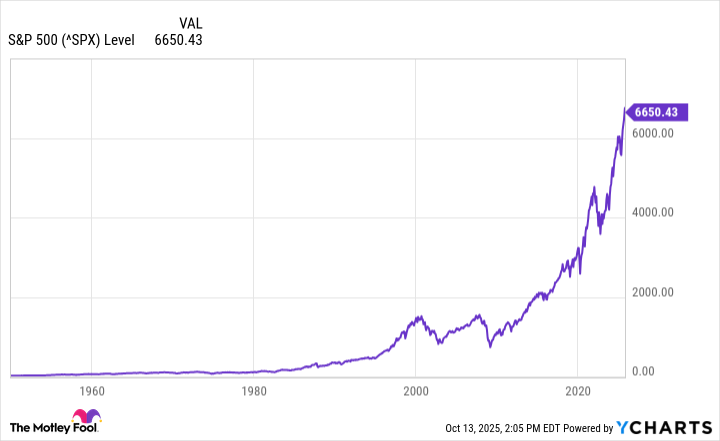

One might be forgiven for suspecting the stock market has misplaced its compass in 2025. Despite geopolitical tempests and tariff-induced tremors, the S&P 500 parades a 13% gain like a peacock preening in a thunderstorm. Yet beneath this gilded surface lies a drama Wilde himself might appreciate: a tale of irrational exuberance dressed as rational optimism.

The year opened with AI zealots chanting “progress!” as if it were a liturgy. But when President Trump’s tariff theatrics struck Wall Street like a farcical opera, the crowd’s faith wavered. How quaintly human: to flee the storm only to return when the sun reappears. Since April’s nadir, the index has vaulted 20%-a phoenix-like resurgence that proves markets, like fashion, thrive on reinvention.

Should this alchemy persist, 2025 would join the 1920s, 1930s, 1950s, and 1990s as the only centuries-old cohorts to boast triple-digit gains. A rarefied club indeed-one where champagne flows until the hangover arrives. These eras remind us that markets are the world’s greatest storytellers, weaving tapestries of fortune and folly with equal thread.

History’s Repetition: Four Acts, Four Masks

The 1920s were a bacchanal of easy credit and flapper-era frivolity. The market danced until dawn, only to discover its revelry had been a funeral masquerade. “To lose one decade’s gains may be regarded as a misfortune,” quipped Wilde’s ghost, “to lose two looks like carelessness.”

The 1930s, by contrast, played the tragic farce to perfection: a 69% surge followed by a 38% collapse. Investors became tragicomic figures, wagering on resurrection while building their own pyres. Volatility, it seems, is the one dividend history guarantees.

The 1950s delivered the rarest commodity: substance beneath the spectacle. Postwar pragmatism birthed gains of 45% and 26%, earned not through speculation but through the quiet dignity of middle-class ambition. A reminder that when Main Street thrives, Wall Street merely keeps score.

Then came the 1990s-a carnival of dot-com delirium. The internet promised utopia, and investors bought tickets to a circus without clowns (or so they thought). When the bubble burst, the emperor’s new wealth vanished, leaving only the sound of trillion-dollar IOUs crumpling.

AI: Bubble or Breakthrough?

Today’s rally pirouettes on a knife’s edge between genius and charlatanry. The AI chorus sings hymns to progress, transforming semiconductors and data centers into modern cathedrals. Yet one must ask: Are we funding miracles or merely mirages? The difference between a revolution and a rumor, dear reader, lies in the balance sheet.

Skeptics cry “1999!” while optimists chant “1945!” The truth? AI may yet prove the new electricity-a thesis worth pondering over a decanter of claret. But as Wilde knew well, “The visionary sees not clearer than the drunkard-merely differently.”

Will earnings growth sober the party or fuel its crescendo? The crystal ball remains stubbornly opaque. But remember: Every great era marries genuine innovation with speculative champagne. The trick is to sip without drowning.

The Eternal Verdict: Time’s Unyielding Verdict

Market timing, that favorite parlor game of charlatans and fools, remains an exercise in elegant futility. The value investor’s creed is simpler: Own businesses you’d gladly tend in a monastery, hold through storms, and prune losers while nurturing champions. Patience, that most unfashionable virtue, compounds like no other.

History whispers what the crowd refuses to hear: The S&P 500’s 7% post-inflation gains aren’t magic but mathematics. Wars, crashes, and panics come and go-but compound interest, like the guillotine, treats all equally.

Markets lose their way as lovers quarrel-in dramatic fashion-only to rediscover their path with tedious regularity. Resilience, that quiet hero of financial epics, ensures the show always goes on. And so, dear reader, we invest-not because we trust the players, but because we trust the stage. 🎭

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-16 16:11