In the grand theater of finance, BlackRock’s audacious venture into the realm of tokenized US Treasury funds, known as BUIDL, has witnessed an astonishing surge, with its assets under management (AUM) vaulting past the illustrious $1 billion threshold this very month.

This meteoric rise is not merely a footnote in the annals of finance; it signifies a profound transformation toward the tokenization of real-world assets (RWA), even as the broader crypto landscape grapples with its own tempestuous winds.

BlackRock’s BUIDL: The Vanguard of the RWA Frontier

According to the esteemed data purveyors at RWA. XYZ, BUIDL’s AUM has soared by nearly 129% over the past thirty days, now standing at a staggering $1.4 billion. One can only marvel at the speed with which this fund, birthed on the Securitize platform in the spring of 2024, has traversed the $1 billion milestone in a mere year—an achievement that would make even the most seasoned investors raise an eyebrow.

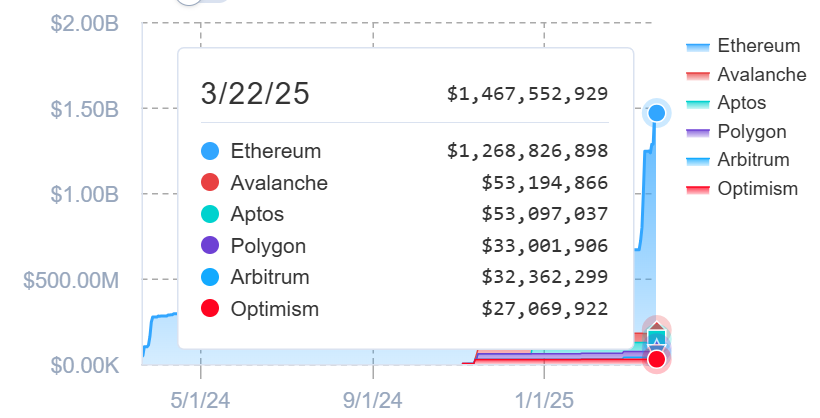

While BUIDL has cast its net across multiple blockchains, an overwhelming majority—over $1 billion, or 86.46%—remains firmly anchored in the Ethereum sea. This indicates a veritable frenzy of minting activity upon the network, as if the digital gold rush of yore has found a new life.

Other chains, such as Avalanche and Aptos, each clutch about $56 million of the fund’s bounty, a meager 3.6%. The Ethereum Layer-2 networks, like Polygon, Arbitrum, and Optimism, host the remainder, like a well-organized family reunion.

In the realm of investors, participation has also burgeoned. In the past month, the number of holders has risen by 19%, swelling the ranks to a grand total of 62. Ah, the thrill of being part of something so monumental!

Market watchers have observed that these burgeoning numbers reflect a growing faith in blockchain-based financial products, as institutional interest in the noble art of tokenizing bonds and credit instruments continues to swell.

Fidelity Enters the Tokenization Arena

As if on cue, BUIDL’s momentous achievement coincides with Fidelity’s own foray into the tokenization fray. Just last week, this asset management titan filed with the US Securities and Exchange Commission (SEC) to unveil a blockchain-based iteration of its Treasury money market fund. The new share class, whimsically dubbed “OnChain,” will utilize blockchain as both a transfer agent and a settlement layer. How avant-garde!

“The OnChain class of the fund currently uses the Ethereum network as the public blockchain. In the future, the fund may use other public blockchain networks, subject to eligibility and other requirements that the fund may impose,” the filing elaborated, as if trying to keep up with the ever-evolving landscape.

Fidelity’s move is but a reflection of a broader trend, as financial institutions flock to blockchain to tokenize bonds, funds, and credit instruments. This shift promises not just efficiency but the tantalizing allure of round-the-clock settlement and enhanced transparency.

Meanwhile, this filing emerges amidst a backdrop of rising institutional interest in RWAs, despite the sluggish crypto market. While Bitcoin finds itself down 11% year-to-date, RWA tokens have exhibited a remarkable resilience, flourishing in 2025.

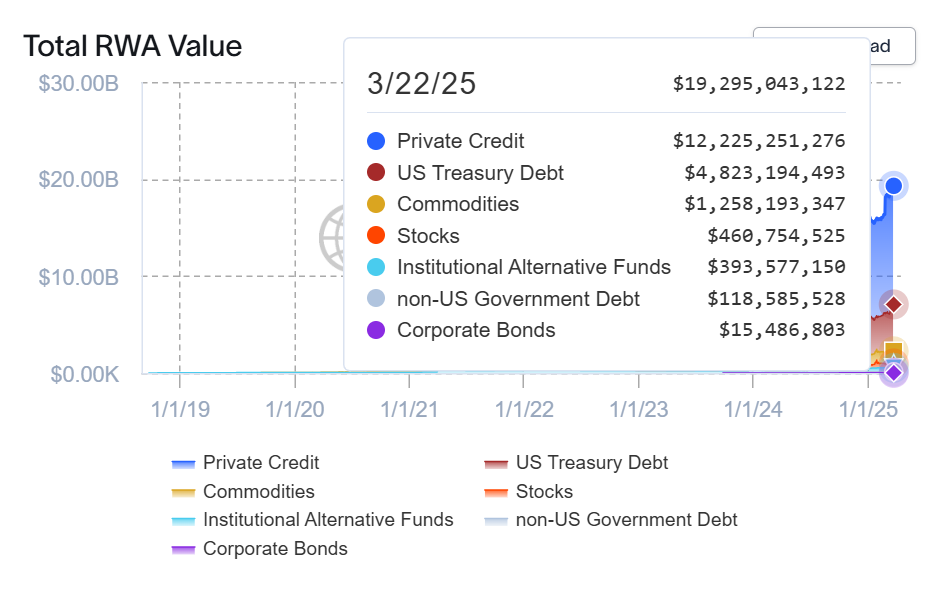

On-chain data reveals that the total RWA market has expanded by 18.29% in the past thirty days, now reaching an impressive $19.23 billion. The number of RWA holders has also climbed by 5%, nearing the remarkable figure of 91,000. Truly, a sign of the times!

In this grand tapestry of finance, BlackRock’s BUIDL stands tall as the leader of the RWA pack by market cap. Following closely behind is Hashnote’s USDY at $784 million and Tether Gold (XAUT) at $752 million. Meanwhile, US Treasuries account for a hefty $4.76 billion of the total, while private credit reigns supreme with a staggering $12.2 billion.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-23 12:51