The market stumbles again, as it often does-like an old man down a familiar alley, unsure whether today will bring bread or a stone. The S&P 500 (^GSPC +0.98%) has slipped more than 4% since October’s end. Pessimism, that perennial guest, has taken a seat at the table. According to the American Association of Individual Investors, over 40% now describe themselves as “bearish.” One imagines them staring out rain-streaked windows, sipping lukewarm coffee.

And yet, I continue. Not with enthusiasm, but with the quiet persistence of a clerk who arrives at the office regardless of weather. If I were to choose one ETF to hold-indeed, the only one-I would select the Vanguard Total Stock Market ETF (VTI +1.16%). Not because it sparkles. It does not. But because it endures. And endurance, in markets as in life, is often the only victory available.

Why nothing surpasses the whole

A broad market ETF is not an invention. It is an admission. An acknowledgment that we do not know which corner of the market will flourish, which stock will rise, which sector will survive. So we buy them all. Or nearly all. The Vanguard fund holds 3,531 stocks-large, small, fading, forgotten, and, occasionally, triumphant. It includes everything: the hopeful biotech in New Jersey, the grocery chain in Minnesota, the software firm whose CEO still believes in AI’s golden dawn.

It does not promise brilliance. It promises breadth. And in breadth, a kind of safety-not the thrilling safety of certainty, but the modest safety of not being wrong in just one place.

- Diversification, quiet and thorough: The S&P 500 is a gallery of titans. This ETF is a village market-less polished, more complete. Small-cap, mid-cap, unknowns with no press releases: all have their place. One may fail, ten may stall, but collectively, they carry on. It is not elegant. It is not exciting. But it is difficult to kill.

- Less weight on the tech dream: That dream-the one where algorithms cure loneliness and robots recite poetry-occupies 46% of the S&P 500 ETF. Here, it is only 41%. A small mercy, perhaps. But when dreams burst, even small separations matter. One learns, eventually, to cherish such margins.

- Stability, of a sort: It does not leap. It does not dazzle. Compared to growth ETFs-those feverish portfolios chasing tomorrow’s prophets-it moves like a clock with heavy hands. For some, this is dull. For others, a relief. After all, not every investor desires a heartbeat matched to the NASDAQ.

The true virtue, though, lies deeper: the market, for all its noise, has a habit of outliving its crises. And this ETF, by mirroring the market in full-the strong, the weak, the barely breathing-is built not for triumph, but for survival.

It has seen worse

Volatility always returns. It is the one dependable thing. The Vanguard Total Stock Market ETF launched in 2001-not with a fanfare, but during the slow bleed after the dot-com collapse. Since then, it has weathered the Great Recession, the pandemic, the tantrums of 2022. No fanfare there either. Just numbers ticking upward through ash and uncertainty.

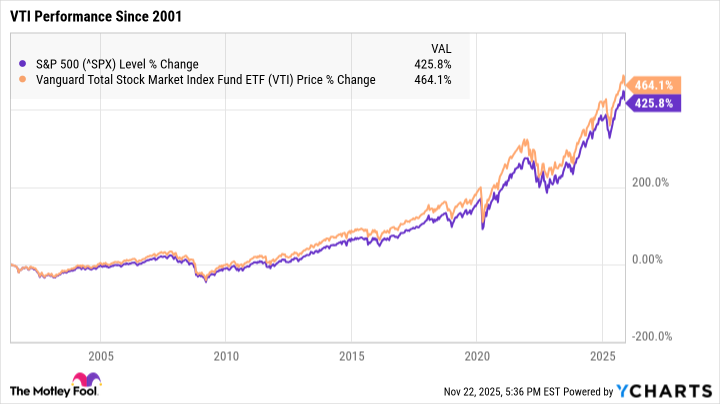

Its total return? Over 464%. Should you have invested $5,000 back then, you would now have $28,000. Not because anyone shouted about it. Not because it made headlines. But because, quietly, across two decades of wars, plagues, and absurdities, the economy kept working. People kept building, buying, hoping-unnoticed, like roots beneath snow.

And yes, it has slightly outperformed the S&P 500-by a thread, by a whisper. Enough to matter, barely. Enough to suggest that wholeness, however unremarkable, holds a quiet advantage over selection.

The market does not promise joy. It promises only continuation. It will crash. It will recover. Men will write reports. Women will retire. New crises will emerge, important for a season, then forgotten. Through it all, this ETF will remain: not brilliant, not bold, but present-like a streetlamp in the rain, unassuming, doing its duty. One could do worse than to stand beside it. 🌱

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- Netflix Co-CEO Ted Sarandos Urges DC to Expand TV Projects Like ‘The Penguin’ After Warner Bros. Acquisition

2025-11-24 11:22