The markets, like the seasons, turn in cycles of abundance and hardship. Recently, a chill has settled upon the exchanges, a temporary disquiet that, for the discerning eye, presents opportunities. It is in these moments of collective apprehension that true value often reveals itself, obscured not by inherent worthlessness, but by the fleeting passions and anxieties of the multitude. To observe the current state of affairs is to witness a familiar drama: the hasty selling of sound holdings, driven by fear, creating a temporary imbalance, a distortion of true worth. A patient investor, however, understands that such imbalances, while unsettling to some, are the very foundations upon which fortunes are built.

Three companies, each a titan in its own right, currently find themselves subject to this temporary disfavor: Microsoft, The Trade Desk, and Nvidia. To consider them merely as ‘stocks’ is to diminish their true significance. They are, rather, embodiments of human ingenuity, engines of progress, and, for those with the foresight to recognize it, potential sources of enduring prosperity. To invest in them now is not a gamble, but a reasoned act, a recognition of underlying strength amidst superficial turbulence.

Microsoft

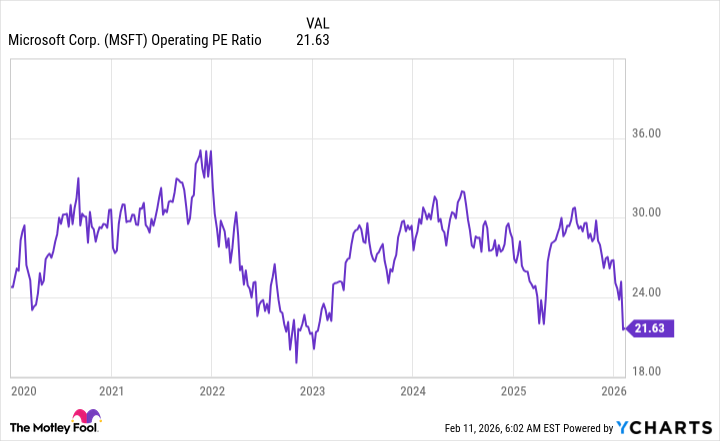

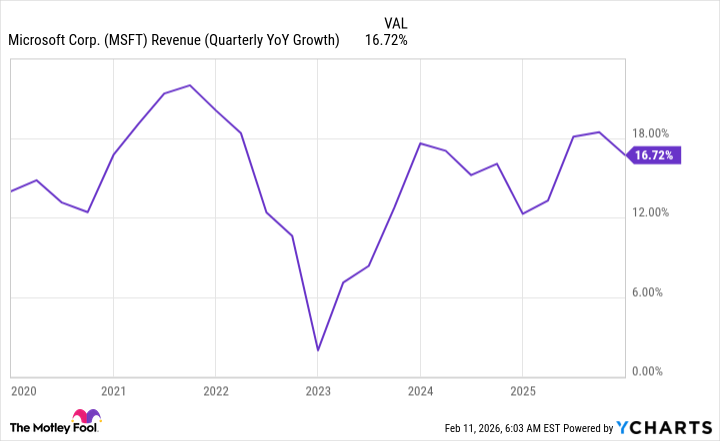

For years, Microsoft has occupied a position of considerable esteem, a premium valuation reflecting its dominance in the realm of software and technology. Yet, the winds of fortune have shifted, and a temporary cloud of doubt has descended. A recent earnings report, perceived as less than stellar by the perpetually demanding market, has prompted a reassessment of its worth. But to focus solely on the most recent quarter is to ignore the decades of innovation, the vast ecosystem of products and services, and the enduring loyalty of its customer base. To value Microsoft solely on the basis of short-term fluctuations is akin to judging a mighty oak by the color of its autumn leaves.

The company’s investment in OpenAI, while introducing a degree of complexity to its financial statements, is a testament to its forward-thinking vision. To disregard this investment, as some analysts have done, is to misunderstand the very nature of progress. It is a gamble, yes, but a calculated one, a recognition that the future belongs to those who dare to explore the uncharted territories of artificial intelligence. The current price of Microsoft stock, therefore, represents not a decline in value, but a temporary aberration, a fleeting opportunity for the astute investor. It is a rare moment, indeed, when a company of such stature can be acquired at a price that belies its true potential.

The Trade Desk

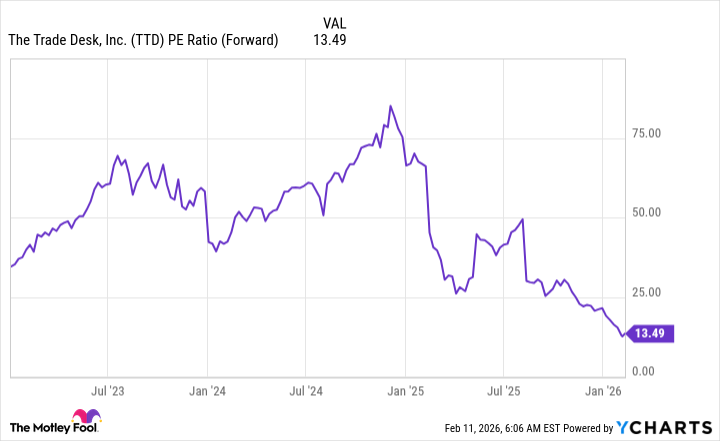

The Trade Desk, unlike the established behemoth of Microsoft, is a more recent arrival on the scene, a nimble and ambitious player in the world of digital advertising. It is not without its challenges, facing headwinds in a rapidly evolving landscape. The complexities of programmatic advertising, the constant need to adapt to new technologies and shifting consumer behaviors, present a formidable test. Yet, despite these challenges, The Trade Desk continues to demonstrate impressive growth, a testament to the efficacy of its platform and the skill of its leadership. The recent quarterly results, while slightly below previous levels, are still a cause for optimism, particularly when viewed in the context of a difficult macroeconomic environment.

To dismiss The Trade Desk as merely another advertising technology company is to misunderstand its unique position in the market. It is a neutral intermediary, a trusted partner for both advertisers and publishers, committed to transparency and accountability. This commitment, while requiring significant investment, is a source of competitive advantage, building trust and fostering long-term relationships. The current valuation, a mere thirteen times forward earnings, is, frankly, astonishing. It is a price that reflects not the company’s inherent worth, but the prevailing mood of pessimism in the market. A prudent investor, however, will see beyond the superficial gloom and recognize the underlying strength of this remarkable company.

Nvidia

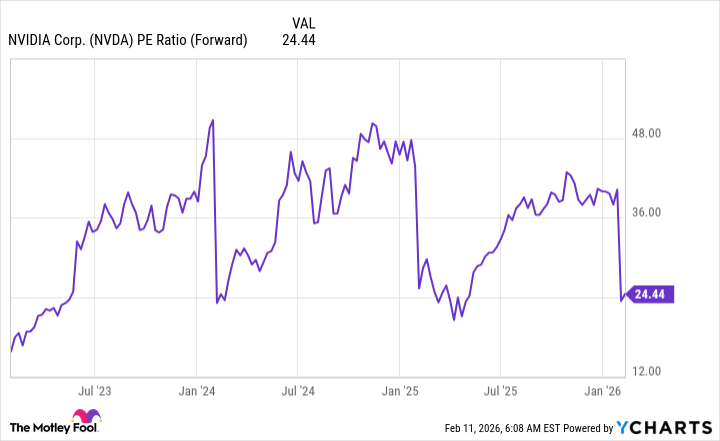

Nvidia, a name now synonymous with the burgeoning field of artificial intelligence, is a company that has, in recent years, undergone a remarkable transformation. From a niche provider of graphics processing units, it has evolved into a dominant force in the world of high-performance computing. Yet, despite its extraordinary success, its stock remains, surprisingly, undervalued. The market, ever fickle, seems reluctant to fully appreciate the magnitude of Nvidia’s achievements. It is a phenomenon that can only be attributed to a collective failure of imagination.

Despite the staggering capital expenditure figures announced by its largest clients – a clear indication of the insatiable demand for its products – Nvidia’s stock has barely budged. It trades for a mere twenty-four times forward earnings, a valuation that is almost too low to believe. Compared to the broader market, as measured by the S&P 500, it is a bargain. The current price, therefore, represents not a reflection of Nvidia’s true potential, but a temporary distortion of the market, a fleeting opportunity for the discerning investor. The projected growth rate of sixty-four percent in fiscal year 2027 is not merely a statistic; it is a testament to the transformative power of artificial intelligence and the central role that Nvidia will play in shaping the future. The belief that global data center capital expenditures could reach three to four trillion dollars by 2030 may seem ambitious, but it is not unreasonable. Nvidia, along with its peers, is poised to reap the rewards of this unprecedented investment. To ignore this opportunity would be an act of folly.

The market, like life itself, is a complex and unpredictable affair. There are no guarantees, no easy answers. But for those who are willing to look beyond the superficial noise, to focus on the underlying fundamentals, and to exercise patience and discipline, there are opportunities to be found. These three companies – Microsoft, The Trade Desk, and Nvidia – represent such opportunities. They are not merely stocks; they are embodiments of human ingenuity, engines of progress, and potential sources of enduring prosperity. And for the prudent investor, they are bargains waiting to be discovered.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- Top 15 Movie Cougars

- Top 20 Extremely Short Anime Series

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

2026-02-15 23:32