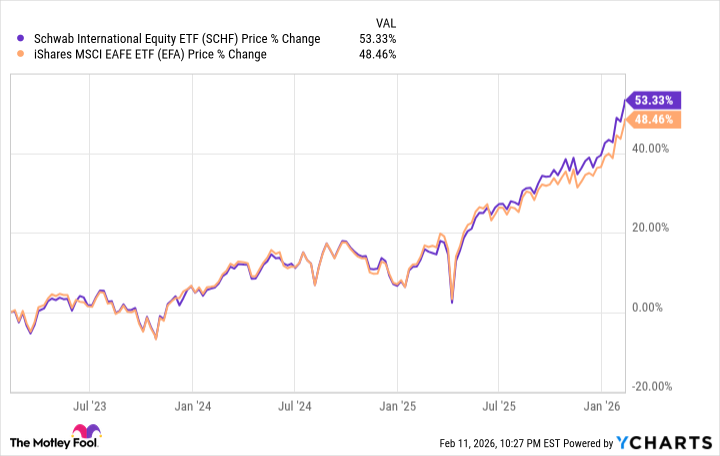

It is, of course, dreadfully vulgar to discuss figures, but one cannot deny the persistent murmurings about international equities finally eclipsing their domestic counterparts. The year 2026, it seems, continues the narrative begun last year, and with a certain, shall we say, justification. The MSCI EAFE index, having ascended a respectable 9.3%, leaves the S&P 500 trailing behind, a mere 1.5% in its wake. A disparity, one might observe, sufficient to pique the interest of even the most languid investor.

For those contemplating the art of geographic diversification – a concept as sensible as wearing gloves in winter – the time may have arrived to act. And fortunately, the task is easily accomplished through the medium of exchange-traded funds, or ETFs, of which the Schwab International Equity ETF (SCHF +0.34%) is a particularly… intriguing specimen. It removes the tedious burden of stock-picking abroad, allowing one to sleep soundly, which, after all, is the ultimate aim of any investment. Though, naturally, a little knowledge before leaping in is always advisable.

Nuance, As Always, Matters

The name of this ETF, thankfully, is not entirely deceptive. It is, as advertised, an international equity fund. Where the unwary investor might stumble is in comparing it to those funds boasting the rather grandiose title of “total” international. The difference, you see, is a matter of scope.

The $61 billion Schwab ETF concentrates on the developed markets beyond our shores. A “total” international fund, such as the Vanguard Total International Stock ETF (VXUS +0.33%), however, extends its reach to the more… volatile realms of emerging markets. A distinction not to be overlooked. One might say it’s the difference between a carefully curated garden and a wild, untamed meadow. Both have their charms, but only one offers a degree of civilized control.

And on that note, the underlying index is of some consequence. The Schwab ETF follows the FTSE Developed ex US index, a subtly different beast than the aforementioned MSCI EAFE. MSCI, you see, considers South Korea an emerging market. FTSE does not. Consequently, the Schwab ETF holds South Korean stocks, a fact that has proven rather advantageous in recent years. It’s a reminder that even the most sophisticated indices are, at heart, merely opinions, elegantly disguised as data.

In short, not all index funds addressing the same asset class are created equal. For those seeking genuine geographic diversification, the Schwab ETF fills a void some of its rivals lack. Even a modest 5.5% weight to South Korean stocks expands the Asia ex-Japan playing field. This also pushes the Schwab ETF’s technology weight to 10.9%, surpassing the 8.7% found in a leading MSCI EAFE ETF. A rather delightful advantage, wouldn’t you agree?

And since geography is, after all, the point, it’s worth noting the FTSE Developed ex US Index includes Canadian stocks, while its MSCI rival does not. Thus, the Schwab fund boasts an almost 11% weight to Canadian equities, a pleasing development given that market’s recent outperformance. It seems the northern neighbors are occasionally blessed with a touch more… prudence.

Big, Broad, and, Thankfully, Inexpensive

Adding international exposure to a portfolio is but one facet of diversification. Ensuring those funds themselves are diverse is equally crucial. The Schwab international fund answers that call admirably. It holds 1,498 stocks, none of which dominates the lineup (the largest holding commands a mere 1.96%), spanning more than a dozen countries. A commendable degree of breadth, wouldn’t you say?

And for the cost-conscious investor – those who appreciate value as much as elegance – the Schwab ETF is a particularly attractive proposition. Its expense ratio is a paltry 0.03% per year, or $3 on a $10,000 position. A sum so negligible it barely registers on the scale of things. One might even call it… a bargain.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Games That Faced Bans in Countries Over Political Themes

- The Most Anticipated Anime of 2026

- Most Famous Richards in the World

- Top 20 Educational Video Games

2026-02-15 16:52