in the stronger currency. Similarly, commodities like gold and oil often face downward pressure when the dollar is strong since they become costlier for buyers using other currencies, which can lead to decreased demand.

While it’s not always the case, some assets might thrive even when the dollar is strong. For example, U.S. Treasury bonds may initially experience higher yields but remain attractive to global investors seeking safety. Similarly, defensive sectors in the stock market, such as healthcare and utilities, can demonstrate robustness. Gold, typically moving opposite to the dollar, could also increase during times of significant unpredictability, as both gold and the dollar are often seen as secure investments.

The overall economic situation highlights the close relationship between various international markets. While cryptocurrencies are frequently considered separate from traditional finance, they are significantly affected by fluctuations in liquidity, interest rates, and general investor sentiment towards risk. If the DXY (US Dollar Index) keeps getting stronger, cryptocurrencies might encounter challenges as investors cut back on higher-risk investments. On the other hand, a weakening dollar could provide a more advantageous setting for Bitcoin, Ethereum, and similar digital currencies by enhancing global liquidity and sparking investor interest in taking risks once again.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-23 12:43