In a world where the specter of artificial intelligence looms ever larger, the stock market has embraced a curious fervor, igniting the aspirations of investors with the flames ofhope. Among the flickering lights of technology, a particular star has ascended: the graphics processing unit maker, Nvidia (NVDA). As of the 14th day of August, it proudly claims the title of the world’s most valuable public company, its market capitalization shimmering past $4.4 trillion-a milestone that would surely evoke a bemused grin from a simple village merchant.

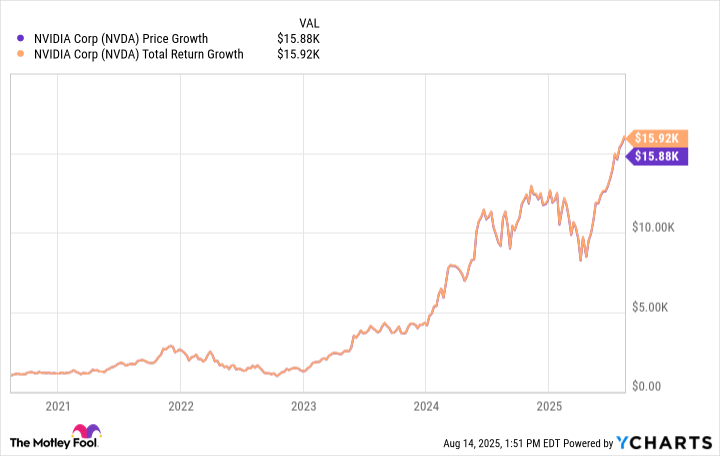

Nvidia’s journey began long ago, in the winter of 1999, yet it is the last few years that have seen it rise to a stature nearly akin to mythic proportions, bestowing untold fortunes upon its loyal investors. Imagine, if you will, having taken a mere $1,000 and entrusted it to Nvidia five years past, on the day of August 14, 2020; today, that investment would yield the astonishing sum of approximately $15,900. Such figures, reminiscent of fever dreams, beckon to the heart, though they are often followed by the faint echo of reality’s laughter.

The Allure of Nvidia’s Popularity

The repute of Nvidia is anchored in its position as a dominant provider of GPUs-the very lifeblood of contemporary AI advancements. With a commanding market share exceeding 90% among data center GPUs, its products serve as the backbone for developing intricate AI systems. These GPUs, elegant in their complexity, have become indispensable tools for businesses seeking to harness the power of artificial intelligence, thereby reinforcing Nvidia’s status as the proverbial go-to provider.

In the first fiscal quarter, concluding on April 27, the company’s revenue burgeoned by an impressive 69% relative to the previous year, reaching $44.1 billion. A remarkable 73% increment in data center revenue, amounting to $39.1 billion, reflects the pressing demands of today’s AI-driven narrative. The heart of their revenue-almost 89%-emphasizes the profound influence the current AI boom holds over Nvidia’s burgeoning empire.

However, while the past five years dance in exuberance, one may, with cautious optimism, speculate whether such splendid returns can be expected to recur in the next half-decade. As the market’s capricious nature disallows outright predictability, one cannot help but marvel at Nvidia’s pivotal role within the AI ecosystem-a role marked distinctly by both triumph and the shadows of unnoticed potential.

Thus, we find ourselves pondering once more, in a world that continues to spin with relentless vigor, where aspirations clash with the mundane realities of tomorrow. Only time will tell if Nvidia’s tale will unfold as grandly as its projections, or if it too, like many before, will fade gently into the hum of status quo. 🌱

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-17 18:20