In the grand theater of capital markets, where fortunes sway like reeds in the wind, there exists a quiet contrarian – Invesco S&P 500 Equal Weight ETF (RSP). It moves not with the grandiloquent fanfare of its market-cap-weighted brethren, but with the measured grace of a scholar perusing ancient texts. Let us consider its merits, not as mere numbers on a screen, but as chapters in the eternal story of human enterprise.

1. The Democratic Pulse of Equal Weighting

The S&P 500, that august assembly of corporate titans, resembles a gilded ballroom where the wealthiest guests dictate the evening’s tone. Here, the Invesco ETF appears as a wandering minstrel, granting each performer equal voice. For while the standard index lets megacaps like modern-day tsars command 39% of the melody through their sheer bulk, our humble ETF distributes its attention like spring rain – each of its 500 constituents receiving precisely 0.2% of its devotion.

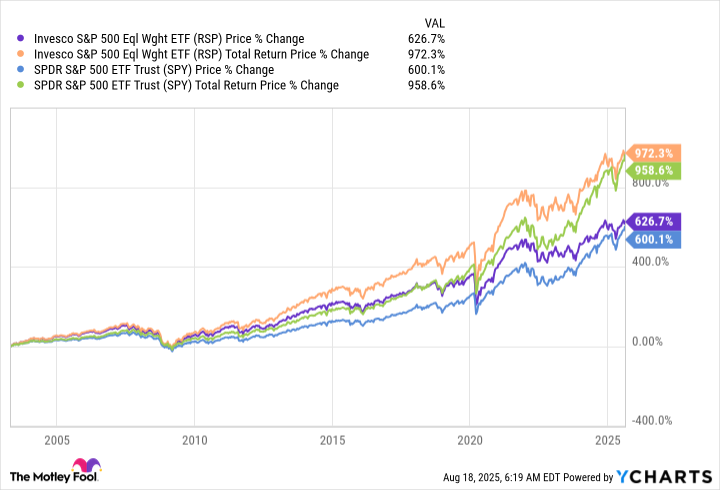

History whispers secrets to those who listen. From its 2002 inception through 2020, this ETF outperformed the cap-weighted index by nearly 50 basis points annually – a quiet triumph of equilibrium over excess. True, its 0.2% fee appears a blemish, yet consider: in an age where index funds charge pennies, this premium buys passage to a different philosophy, one that prizes balance over convenience.

2. A Portrait of Value in Turbulent Times

Behold the present tableau: the S&P 500 trades at 27.6 times earnings, its price-to-book ratio stretching toward 5 like ivy climbing a crumbling manor wall. Contrast this with Invesco’s more modest 19.3 P/E and 2.9 P/B ratios – metrics that speak of prudence, of careful stewardship. It is the difference between purchasing a gilded carriage and acquiring a sturdy ploughshare; both serve transport, yet only one prepares for winter’s frost.

When the tech barons inevitably stumble – as all mortal creations must – this ETF’s diversified foundations shall prove its strength. For while the standard index has become a temple to silicon prophets, with technology commanding one-third of its composition, our subject allocates but 14% to this fickle sector. It is the financial equivalent of planting oaks among pines, ensuring the forest survives the first dry season.

3. The Alchemy of Disproportion

Consider the paradox: the top 10 holdings of conventional wisdom represent nearly 40% of its value – nine technology concerns and one outlier, all basking in speculative glow. Invesco’s top 10, by contrast, form a mosaic of industries, each claimant possessing but 0.3% of the whole. This is not neglect, but intention – the work of portfolio architects who understand that true wealth lies not in concentration, but in the quiet compounding of diverse seeds.

Herein lies the ETF’s quiet rebellion: it refuses to anoint modern-day Medicis as eternal rulers. When the market’s fever breaks – as break it must – this equal-weighted vessel shall weather the storm, its ballast of forgotten sectors and overlooked champions keeping it steady while others founder.

The Unassuming Sentinel of Prudence

In this age of algorithmic courtship with growth stocks, Invesco S&P 500 Equal Weight ETF stands apart – not as a contrarian provocateur, but as a custodian of equilibrium. Its methodology, simpler than the arithmetic of a village scribe, yields a portfolio that breathes with the rhythms of economic reality rather than the fevered dreams of speculation. For the patient investor – one who hears in market cacophony the promise of eventual harmony – this ETF offers not excitement, but the quiet dignity of compounding returns. 📈

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2025-08-20 13:06