![]()

As the Nasdaq Composite (^IXIC) ascends from its 2022 abyss like a phoenix-or perhaps Icarus-renewed by the molten breath of artificial intelligence, one recalls the apocryphal words of the Book of Market Mirrors: “All trends are but reflections in a hall of glass, each shard distorting time.” The current veneration of AI as the next industrial revolution invites scrutiny, not as heresy against progress, but as an exercise in cartographing labyrinths.

Trillions are summoned to crystallize in silicon and algorithm, yet who among us can divine the Minotaur lurking at the maze’s heart? Let us examine three Ariadne threads-Nvidia (NVDA), Taiwan Semiconductor Manufacturing (TSM), and Alphabet (GOOGL)-whose legends intertwine with the Oracle of Growth.

1. Nvidia: The Ouroboros of Computation

In the beginning was the GPU, and the GPU was with Moore’s Law, and the GPU was Moore’s Law incarnate. Nvidia’s graphics processors, serpentine in their self-devouring ascent, now power the training of large language models-digital titans gnawing endlessly on the carcass of human knowledge.

The CUDA platform, a closed garden where developers till soil pre-sown with proprietary seeds, has become a Babel of code. Hyperscalers-Meta, Microsoft, Amazon-clutch its fruits like Demeter in winter, their hunger inversely proportional to the season. Analysts whisper of a “$10 trillion ouroboros,” yet one wonders: does the serpent’s tail grow fatter from its own digestion?

2. Taiwan Semiconductor: The Hidden Architect of Silicon Labyrinths

TSMC operates the Labyrinth of Minos, where Theseus himself might falter. Here, etched in nanometers finer than a hair’s caprice, lie the circuits that animate AI’s simulacrum. Advanced Micro Devices and Apple alike pilgrimage to this shrine, bearing offerings of blueprints and gold-plated wafers.

Its fabs in Arizona and Kyoto are Doric columns supporting the Parthenon of Progress. Yet consider the paradox: as demand for high-performance computing swells, TSMC’s fate turns recursive. It builds the tools that build the tools-a mise en abyme where even the architect may vanish into the mortar.

3. Alphabet: The Aleph of Data

Alphabet, that ever-expanding Aleph, contains all perspectives at Google’s nexus. Its Gemini model-a digital Janus-gazes simultaneously at search queries and OpenAI’s machinations. YouTube’s recommendation engine, a Möbius strip of engagement metrics, bends user behavior into perpetuity.

Google Cloud’s recent pacts with Meta and OpenAI echo the Library of Babel’s infinite hexagons: every contract a corridor leading to another corridor, ad infinitum. One might conjecture Alphabet’s true product is not AI, but the illusion of choice-a hall of mirrors where advertisers and users collide like atoms in a Tokamak.

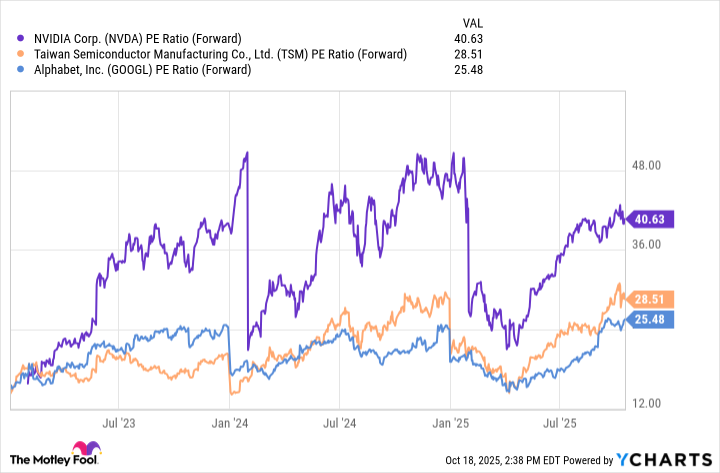

Epilogue: The P/E Ratio as a Palimpsest

The chart below, a palimpsest of forward price-to-earnings ratios, reveals each company’s visage layered atop prior selves. Nvidia’s multiple ascends like a gnostic aeon; TSMC’s pricing power solidifies like cooled magma; Alphabet’s valuation, modest yet protean, mirrors the moon’s dual face of crater and sea.

Yet all metrics are provisional-a Ptolemaic epicycle adjusting to the Copernican shift of AI. As the Oracle of Delphi purportedly proclaimed only “Nothing in excess,” so too might the market whisper: “Beware the labyrinth’s center. It is emptier than the periphery.”

Thus, the skeptic treads warily, compass in hand, through the recursive corridors of growth narratives. 🧭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- The Best Actors Who Have Played Hamlet, Ranked

2025-10-21 18:47