A million dollars. The very phrase tastes of dust and vanished empires, doesn’t it? Most chase it with the frantic energy of a moth near a flickering bulb, believing salvation lies in accumulation. They save, they clip coupons, they deny themselves small joys… a pathetic spectacle, really. Investing, however, offers a different sort of madness – a gamble dressed in the respectable clothing of compound interest. And in this particular circus, the Invesco QQQ Trust ETF – QQQ, if you prefer brevity, as I do – presents itself as a rather intriguing beast.

The market, of course, offers no guarantees. To suggest otherwise is the province of charlatans and estate agents. Yet, if the QQQ continues its current, almost unsettling trajectory, a modest $500 a month might, just might, conjure a seven-figure sum. It’s a preposterous notion, naturally. Like expecting a decent cup of coffee in Siberia. But let us entertain it, shall we?

A History of Outperformance (and the Vanity of Numbers)

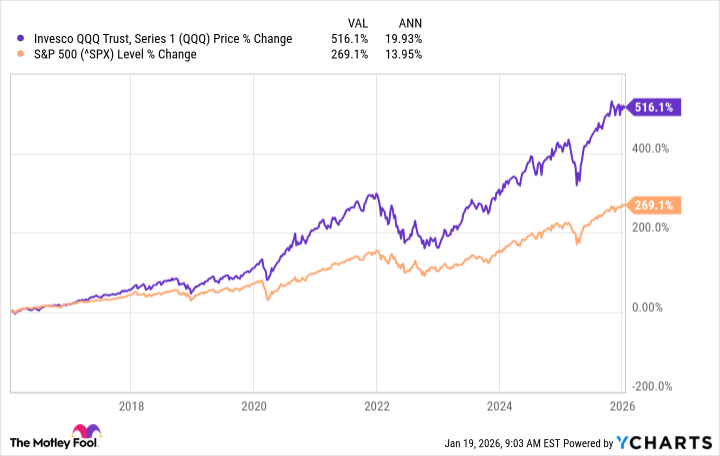

The QQQ, you see, mirrors the Nasdaq-100 – a collection of the one hundred largest non-financial companies clinging to the Nasdaq exchange. A rather exclusive club, filled with tech titans and the occasional hopeful. Approximately 64% of the fund is dedicated to technology, though it also dabbles in other, less volatile sectors. It launched in March of 1999, a time of unbridled optimism and questionable fashion choices. Since then, it has averaged a respectable 10% annual return. Though in the last decade, that average has swelled to nearly 20%. A truly alarming figure. It suggests either genius or a systemic delusion.

I do not anticipate such consistent returns. The universe, you see, abhors predictability. But for the sake of argument, let us assume an average of 15% per annum. Subtracting the negligible expense ratio of 0.18%, a monthly investment of $500 could, in approximately 24 years, blossom into a sum exceeding a million dollars. A more conservative estimate of 10% extends the timeline to around 31 years. Time, my friend, is the great illusionist. It makes even the impossible seem… plausible.

The personal contribution, in these scenarios, is almost… quaint. A mere $144,000 over 24 years, or $186,000 over 31. The real magic, of course, lies in the compounding. A subtle form of alchemy, transforming modest sums into… well, more modest sums, but significantly larger than the original investment. The market doesn’t care about your intentions, only your capital.

And let us not forget the dividend yield, currently averaging around 0.7%. A pittance, certainly. But with a million dollars invested, it translates to $7,000 annually. Enough, perhaps, for a week in the Crimea. Or a decent bottle of wine.

Why QQQ Might Continue Its Dance (and the Fragility of Empires)

The long-term success of the QQQ hinges, naturally, on the fortunes of the American tech sector. Specifically, the “Magnificent Seven” – those behemoths that account for almost 43% of the ETF. They are, at present, rather overvalued, like a spoiled nobleman flaunting his inheritance. But they remain crucial to the global economy, a fact that is both terrifying and undeniable.

Barring some cataclysmic event – a meteor strike, a sudden outbreak of common sense – companies like Microsoft, Apple, Alphabet, Amazon, and Meta will continue to dominate our lives. Their roles may evolve, they may adopt new disguises, but they will be there, lurking in the shadows, collecting our data and selling us things we do not need.

If I were to invest for the long term, I would place my trust in these established giants, and the blue-chip stocks from other sectors. Not because they are virtuous, but because they are… inevitable. The market, after all, is not a meritocracy. It is a game of survival, played by those with the deepest pockets and the fewest scruples.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-01-24 00:02