Wall Street appreciates compelling stories, and shares in quantum computing companies have provided quite a few over the past year. Last year, Alphabet showcased groundbreaking quantum abilities with its Willow processor, causing a wave of investment into firms promising to tackle optimization challenges and speed up drug discovery.

However, the initial enthusiasm overlooks the main point: The quantum leap isn’t primarily due to these advancements or possible AI collaborations. Instead, it’s a critical, government-imposed cybersecurity crisis that has redefined quantum computing from a speculative technology into a recognized strategic threat. The term “Q-Day” the supposed day when quantum computers could break present encryption has transitioned from theoretical discussion to immediate concern, lending significant credence to the entire field.

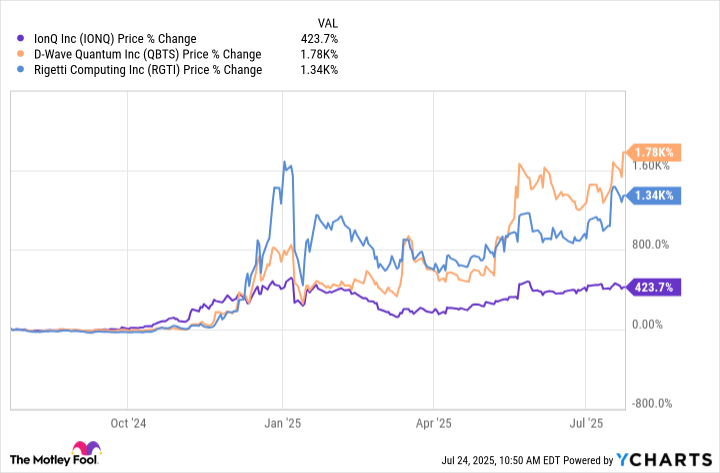

From my perspective as an observer, it’s evident that the progress of stocks specialized in quantum computing is telling quite a compelling narrative. To be specific, IonQ (IONQ) has seen a staggering increase of 423% within the past year, while D-Wave Quantum (QBTS) has soared over 1,700%, and Rigetti Computing (RGTI) has experienced a massive jump of more than 1,300%. These aren’t ordinary tech stock surges; instead, they signify the market’s unmistakable acknowledgment that quantum computing has matured from a mere laboratory oddity into a verified national security concern.

The encryption emergency driving quantum validation

In August 2024, the National Institute of Standards and Technology (NIST) unveiled the initial three standards for post-quantum cryptography. These standards are CRYSTALS-Kyber, used for key creation, and CRYSTALS-Dilithium, employed for digital signatures. Unlike theoretical studies, NIST provided practical roadmaps to fortify against potential quantum computer threats. Such threats could render existing encryption techniques obsolete within the next ten years.

The government’s actions have extended beyond providing research funds. The Office of Management and Budget has issued mandatory guidelines, making it compulsory for all federal departments to list their cryptographic systems and create transition strategies. The White House predicts that the federal transition will cost approximately $7.1 billion from 2025 to 2035, which is a significant investment in quantum-resistant cybersecurity solutions. These solutions are more likely to benefit established cybersecurity firms and cloud providers instead of startups solely focused on quantum technology.

On the other hand, the immediate validation of the quantum threat by the government has significantly boosted momentum across the entire quantum industry. John Young, COO at Quantum eMotion America, cautions that “many businesses are still alarmingly unready for Q-Day,” while government entities grapple with compliance deadlines. The understanding that quantum computers pose an existential cybersecurity risk has reshaped investor views of quantum hardware companies from being perceived as speculative science endeavors to being considered vital national assets.

Pure-play companies capture the quantum opportunity

Despite facing tough financials, IonQ stands out as the most prominent recipient. In the first quarter, the company reported nearly stable revenue of $7.6 million compared to last year, while recording a significant net loss of $32.3 million. Yet, IonQ boasts an impressive cash reserve of $697 million and has recently concluded a $1 billion equity offering, ensuring ample resources for further advancement and potential acquisitions in the realms of quantum computing and networking.

D-Wave Quantum has adopted an unconventional business strategy, concentrating on the application of quantum annealing technology for particular optimization challenges. Their first-quarter performance validated this approach, as revenue hit $15 million – a 509% surge compared to the previous year, primarily due to system sales and subscription-based cloud access programs. By offering quantum computing services, D-Wave enables organizations to utilize advanced quantum capabilities without the need for substantial upfront financial investments.

Rigetti Computing, with its full-stack strategy encompassing processor creation, system integration, and cloud services, presents the highest level of risk. Nevertheless, recent findings indicate difficulties in execution: Their first-quarter earnings dropped from $3.1 million to $1.5 million, while operating costs amounted to $22.1 million. While their 84-qubit Ankaa-3 system signifies a significant technological advancement, the ability to transform these accomplishments into consistent income is yet to be demonstrated.

Yes, but speculation risks remain elevated

In simpler terms, these three companies (IonQ, D-Wave, and Rigetti) have high prices that assume perfect performance and quick market acceptance. For instance, IonQ is valued around 219 times its recent sales. Similarly, D-Wave and Rigetti are also priced quite high. The quantum computing market is still in its infancy with few commercial uses and unclear technology leaders.

Progress made by significantly financed rivals such as IBM, Alphabet, and Microsoft could potentially upend the market positions of smaller companies within the field. At present, existing quantum systems are marred by high error rates and exorbitant costs, making them unsuitable for widespread commercial use beyond niche applications. Investing in stocks that focus solely on quantum technology necessitates a willingness to accept significant volatility and prolonged development periods.

Capitalizing on quantum’s validation moment

As an observer, I’ve noticed a significant shift in the realm of quantum computing. The government’s fervent readiness for Q-Day has propelled quantum computing from a theoretical concept into a strategically indispensable reality. The influx of $7.1 billion in federal funding earmarked for post-quantum cryptography will predominantly benefit cybersecurity firms and cloud service providers, fortifying their defensive measures. This substantial investment underscores the quantum threat’s authenticity, elevating pure-play quantum companies from mere laboratory oddities to crucial national assets.

Indeed, the valuations are steep, and the foundations continue to pose difficulties. The realm of quantum computing is still a minor, speculative niche with scarce existing commercial uses, making it hard to foresee which firms will lead in this burgeoning technology. However, the Q-Day validation serves as a significant catalyst that has reshaped investor perspectives and might speed up the pace of development.

For those looking to invest in this developing quantum story, a well-balanced investment strategy throughout the quantum domain could provide the most advantageous risk versus reward scenario. You might want to set aside a modest, speculative portion of your growth investments across key industry leaders: IonQ for its extensive approach and robust financial standing, D-Wave due to its early commercial successes, and perhaps Rigetti for its versatile development strategy. This method recognizes the challenges in predicting winners in emerging technology sectors, while at the same time, maximizing potential gains as the field progresses from government validation towards broader commercial use.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-25 13:04