Now, the S&P 500, that rather puffed-up index, has been enjoying a jolly good time lately – three years of gains, you see, like a greedy child with too much sweets. It’s already popped up 1.4% this year, and some clever-clogs on Wall Street reckon it’ll keep on climbing in 2026. They predict, they do. But let me tell you, old friends, there are rumblings. Nasty little rumblings that even a dividend hunter like myself can’t ignore.

This index, you see, is getting rather high on its own fumes. It’s a bit like a giraffe trying to balance on a beach ball. Its ‘forward price-to-earnings’ – a rather ghastly phrase, isn’t it? – is around 22. Now, over the last thirty years, it’s usually been closer to 17. That’s a hefty premium, that is. The last time it was this inflated, just before the techy-poos had a tumble in 2021. Before that? The late nineties, when everyone went mad for dot-coms. A crash followed, naturally. Greedy sorts, those dot-coms.

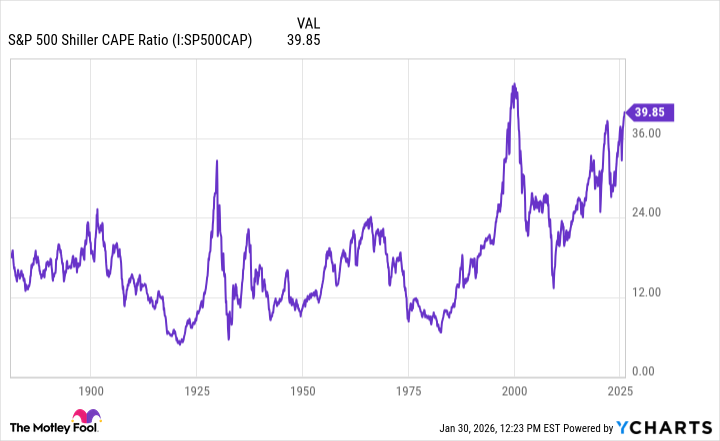

But the truly unsettling thing, the one that makes my whiskers twitch, is something called the CAPE ratio. It’s a complicated contraption, this, that tries to guess how the market will do over a long stretch. It usually averages around 28.5. But now? It’s nudging 40! Nearly forty, can you believe it? That’s only happened once before in the last 153 years. And what followed that, you ask? The year 2000 went splosh. A very messy splosh indeed.

Does this mean the market will go belly-up in 2026? Not necessarily. Markets are funny things. They bounce, they wobble, they sometimes even behave reasonably. But it does suggest that this S&P 500 has climbed a bit too high for comfort. It’s like building a tower of biscuits – sooner or later, it’s going to crumble.

It wouldn’t surprise me if things took a tumble. It would, in fact, be rather… resonant, wouldn’t it? History has a habit of repeating itself, especially when there’s a bit of foolishness involved.

Now, I’m not suggesting you rush out and sell everything. That’s never a sensible thing to do. But a careful selection of investments, the sort that can weather a bit of a storm, might be a rather clever idea. Look for companies that actually make things, that pay a decent dividend, and aren’t just relying on hot air and fancy tricks. Those are the ones that will keep you snug when the wind starts to blow. A bit of prudence, a dash of caution, and a keen eye for a good yield – that’s the secret, you see. And remember, a healthy dividend is a very satisfying thing indeed.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 21:12