In the grand theatre of our modern economy, few players have captured the public’s gaze quite like those engaged in the artifice of artificial intelligence. Some freshly sprouted, like the dainty wildflower, while others remain much like the venerable oak-established and formidable. Yet, if we are to speak of enduring establishments, let us deliberate upon one that presents itself as the finest bargain amidst this alluring bazaar: Alphabet (GOOG) (GOOGL), which dances before us like a well-rehearsed actor in search of its true spotlight.

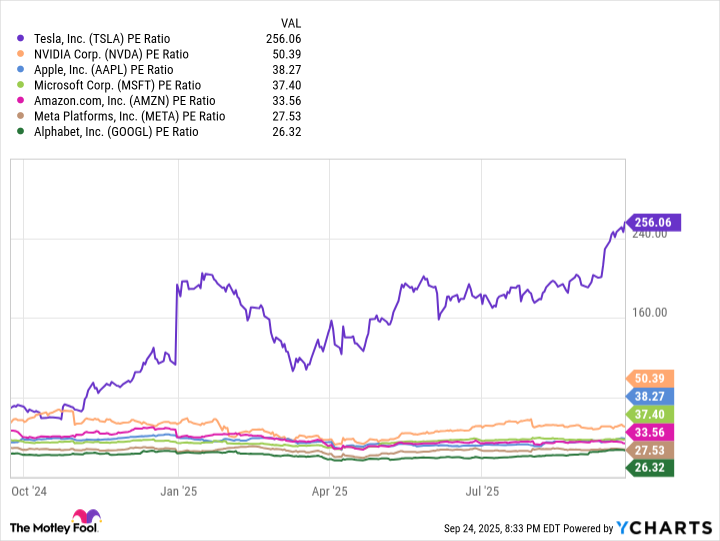

As I proffer my calculations, it appears that our protagonist trades at a modest 26.3 times its anticipated earnings over the ensuing twelve months-a veritable misalignment amidst the grand performance of the so-called “Magnificent Seven.” Surely, dear audience, this is naught but the frugality of a shrewd trader; within its valuation lies a canvas awaiting the brush of fortune, free from the extravagant expectations that often bind lesser stocks.

Let us not be fooled, for a mere price tag doth not a worthy investment make. Valuation is akin to the scenic backdrop of our play: it provides context and possibility, but it cannot dictate the outcome. In this case, the frugal pricing affords us greater prospects than perils, presenting a delightful cushion against the merciless grip of disappointment, should reality fail to fulfill its anticipated promise.

Beyond these numeric musings lies Alphabet’s distinguished role as a multi-faceted player in the AI landscape-a veritable puppeteer governing several strings of innovation. Its esteemed subsidiary, DeepMind, dabbles in the arcane arts of AI research, whilst a constellation of data centers stands as fortresses, essential for the training of these digital sprites. Moreover, its consumer innovations, like the generative whiz-bang known as Gemini, along with the cinematic enchantment of Flow, add a flourish that would make even a seasoned playwright envious.

The merit of engaging in diverse realms of the AI spectacle is doubly advantageous. Alphabet commands not just an array of initiatives but also a sovereign hand over innovation and integration, rendering it less beholden to vagaries that might ensnare its contemporaries. In this grand design, one might wonder-are the spectators around us prepared to applaud, or shall they sit back, arms crossed, waiting for the inevitable folly to unfold?

For in the realm of high tech as in life itself, the sweet anticipation of progress is often but a precarious balancing act, where one misstep may result in a swift descent from the stage of success to the audience’s jeers. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-29 04:32