As we wade through the turbulent waters of investment opportunity, quantum computing emerges as a trendy new marvel-though, alas, not yet ripe for real-world implementation. It stands as a siren’s call to investors, enticing them into a world where potential and peril are precariously intertwined.

Among the luminaries willing to wrestle with this concept are the minnows like IonQ (IONQ), presenting a tantalizing prospect of massive returns-provided, of course, that fortune smiles upon their endeavors. Yet, one must also cast a glance at the leviathans such as Alphabet (GOOG) (GOOGL), whose coffers overflow with resources, palliating the risks involved in this modern arms race. But, dear reader, the shadow of trepidation looms-are we, in our pursuit of security, sacrificing the splendid bounty of high stakes?

So, in this veritable dance of giants and fledgling hopefuls, which stock shines brighter for the astute investor?

The Premium on IonQ’s Provocative Promise

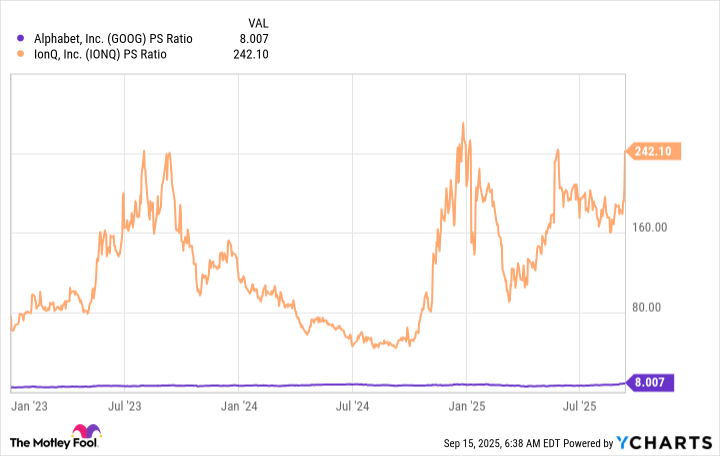

Consider, if you will, the rather pronounced size disparity betwixt these two contenders. Alphabet, that omnipotent tech Goliath, boasts a market capitalization soaring to $2.9 trillion-a resplendent figure. In contrast, IonQ clings tenuously to a modest valuation of a mere $17 billion. Yet, astonishingly, the latter presents itself as the more extravagant acquisition at present. Allow me to elucidate this peculiar anomaly.

At present, IonQ’s financial machinations yield but a trifling income. Its coffers are filled via an assortment of research partnerships, leaving it to report a paltry $21 million in revenue last quarter-a noisome speck next to Alphabet’s staggering $96.4 billion. Put in more vivid terms, IonQ’s revenue represents a mere 0.0218% of its rival’s mighty intake-an outrageous contrast that no amount of wishful thinking can disguise.

In monetary terms, to buy Alphabet is to pay around eight times its sales-a modest and unassuming number, if I may say so. IonQ, however, asks for a staggering 242 times sales. It seems the market is caught up in a feverish optimism regarding IonQ’s projected future, while Alphabet is left with the more banal comforts of stability. Should both entities succeed in delivering a commercially viable quantum computing system, their divergence in growth will be exponential. For Alphabet, this may yield trivial gains in quarterly revenue. For IonQ, however, a single lucrative sale could propel its earnings into the stratosphere-a delightful prospect for the sprightly investor, albeit intensely speculative.

Yet, one must contemplate the very real vagaries that bound both enterprises. The fate of each is susceptible to hidden flaws in their respective designs-quirks of fate that may not reveal themselves for years. If such a calamity were to befall either, the repercussions could be dire, perhaps dealing a fatal blow to IonQ, while Alphabet would likely bounce back into the cushy arms of its advertising empire.

Thus, the question remains: which stock should you grace with your presence? If you are haunted by nightmares of catastrophic losses, IonQ may present a spine-chilling specter best avoided. Alphabet, with its far more solid foundation, stands as the beacon of reason. Yet, might I posit an alternative strategy? By committing no more than a paltry 1% of your investment portfolio to a high-risk oracle like IonQ, you may partake in the thrill of its possible triumphs all while keeping your losses contained. Simultaneously, acquiring shares of Alphabet will act as a stabilizing anchor-the very essence of modern investment strategy in our brave new quantum world.

Indeed, this basket approach cautiously straddles the rickety tightrope of risk, affording one the capacity to navigate the emerging intrigues of quantum computing without collapsing into the abyss of folly.

🪄

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-20 13:56