They speak of fortunes made in swift currents, of markets ablaze with speculation. But the truest wealth, I suspect, is not found in the roar of the crowd, but in the quiet accumulation – a slow, deliberate gathering of stones against the coming winter. To chase the spectacular is to invite ruin. Better, then, to consider these vessels – not as pathways to instant riches, but as anchors in a restless sea.

One does not expect miracles from a thousand dollars. A doubling in a season is a fever dream. But a steady tending, a mindful placement… that can yield a harvest, not of abundance, but of resilience. A shield against the inevitable storms. And perhaps, in the long run, a measure of peace.

The Broad Landscape

To invest in the ‘S&P 500’ – a name that rings with the cold precision of a ledger – is to acknowledge the vast, indifferent machinery of American enterprise. Five hundred companies, a forest of ambition and calculation. It is not a celebration of ingenuity, but an acceptance of its inevitability. The Vanguard S&P 500 ETF (VOO 0.02%) is merely a way to participate in this grand, impersonal dance, to claim a sliver of the collective striving.

There was a time when this landscape was more varied, a mosaic of industries. Now, the giants cast long shadows, the tech sector dominating like a single, immense tree. Yet, even within this concentration, there remains a certain robustness, a core of established businesses that endure. These are not the shooting stars, but the steady constellations, visible even through the haze of speculation.

The promise of ten percent annual returns feels… optimistic. The market is a fickle mistress, prone to moods and caprice. But seven percent, consistently achieved, would be a quiet triumph. A gentle slope upward, a slow but certain ascent. It is not the peak that matters, but the unwavering direction.

The Patience of Dividends

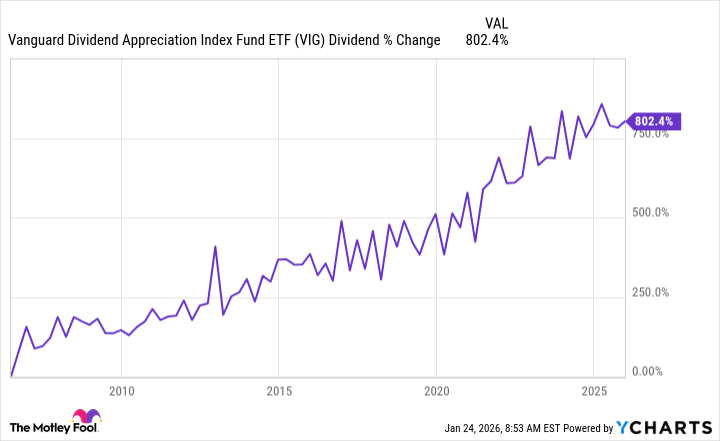

The Vanguard Dividend Appreciation ETF (VIG 0.37%) does not shout its virtues. Its yield is modest, a whisper compared to the boisterous pronouncements of other dividend funds. But this is not about immediate gratification. It is about the slow, deliberate cultivation of a revenue stream, a source of income that grows with each passing season.

To seek companies that consistently increase their dividends is to align oneself with a certain philosophy: a belief in long-term value, a commitment to sustainable growth. These are not businesses chasing fleeting trends, but enterprises rooted in solid foundations. It is a three-fold benefit, yes – the potential for price appreciation, the present income, the promise of future growth. But it is also a statement of faith: a belief in the enduring power of responsible stewardship.

The current payout of $0.8844 (as of December 2025) is but a single leaf on a growing branch. The true measure of success will not be the absolute amount, but the consistent, upward trajectory. A steady rhythm, a gentle unfolding.

The Wider Horizon

To confine oneself to the American landscape is to embrace a certain provincialism. The world is vast and complex, a tapestry of cultures and economies. The Vanguard Total International Stock ETF (VXUS 0.40%) is a window onto this wider horizon, a way to diversify one’s holdings and mitigate the risks of a single, dominant economy.

With over 8,600 stocks spanning the globe, VXUS offers a degree of insulation against regional downturns. Europe, emerging markets, the Pacific – each region contributes its own unique flavor to the portfolio. It is not about chasing the highest growth rates, but about achieving a balanced, sustainable allocation.

- Europe: 38.2%

- Emerging Markets: 26.8%

- Pacific: 25.6%

- North America: 8.1%

- Middle East: 0.8%

- Other: 0.5%

Developed markets offer stability, while emerging markets promise growth. The balance between the two is a matter of temperament. But in a world of increasing uncertainty, diversification is not merely a prudent strategy, it is a necessity.

VXUS is not a solution to all problems. It does not eliminate risk, it merely distributes it. But in a world of constant flux, a broad, diversified portfolio is a shield against the unpredictable winds of fortune. It is a quiet acknowledgement that the world is larger than ourselves, and that true wealth lies not in domination, but in harmony.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Brent Oil Forecast

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Michael Burry’s Market Caution and the Perils of Passive Investing

2026-01-28 23:53