![]()

In the realm of technology, where the ephemeral nature of human ambition collides with the relentless march of progress, many quantum computing equities have skyrocketed, notably IonQ (IONQ). Indeed, one’s eyes may widen as the shares have surged by an astonishing 450% over the past year-a phenomenon that raises eyebrows not only in the corner offices of investors but also in the darker recesses of the market’s psyche.

IonQ dares to dream-a lofty aspiration to become the Nvidia of quantum computing. It aspires to craft the very devices that shall propel us into a new age, akin to the pivotal role Nvidia plays in the current technological paradigm. Yet, herein lies the tension: if IonQ succeeds, the stock could indeed reach vertiginous heights. But are we toys of fate, pondering if now is the moment to cast our fortunes to a capricious tide?

The Technological Aspirations of IonQ

In constructing its quantum processors, IonQ employs a methodology as nuanced as the human soul; it manipulates trapped ions, those minuscule, positively charged atoms that resemble the fragile nature of our own existence. These qubits, the core of the quantum experience, operate under principles far detached from the mundane operations of classical computing. These harmonies of atomic interaction allow IonQ to illuminate the answers to complex dilemmas that might take mere mortals eons-if they ever arrive at a solution at all.

Consider the recent partnership with the U.S. Department of Energy; through this collaboration, IonQ has set out to orchestrate an optimal schedule for power generators, aiming to meet the increasingly voracious appetite of electricity demands. Yet, one cannot help but wonder, amidst the cacophony of renewable sources-hydroelectric, wind, and solar-does IonQ hold the key, or merely an elaborate façade?

The company’s financial trajectory proclaims growth; revenues have doubled annually since its IPO in 2021-a testimony to ambition, yet does this growth foster genuine faith? For the current year, IonQ forecasts revenues between $82 million and $100 million, a marked rise from a mere $43.1 million in 2024. Such promises tantalize the investor’s spirit, yet expectations can be treacherous bastions of hope.

In the second quarter, the sales figures reached $20.7 million-an increase from $11.4 million a year prior-while the prophecy for Q3 dances above $25 million. But does sheer numerical growth mask an underlying turmoil?

Another Layer: IonQ’s Financial Ethics

Despite the rapid expansion, IonQ’s narrative is laced with the pensive echo of losses; it operates not within the realm of profitability but rather in the shadows of debt, an operating loss of $160.6 million echoing through its financial halls like a lament for the lost souls of classic tragedies. This figure has burgeoned ominously from a $48.9 million loss a year prior. Such steep operational expenses stem from its ambitious acquisitions-a quantum cryptography firm here, a technology venture for orbital satellites there.

The fissure between Q2 sales of $20.7 million and an operational abyss of $160.6 million ignites a dire warning. For IonQ to navigate this tempest, it must cultivate fiscal prudence unless, like Icarus, it flies too close to the sun amidst the inflationary winds flung forth by economic policies beyond its control.

In the immediate future, IonQ’s life force appears robust, proudly displaying total assets of $1.3 billion against liabilities of $168.2 million. Cash and investments totaling $546.9 million bolster this fragile castle in the air. Moreover, securing over $1 billion from an equity offering grants a temporary reprieve-yet, can one stand firm amidst such relentless uncertainties?

To Buy or Not to Buy: The Existential Question

Alas, it may be years before IonQ’s innovations find foothold in the practical terrains of society. The quantum experience remains hindered by adversities akin to a Dostoevsky character, grappling with a world that is often indifferent to the struggles within. The quantum computer’s fragility-the sensitivity of its atomic particles to the whims of the environment-renders it susceptible to errors that bespeak a tragic fate.

Earlier this year, Nvidia‘s luminary, CEO Jensen Huang, dared to predict that practical quantum systems wandered some 15 to 20 years away-a sentiment that, while retracted later, still lingers in the air like the ghost of missed opportunities. Industry insiders, however, projec their sights on a timeline stretching toward the realms of 2030 to 2040 for significant maturity in quantum technology.

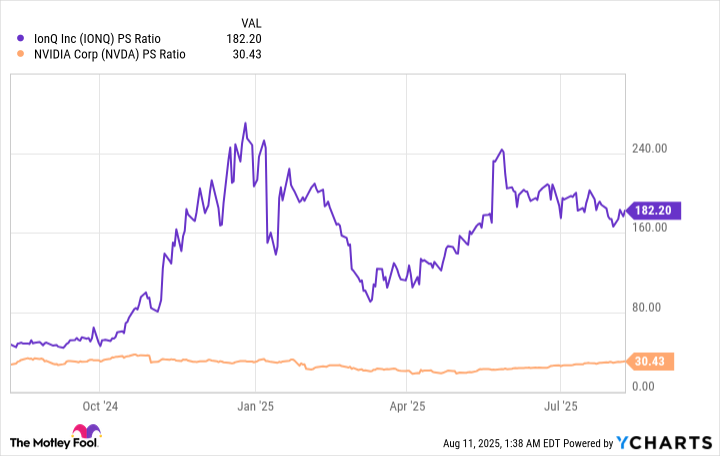

As investors ponder the wisdom of embracing IonQ, the question of valuation climbs to prominence. With no earnings to anchor its worth, we turn our gaze to the price-to-sales (P/S) ratio-a measure that reflects our psychological state as we evaluate how much we are willing to pay for each dollar of revenue, as if chasing the ghost of an ideal. Yet, upon inspection, IonQ’s P/S ratio appears extravagant; it stands unfavorably high compared to Nvidia, the very benchmark against which IonQ measures itself.

Thus, drawing upon the patterns of the markets, it becomes apparent that now may not be the apt moment to entwine one’s prospects with IonQ. The specter of time looms large; with widespread quantum adoption likely still a distant mirage, we find ourselves compelled to question the robustness of IonQ’s technology as it dances with its wealthier, deeper-pocketed adversaries.

In summation, IonQ represents a high-stakes game, a venture suited only for those who traverse the realm of risk with a courageous heart. Examine IonQ’s path over the coming quarters with a discerning eye; if it manages to foster rapid revenue growth while paring down its costs, perhaps then, it shall emerge as a worthy contender for your portfolios-a glimmer of salvation on the horizon amidst the existential turbulence of the marketplace. 🌌

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-08-13 22:33