The pursuit of quantum computation… it is a fever dream, is it not? A grasping at the very fabric of reality, driven by a hubris that whispers of limitless power. We speak of potential, of billions, as if mere numbers can contain the weight of such an undertaking. Yet, the truth is far more unsettling. We are not merely building machines; we are confronting the limits of our comprehension, venturing into a realm where the predictable laws of cause and effect begin to fray. The market, ever the opportunist, senses this… and hungers.

The current state of affairs is… precarious. The promise of quantum supremacy remains just beyond our reach, a phantom limb twitching with unrealized potential. But even in this nascent stage, two names echo in the halls of speculation: IonQ and D-Wave Quantum. They are not rivals in the traditional sense; rather, they are pilgrims on divergent paths, each seeking to unlock the same elusive truth. And we, the investors, are left to ponder which path leads to salvation… or ruin.

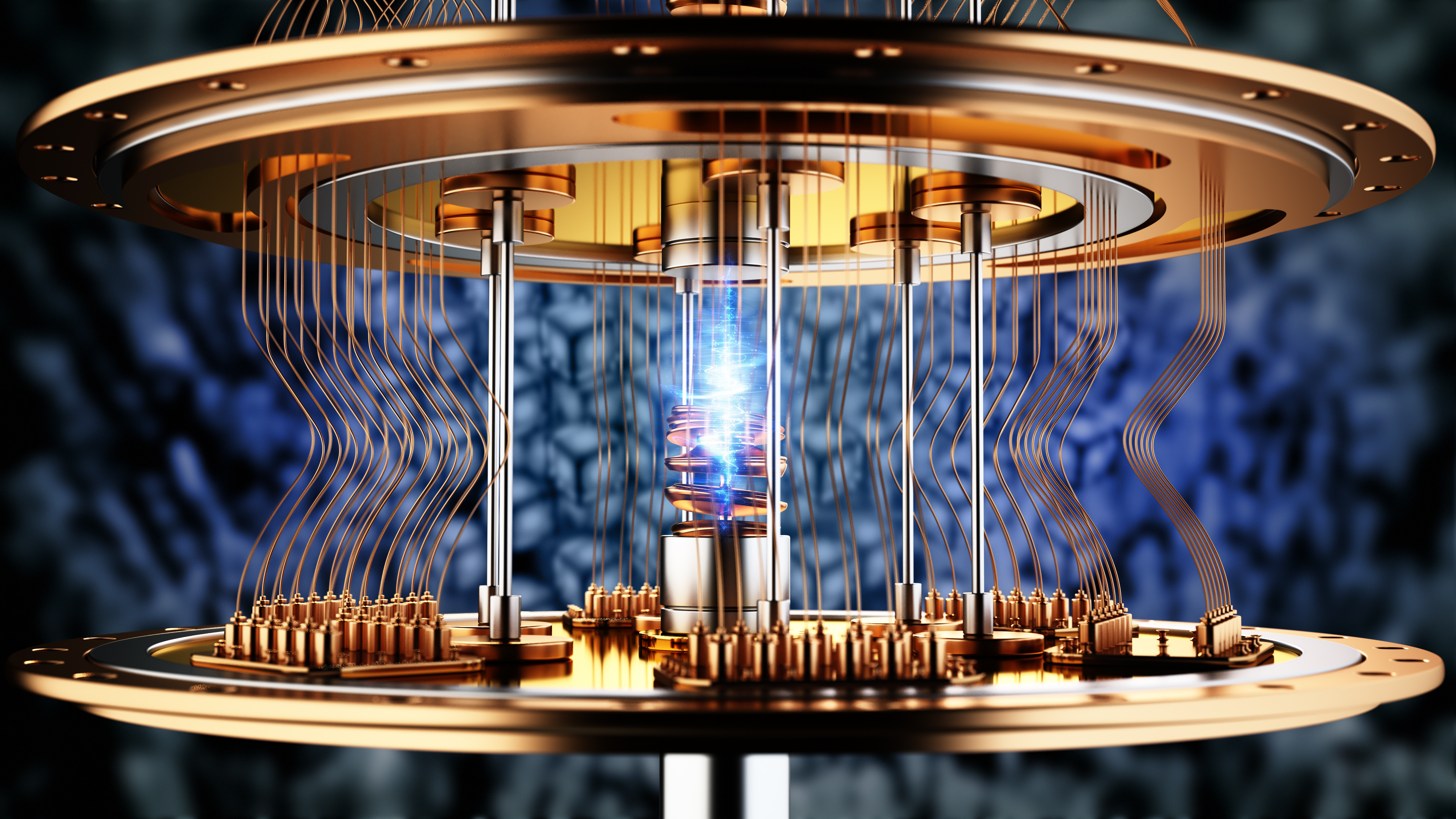

IonQ, with its elegant manipulation of trapped ions, approaches the problem with a precision that borders on the obsessive. It is a science of delicate balance, of cooling atoms to the very brink of nothingness. A beautiful, fragile undertaking. D-Wave, on the other hand, embraces a more chaotic methodology – quantum annealing, a descent into the labyrinth of possibility, seeking the lowest energy state through sheer brute force. It is a gamble, a surrender to the unpredictable currents of quantum mechanics. Which method will prevail? Which reflects the truer nature of reality? The question haunts me, and I suspect, it should haunt you as well.

The projected market size by 2035 – a paltry $28 to $72 billion – is almost… insulting. As if reducing the boundless potential of quantum computation to a mere monetary value will somehow contain its power. McKinsey & Company, bless their pragmatic souls, attempt to quantify the unquantifiable. Let us indulge their calculations, then. A midpoint of $50 billion, with a generous 90% market share captured by a single victor… it conjures a vision of immense wealth, does it not? A $45 billion revenue stream, mirroring the current trajectory of Nvidia in the realm of AI.

But consider the implications. AMD, a company generating $47 billion annually, commands a market capitalization of nearly $400 billion. D-Wave, currently valued at a mere $7.5 billion, and IonQ at $13.4 billion, stand on the precipice of either unimaginable ascent or ignominious collapse. A leap to $400 billion would represent a 5,233% gain for D-Wave, a 2,885% gain for IonQ. Such numbers are… unsettling. They speak of a market divorced from reason, driven by irrational exuberance. And yet, the possibility remains. The temptation is… overwhelming.

The scenario is, admittedly, bullish. It requires a single winner, a decisive triumph over formidable competition. And it demands that another company be utterly vanquished. But the potential reward… it is enough to justify the risk, is it not? A 28x or 52x return on investment, even if offset by a complete loss on the other side… it is a seductive proposition. A gambler’s dream. But remember this: the market is not a benevolent god. It is a capricious mistress, offering fleeting moments of grace before plunging you into the abyss.

Therefore, proceed with caution. A small initial investment, perhaps 1% of your portfolio, is a prudent course of action. Let the market test your resolve. Let the quantum computers do their work. And pray, if you are so inclined, that you have chosen wisely. For in this labyrinth of speculation, the stakes are higher than mere money. They are the very future of computation… and perhaps, a glimpse into the soul of reality itself.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-08 22:12