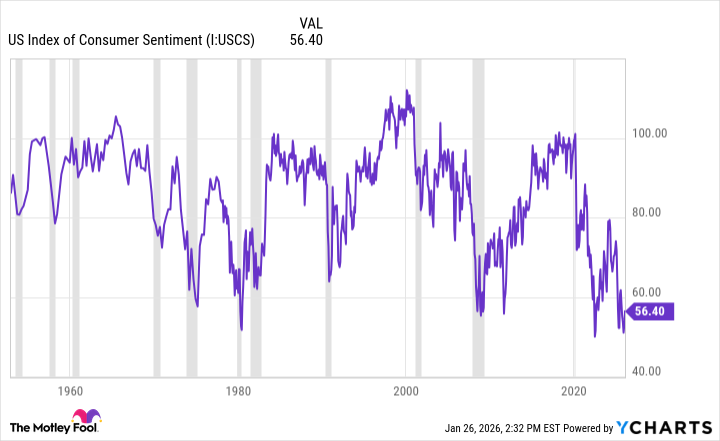

It has come to my attention – a matter of some amusement, I assure you – that the public, in its collective wisdom, is currently seized by a fit of despondency. The University of Michigan, a body devoted to measuring such things, reports a ‘Consumer Sentiment Index’ at a level scarcely above the abyss. A paltry 51, they say – a figure that would scarcely enliven a funeral. The common investor, naturally, flees in terror, convinced that ruin is at hand. And it is precisely at this moment, my friends, that a discerning mind may find opportunity.

Observe, if you will, the spectacle of the panicked herd. They believe, with a touching naiveté, that the market reflects reality. A most peculiar notion! The market, I assure you, is a stage upon which folly and greed perform a perpetual dance. To believe it a mirror to the world is to mistake a painted mask for a true face. Last June, the index plumbed even greater depths – a mere 50! One might have expected the very foundations of commerce to crumble. Instead, for a brief, deceptive moment, the sensible investor might have considered retreat. But alas, such prudence is rarely rewarded.

The market, ever the contrarian, promptly rallied. Over the ensuing months, it demonstrated a most inconvenient truth: that despair is often the precursor to prosperity. The S&P 500, that barometer of collective delusion, gained a respectable 17%. A single data point, you say? Perhaps. But it serves to illustrate a principle as old as avarice itself: buy when others are selling, and sell when others are buying. A simple maxim, yet one so consistently ignored.

The sage Mr. Buffett – a man who, despite his wealth, possesses a certain shrewdness – has articulated this elegantly: “Be fearful when others are greedy, and greedy when others are fearful.” A sentiment worthy of inscription above the door of any exchange, yet one drowned out by the clamor of speculation. The recent depths of consumer sentiment, therefore, are not a cause for alarm, but a most promising sign. It suggests a fertile ground for those with the courage to defy the prevailing winds.

To confirm this suspicion, I have undertaken a modest investigation, spanning the years since 1985. I have correlated the monthly pronouncements of the University of Michigan with the subsequent performance of the S&P 500. The results, while not entirely predictable – for the market is a capricious mistress – are nonetheless revealing. I grouped the sentiment readings into convenient ‘buckets,’ and calculated the average returns over the following twelve months. The table below presents these findings.

| Consumer Sentiment Range | Number of Instances | Average Forward 12-Month S&P 500 Return |

|---|---|---|

| <55 | 2 | 14.34% |

| 55-59.9 | 16 | 12.65% |

| 60-64.9 | 16 | 11.57% |

| 65-69.9 | 31 | 10.97% |

| 70-74.9 | 39 | 11.39% |

| 75-79.9 | 40 | 11.25% |

| 80-84.9 | 45 | 7.91% |

| 85-89.9 | 55 | 9.79% |

| 90-94.9 | 116 | 9.69% |

| 95-99.9 | 70 | 12.47% |

| 100+ | 50 | 8.96% |

As you may observe, the lower the sentiment, the greater the potential reward. It is a simple, almost vulgar truth, yet one so consistently overlooked by those who chase fleeting pleasures and illusory gains. Of course, this is not a foolproof scheme – the market is a fickle jade, and fortunes can be lost as easily as they are won. But to ignore this pattern is to surrender to the whims of the crowd, and to forfeit the opportunity to profit from their folly.

Therefore, I suggest you embrace the prevailing melancholy. Let the pessimists lament, and the doubters despair. For it is in their darkness that the discerning investor may find the light.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-01-30 17:02