To observe the stock of Palantir (PLTR) is to witness a peculiar drama, where the improbable has become the inevitable. It defies gravity with the grace of a swan and the audacity of a peacock. To call it a mere stock would be an insult—to its volatility, if nothing else.

Once a darling of speculative fervor in late 2020, Palantir soared to celestial heights only to descend precipitously by the end of 2022, losing over 80% of its value. Yet, like a phoenix adorned in silicon feathers, it rose again, delivering returns so staggering they seem almost impertinent. Last year, it led the S&P 500 with a 340% gain, and this year, it continues its ascent with a 105% rise thus far. Its price-to-sales ratio, hovering around 120, suggests either genius or madness—or perhaps both, which is often the case in matters of finance.

And yet, dear reader, the bears who cry “overvalued!” are met with the shrug of a market that appears to care little for their protests. Let us, then, examine the forces propelling this enigmatic entity upward, as one might admire a painting whose beauty lies not in its realism but in its ability to provoke thought.

1. The Art of Turning Numbers into Poetry

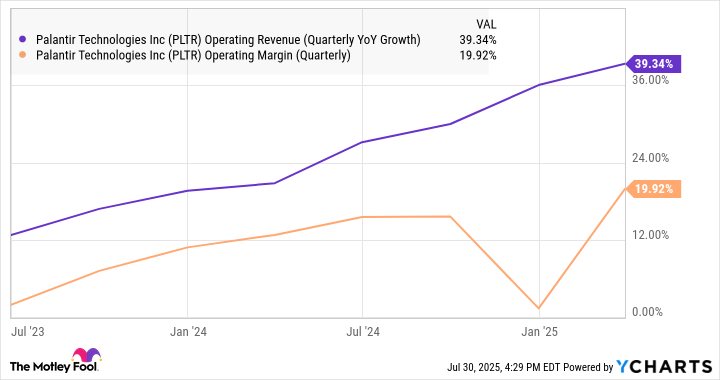

It is said that success leaves clues, and Palantir’s resurgence is no exception. Since unveiling its Artificial Intelligence Platform (AIP), the company has transformed itself from a plodding tortoise into a galloping thoroughbred. Revenue growth has accelerated, margins have expanded, and the Rule of 40—a metric so beloved by software investors—has reached a score of 83%. One might say that Palantir has mastered the art of turning numbers into poetry, though the verse is written in the language of algorithms.

In the first quarter alone, U.S. revenue surged 55%, while commercial revenue leapt 71%. These figures are not merely statistics; they are declarations of intent, whispered softly to those who know how to listen. As CEO Alex Karp noted, the company’s performance exceeds conventional standards for investable software stocks—a fact that must surely delight shareholders and confound skeptics alike.

2. The Favor of Fortunes Favored by Fate

Ah, the government—the eternal patron of innovation, whether it seeks to build or to surveil. For Palantir, the federal coffers remain a wellspring of opportunity. In the first quarter, U.S. government revenue climbed 45% to $373 million, accounting for more than 40% of total revenue. And who can blame the bureaucrats for their enthusiasm? After all, when one wishes to navigate the labyrinthine corridors of data, there are few better guides than Palantir.

The Trump administration, with its penchant for executive orders and grand ambitions, has proven particularly fertile ground. An order requiring inter-agency data sharing plays directly into Palantir’s hands, much like a chess piece moving inexorably toward checkmate. Meanwhile, projects such as “ImmigrationOS” underscore the company’s role as both architect and overseer of modern governance. Add to this Peter Thiel’s influence within Republican circles, and you have a recipe for sustained favor—a rare commodity in these uncertain times.

3. The Market’s Masquerade Ball

Markets, like society, thrive on spectacle. The recent surge in AI stocks—led by titans such as Nvidia and our own Palantir—is less about fundamentals and more about the intoxicating allure of disruption. Investors, ever eager to dance at the edge of reason, have embraced risk once more, bidding up shares of companies whose valuations stretch credulity itself.

Consider the frothiness of the moment: development-stage enterprises in nascent industries now command valuations that would make even the most ardent dreamer blush. Yet, let us not forget that masquerade balls eventually end, and when they do, the masks come off. High-flyers like Palantir will feel the chill of reality most acutely, as we saw earlier this year when the stock plummeted over 40% in mere weeks.

For now, however, the music plays on. Palantir’s government contracts lend it a veneer of resilience, shielding it from the worst excesses of economic downturns. But beware: its valuation remains a house of cards, precariously balanced atop shifting sands. Should sentiment falter—or should its business stumble—the fall could be as dramatic as the rise.

And so, we find ourselves at the intersection of ambition and absurdity, where fortunes are made and unmade with equal ease. To invest in Palantir is to embrace the paradoxical: to seek stability in chaos, to find beauty in excess, and to wager that tomorrow will forgive what today cannot comprehend. As Oscar himself might quip, “To succeed wildly is divine; to fail spectacularly is human.” 🌟

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Top gainers and losers

- 9 Video Games That Reshaped Our Moral Lens

2025-08-04 01:29