Hedera (HBAR) has taken a nosedive of 10.5% over the past week. You’d think the gods themselves scripted this fall—except no, it’s just technical indicators and a dash of market madness. Futures volume has dipped below $100 million for five days straight. Remember when March hit $1.3 billion? Ah, those were the days—now, it’s just a sad whisper of speculation fading faster than your New Year’s resolutions.

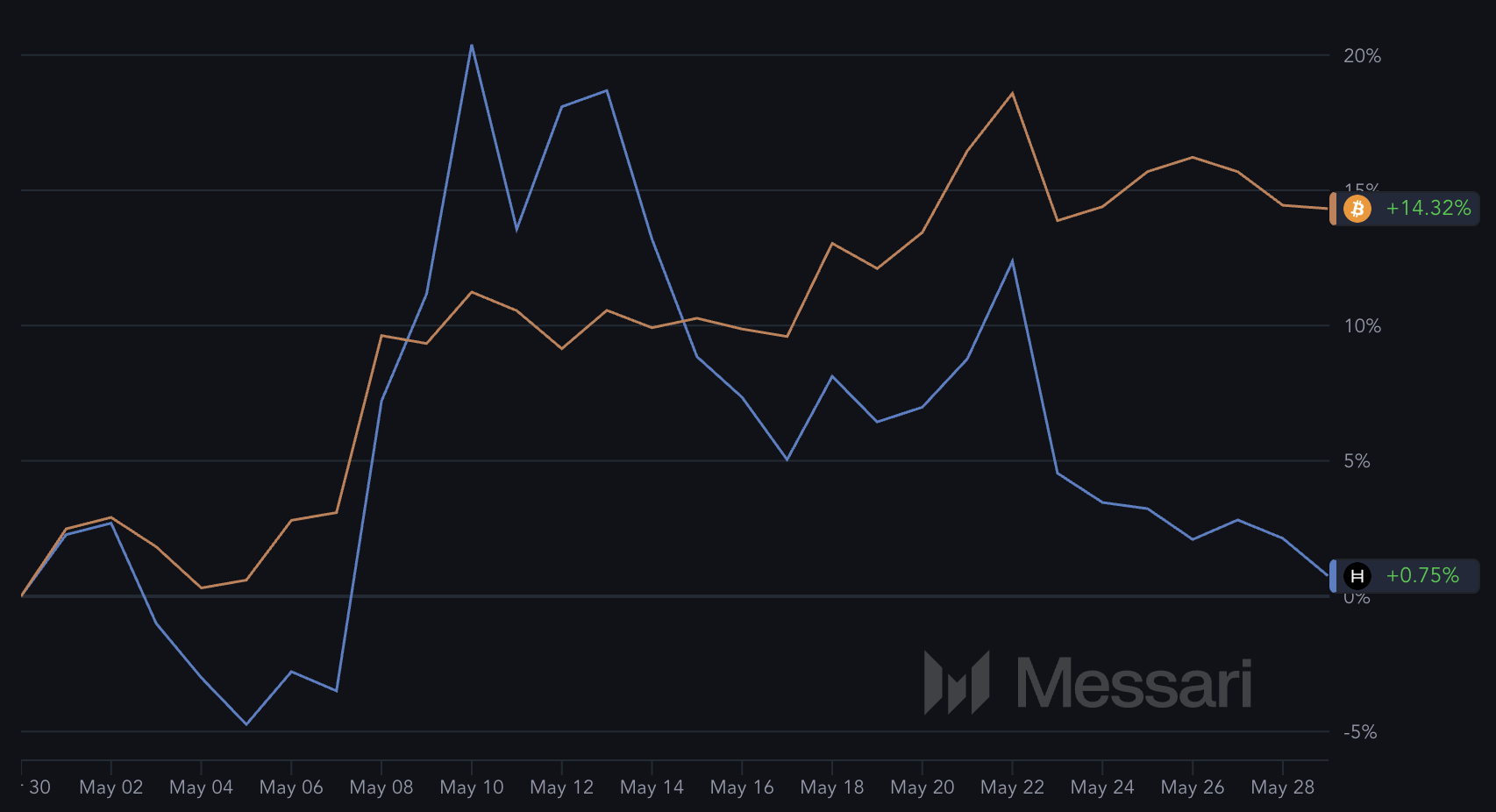

Despite its love affair with Bitcoin, HBAR has been playing the sidekick in the recent rally, barely lifting off with a pathetic 0.75% gain in the last month. The EMA lines—those ever-reliable harbingers of doom—remain bearish, and the price is teetering near the $0.18 support level. It’s like watching a boxer battered and bruised, waiting for a miracle—or a knockout. Will June be the hero, or just another chapter in this tragicomic saga?

HBAR Futures Volume Dives Below $100 Million—Is It Time to Panic or Just Toss a Coin?

The futures volume has plummeted to a mere $96.5 million, hugging the mythical $100 million line for five days. Back in March, things looked promising—peaking at $1.3 billion, promising riches and chaos—but now, volume and open interest are shrinking faster than hope in a crypto winter.

Futures? Ah, those clever contracts letting gamblers wager on the token’s future. When they’re active, you can bet the market’s feeling lively—or downright deranged. When activity drops, it’s a silent scream from traders—”We’re scared, and we know it.”

This rapid decline suggests that everyone with money left in Hedera is hiding under their desks, afraid to make a move. The data—showing the lowest seven-day EMA in three months—might be telling us that the market is now driven more by spot requests than wild leverage. Calm seas ahead? Or just the lull before another storm? Without new speculative activity, don’t hold your breath for fireworks.

Hedera’s Meh Performance vs. Bitcoin—Will the Hero Turn in June?

Hedera, that eager little puppy, has long been mouthing at Bitcoin’s heels—often dancing to the same tune. But lately, it’s more slapstick than symphony. With Bitcoin up 14.3%, HBAR limped along with a 0.75% bump. Looks like HBAR’s playing hard to get, despite the broader market’s bullish shouts.

This divergence is a comedy of errors—HBAR hasn’t yet caught the bullish wave, despite its usual eagerness. Past cycles tell us it sometimes outperforms during rallies but also takes the steepest dives during wipeouts—like a roller coaster designed by sadists. If Bitcoin makes a new high in June, don’t be surprised if HBAR suddenly remembers it’s got some fight left in it; history suggests it might just join the party with a vengeance—bright side or black humor, you decide.

HBAR Nears $0.18 Support—Bearish EMA Keeps the Mood Dark

The technical setup? Oh, it’s as cheerful as a rainy Monday. The EMA lines are still bearish—short-term below long-term, a classic sign of trouble. Like a battered soldier still standing, but barely. It’s been below $0.20 for six days—a sign of persistent pressure and dashed hopes.

Market sentiment? Grim. HBAR is creeping closer to the $0.18 support line—the first breach since May 8. Lamentably, if it falls below, we might see a historic event—Hedera’s first taste of the abyss. But if the brave June winds blow favorably, maybe, just maybe, it’ll bounce back, break above $0.20, and target $0.25—a number that sounds hopeful but might just be a cruel mirage. Buckle up; it’s going to be a bumpy ride through this circus of despair.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-05-29 19:36