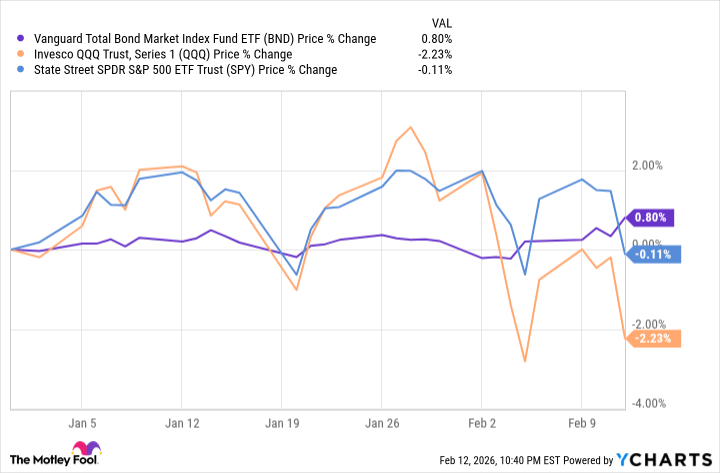

The market, a restless sea, began this year with a tremor, not a surge. The S&P 500, a barometer of collective hope and anxiety, yielded a mere whisper of decline. The Nasdaq-100, that glittering shoal of technological promise, fared less well, a muted fall. Yet, amidst this uncertainty, a different current flowed – the steady pulse of bonds, embodied in the Vanguard Total Bond Market ETF. A modest gain, yes, but a gain nonetheless, a quiet assertion in a world enamored with the spectacular.

For generations, we have been taught to chase the sun, to believe that growth is the only virtue. Bonds, often dismissed as the realm of the cautious, the unadventurous, have been relegated to the shadows. It is a peculiar blindness, this insistence on perpetual motion. A tree does not bloom endlessly; it rests, gathers strength, and then, in its time, offers forth its fruit. And so it is with capital. The past century, a relentless march of equity dominance, may be yielding to a different rhythm. Deutsche Bank’s long study, a chronicle of decades, reminds us that even the most entrenched patterns are subject to the tides of time.

Perhaps this is not a call to abandon the pursuit of innovation, but a plea for balance. A portfolio, like a life, should not be a single, precarious tower, but a landscape of resilience. If the recent enthusiasm for certain technologies feels…unmoored, if the air itself vibrates with a certain precariousness, then a turn towards the solid ground of bonds is not an act of surrender, but of prudence. To diversify is not to doubt the future, but to acknowledge its inherent unpredictability.

Vanguard, a steward of capital, now suggests a shift in perspective. Their forecast, a careful charting of potential currents, anticipates a more favorable climate for bonds in the coming decade. Not a rejection of equities, but a recalibration. The exuberance surrounding artificial intelligence, while undeniably potent, carries within it the seeds of its own correction. To recognize this is not cynicism, but a clear-eyed assessment of the landscape.

It is a curious thing, this market. It rewards boldness, yes, but also punishes hubris. To believe that the past will endlessly repeat itself is a folly. The spring thaw of investment may follow the long winter of the bear market, but even the most vibrant bloom must eventually yield to the autumn’s embrace. To prepare for all seasons is not a lack of faith, but a recognition of the cyclical nature of existence.

A Strategy for the Prudent Investor

Vanguard’s outlook doesn’t prescribe a particular vessel for this shift, but the Total Bond Market ETF, with its vast holdings of investment-grade bonds, offers a sensible path. A modest expense ratio, a testament to efficient stewardship, further enhances its appeal. It is not a glamorous investment, perhaps, but it is a reliable one. A quiet strength, in a world obsessed with spectacle.

For those accustomed to the soaring returns of high-growth technology stocks, the yields offered by bonds may seem…understated. But to equate return with excitement is a dangerous fallacy. Capital preservation, the safeguarding of one’s resources, is a virtue often overlooked. And in a world increasingly prone to disruption, a degree of resilience is invaluable.

Let us not mistake caution for timidity. To diversify, to seek balance, is not to abandon hope, but to embrace a more sustainable path. The market, like life, is a long game. And in the long run, it is not the most spectacular gains that endure, but the steady, reliable currents that sustain us.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-17 17:32