The year 2025 arrived, not as a dawn, but as a peculiar luminescence, illuminating the strange province of quantum computing stocks. It was a bloom, unexpected, almost… willful. For a long while, these shares existed in the shadowed valleys of the market, unnoticed. Then, a flicker from Google’s Willow chip – a fragile promise, really – and the foothills began to stir. A rush, they called it. A gold rush, but for something not yet truly gold.

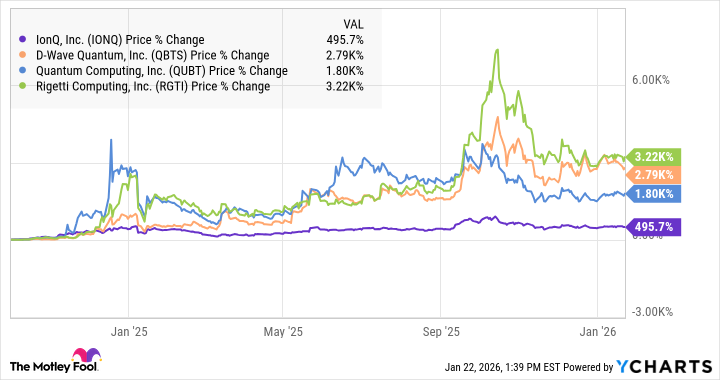

Alphabet, a titan accustomed to the turning of the earth, barely registered the tremor. But IonQ, D-Wave, Rigetti, Quantum Computing Inc. – these smaller vessels, they danced on the waves, inflated by a breath that smelled of hope and, perhaps, a touch of delusion. The chart, a pale map of this brief frenzy, shows a momentary ascent, a reaching for the sun before the inevitable settling.

The year unfolded, and the stocks continued to draw the eye, though with the fitful rhythm of a wounded bird. A retreat, a recovery – a dance dictated not by substance, but by the whims of speculation. They were linked, these ventures, to other shimmering mirages – the vertical flight of Archer and Joby, the contained sun of Oklo and NuScale. All promises, all fueled by the afterglow of artificial intelligence, a phantom limb of innovation.

And it is here, in this abundance of enthusiasm, that a certain unease settles. It is not simply a matter of bubbles bursting, though the air does feel thin. It is something more fundamental: a lack of comprehension. The investors, so eager to claim a piece of the future, seem to be grasping at shadows, mistaking the reflection for the thing itself.

The Essence of the Unseen

Quantum computing, they say, is built on the foundations of quantum mechanics, a realm where the rules of our everyday world dissolve. Qubits, these strange particles, exist in a state of both and neither, a superposition of possibilities. It is a world of probabilities, of entanglement, of unimaginable complexity. And it is this very complexity that breeds the danger. To build such a machine is to attempt to capture the wind, to bottle the sea. A noble ambition, perhaps, but one fraught with peril.

The potential is there, of course. A revolution in medicine, in materials science, in engineering. But potential is a seed that requires years of tending, of nurturing, before it can blossom. To expect a harvest now is to misunderstand the very nature of growth.

The Allure of the Novel

It is easy to see the attraction. These stocks offer the illusion of easy riches, a shortcut to the future. The charts, like seductive whispers, promise exponential gains. And the narrative is compelling: a new technology, a disruptive force, a chance to be part of something extraordinary. It is a story that appeals to the novice investor, the one who seeks not understanding, but validation.

Two of these ventures, D-Wave and Rigetti, have even found their way onto Robinhood’s list of most popular stocks. A curious phenomenon. It suggests that these shares are being driven not by informed analysis, but by a collective impulse, a herd mentality. A fleeting fashion, like a brightly colored scarf worn for a single season.

Retail interest, in itself, is not a condemnation. But when it becomes the primary driver of valuation, when it eclipses fundamental analysis, it is a warning sign. It suggests that the price of these shares is not anchored to reality, but is floating in a sea of speculation.

The Weight of Understanding

Stocks can rise and fall on many things – hope, fear, momentum. But ultimately, a share price should reflect a reasonable understanding of the underlying business. Biotech, for example, is notoriously complex, but it attracts a different kind of investor – one who is willing to delve into the science, to assess the risks and rewards. Quantum computing, however, seems to attract a different breed – one who is drawn to the spectacle, to the promise of quick profits.

Scott Aaronson, a computer scientist who has dedicated years to studying quantum mechanics, remains skeptical. He argues that the recent gains of IonQ and its peers are driven more by marketing than by genuine technological advancements. He suggests that Quantinuum, a privately held competitor, is significantly ahead in hardware development. His opinion, though not reflected in the stock price, carries a weight that the enthusiasm of meme stock investors cannot match.

These quantum stocks may remain fashionable for a time, attracting the attention of growth stock investors. But speculation and FOMO, especially for a stock that has already been inflated, are poor foundations for a long-term investment. I prefer to remain on the sidelines, observing the unfolding drama with a detached curiosity. The technology may eventually be disruptive, but based on recent results, we are still years, perhaps decades, from realizing its full potential. And in the meantime, the market, as always, will continue its restless dance, searching for the next illusion.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-23 09:23