The talk, of course, is all of artificial intelligence. A grand ambition, promising efficiencies and wonders. Yet, one cannot help but observe the rather prosaic requirements of such marvels. They demand, it turns out, a great deal of electricity. An almost embarrassing quantity, really. The market chases the dream, and overlooks the humble necessity. It’s always the way.

Goldman Sachs, in a display of uncharacteristic clarity, predicts a surge in demand – 165% by 2030. A substantial figure, though one suspects the projections will be revised upwards, as is so often the case. Data centers, these temples of the digital age, require sustenance. And that sustenance, regrettably, is not found in algorithms, but in kilowatt-hours. The irony is almost… touching.

Many will attempt to provide this energy. Ingenious solutions will be proposed, grand schemes unveiled. But the most reliable provider, the one quietly humming along, is often overlooked. Utilities. A rather unglamorous business, admittedly. But a necessary one. And one, it seems, poised for a quiet, understated boom.

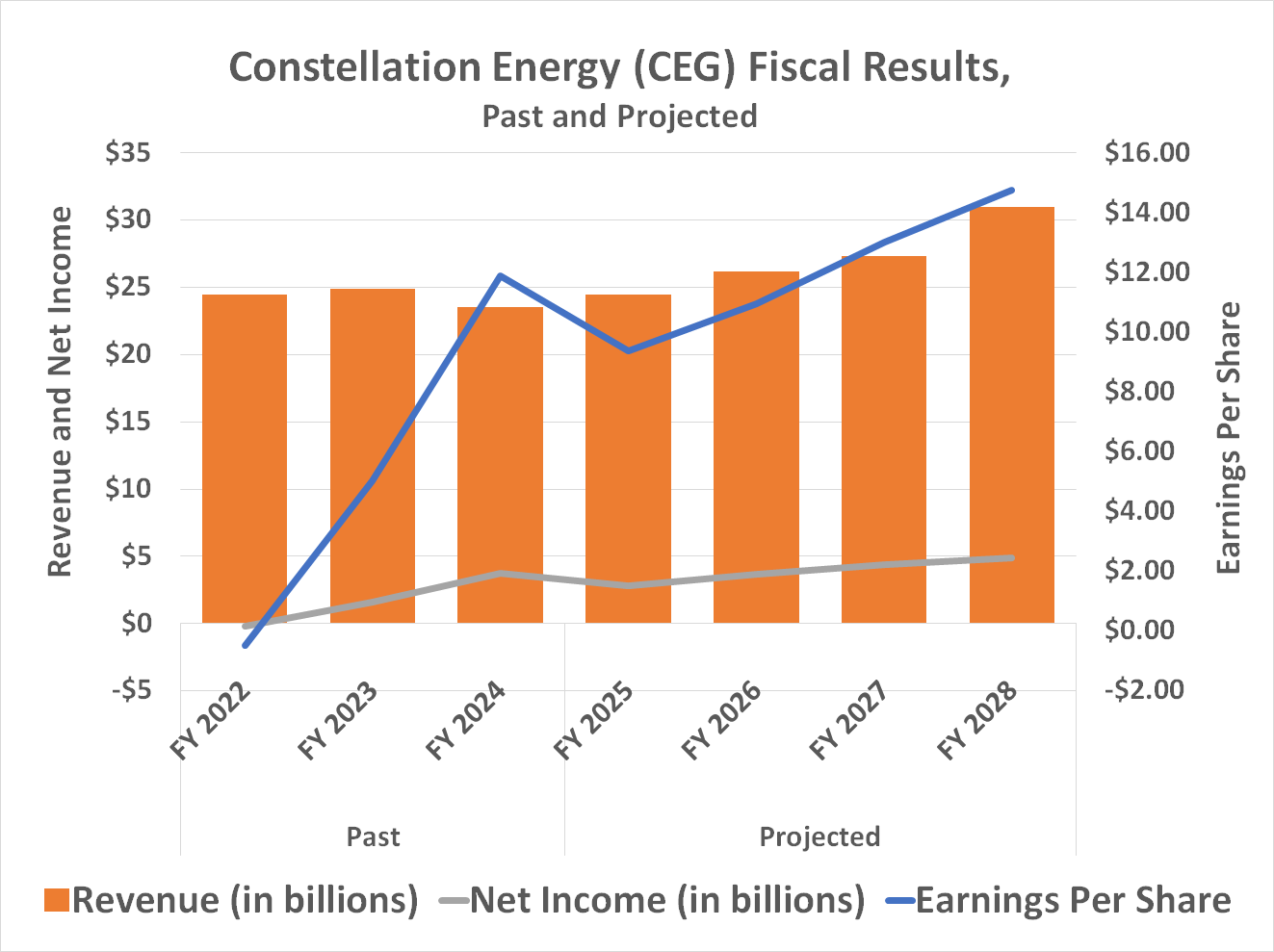

Constellation Energy (CEG 2.39%), in particular, appears well-positioned. Not through brilliance, mind you, but through simple preparedness. They possess, rather conveniently, a substantial portfolio of nuclear reactors. Twenty-one, to be precise, scattered across twelve sites. A significant holding, and one that allows them to generate carbon-free electricity with a degree of consistency that renewable sources, for all their promise, have yet to match. They have, it seems, simply been building, while others have been dreaming.

The recent announcement regarding the restart of the reactor at Three Mile Island – a place with a certain… history – is merely a symptom of a larger trend. An agreement with Microsoft, naturally. The giants always seek reliable partners. But it’s not the deal itself that’s noteworthy, but what it represents: a growing recognition of the need for stable, predictable power.

They boast, and not without justification, a capacity exceeding that of all other US nuclear producers combined. A rather imposing statistic, though one suspects the other producers have their own justifications. More importantly, they possess the ability to increase output from existing facilities. A slow burn, perhaps, but a steady one. And in a world obsessed with overnight sensations, a little stability is a welcome thing.

Nuclear power is not a panacea, of course. Electricity is, ultimately, electricity. But it offers a certain… solidity. A reliability that other sources struggle to match. Goldman Sachs anticipates a 50% increase in global nuclear production by 2040. A reasonable projection, given the circumstances. And with executive orders from President Trump adding a further impetus, the United States could see its nuclear capacity quadruple by 2050. A rather ambitious goal, perhaps, but one that Constellation Energy is well-equipped to meet.

The recent dip in the stock price, prompted by threats of electricity rate caps, is, as these things often are, a temporary inconvenience. A fleeting shadow in the grand scheme of things. A buying opportunity, perhaps, for those with the patience to wait. Though, one should never mistake patience for certainty.

One can envision a future where Constellation Energy quietly, steadily, provides the power that fuels the digital age. A future where they are not celebrated as innovators, but simply… relied upon. A modest fate, perhaps. But a secure one. And in a world of grand ambitions and fleeting fortunes, a little security is a rare and precious thing. It is, after all, the quiet currents that sustain the greatest vessels.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

2026-02-02 04:32