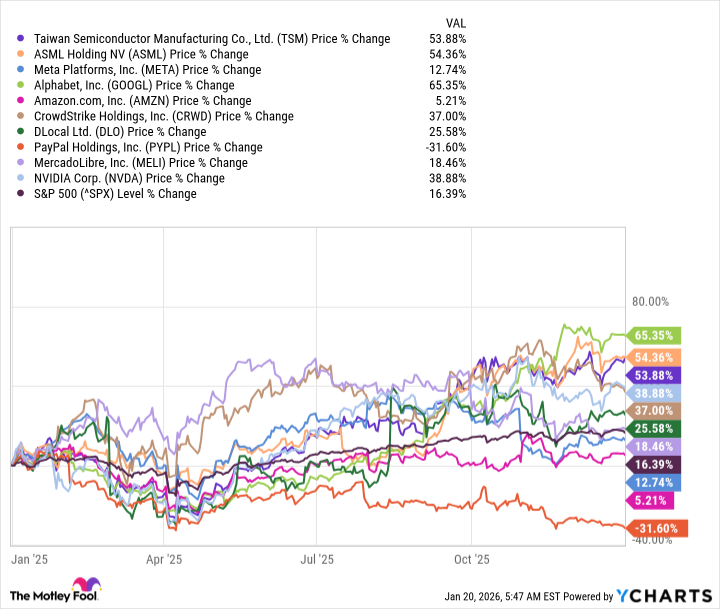

Last December, I ventured a prediction – a list of ten companies poised to flourish in the year just past. A rather presumptuous act, you might say, akin to attempting to predict the whims of a particularly capricious deity. But the market, that grand illusionist, occasionally deigns to cooperate. The chosen ten – Taiwan Semiconductor Manufacturing, ASML, Meta Platforms, Alphabet, Amazon, CrowdStrike, dLocal, PayPal, MercadoLibre, and Nvidia – performed, shall we say, adequately. Seven exceeded the S&P 500, six experiencing growth exceeding 25%. A small triumph, perhaps, in a world brimming with larger follies.

Now, the inevitable question arises: can this momentum be sustained? The market, like a spoiled child, rarely appreciates repetition. Investors, ever hopeful, cling to the notion that past performance guarantees future results. A comforting delusion, easily dispelled by a single unfavorable earnings report. But let us examine the candidates, not as mere tickers on a screen, but as players in a rather absurd drama.

The Persistent Few

Six of the original ten – dLocal, CrowdStrike, Nvidia, TSMC, ASML, and Alphabet – enjoyed particularly robust growth. Of these, I believe Nvidia, TSMC, and dLocal possess the potential to repeat, or even surpass, their previous performance. Nvidia and TSMC, you see, are the smiths of the new age, forging the very hardware upon which artificial intelligence – that most ambitious of human endeavors – depends. The demand for their creations is insatiable, fueled by a relentless pursuit of the algorithmic sublime. To bet against them now would be akin to betting against the tide.

dLocal, meanwhile, operates in a more shadowy realm, facilitating transactions in those corners of the globe where conventional financial systems struggle to penetrate. A necessary, if somewhat unglamorous, role. Their recent gains, however, are partially attributable to a recovery from previous lows – a wounded beast regaining its footing. Still, the potential for growth remains significant. One cannot help but wonder, though, if this recovery is built on solid ground or merely a temporary reprieve.

The Others: A Measured Optimism

CrowdStrike, ASML, and Alphabet remain worthy investments, but I suspect their ascent will be more… measured. They have reached a point of maturity, a certain… fullness. The valuations, shall we say, are… optimistic. ASML and Alphabet trade at multiples that would make even the most ardent speculator blush. Such heights are precarious, susceptible to the slightest tremor. CrowdStrike, too, is richly valued, though its performance justifies a certain premium. One suspects, however, that the easy gains have already been harvested.

These valuations, like overripe fruit, may attract unwelcome attention. A correction, though not necessarily catastrophic, is certainly possible. Still, I believe these companies possess the underlying strength to outperform the market, albeit at a more modest pace. They are, after all, not merely companies, but institutions – behemoths that have weathered countless storms. But even behemoths, as history reminds us, are not immune to the whims of fate.

The market, you see, is not a rational entity. It is a creature of emotion, driven by fear and greed, hope and despair. To attempt to predict its movements is a fool’s errand. But to understand the underlying forces at play – the technological innovations, the economic trends, the psychological biases – is perhaps, just perhaps, a worthwhile endeavor. And so, we observe, we analyze, and we speculate, knowing full well that the ultimate outcome remains shrouded in mystery. A grand masquerade, indeed, where fortunes are won and lost, and the only certainty is uncertainty.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-23 22:22