The year, as they say, turns. October breathed its last, and the S&P 500, a creature of habit and expectation, entered its third year of ascent. A bull market, yes, but one tinged with a peculiar lightness, a fragility I’ve observed before in blooms too eager to reach the sun. A gain, a double-digit flourish, brought the index to a height – seventy-eight percent over three years – that felt, even then, a touch precarious. The air, thick with optimism, smelled faintly of frost.

It was the scent of new growth, certainly. Investors, like migrating birds, had flocked to the territories of innovation – artificial intelligence, the whispers of quantum possibility, and the promise, or perhaps the illusion, of weight loss miracles. Nvidia, IonQ, Eli Lilly – these names became incantations, each share a seed planted in the fertile ground of speculation. The market, it seemed, had decided to believe in alchemy.

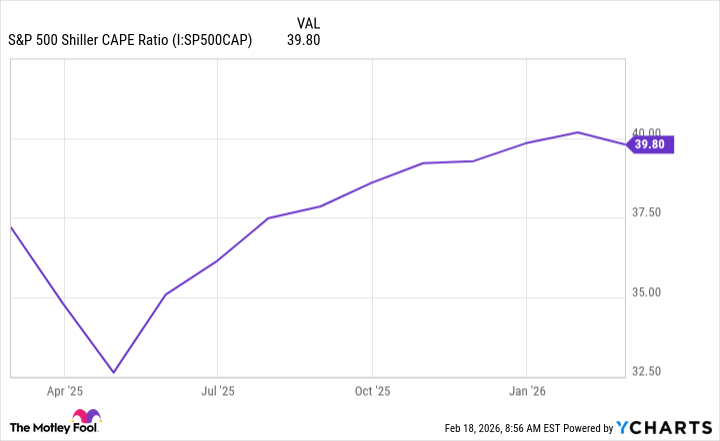

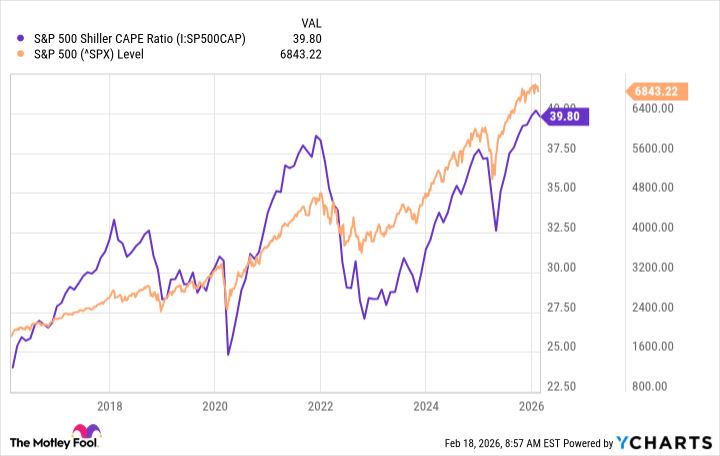

And the Federal Reserve, a benevolent gardener, pruned the branches of interest rates, easing the pressure on the consumer’s purse, loosening the soil for corporate borrowing. A gentle rain of capital fell upon the landscape. But even abundance can be deceptive. The Shiller CAPE ratio, that stern and unforgiving measure, began to climb. It breached forty – a level attained only once before, in the fever dream of the dot-com boom. A ghost returned to haunt the present. The market, it appeared, was building a castle on sand.

Now, in these early months of 2026, a tremor runs through the foundations. A quiet unease, a sense that the music is about to stop. The market, that capricious dancer, has performed a peculiar step. It hasn’t moved, hasn’t ascended, for nearly a year. A stillness, a hesitation. And history, that relentless teacher, offers a chillingly clear lesson.

The S&P 500 in 2026

The concerns began, as these things often do, with a whisper. Late in 2025, the valuations of those AI darlings – those bright, fragile blossoms – began to feel…untenable. A dip in November, a slight drooping of the petals. Investors, suddenly sober, questioned the sustainability of such heights. Any cooling of the AI spring, any reduction in demand, could unleash a cascade. The fear, I suspect, wasn’t of ruin, but of a swift, unceremonious return to earth.

And then, other shadows fell. Uncertainty regarding the pace of those promised rate cuts, a lingering doubt about the ultimate payoff of all that AI spending. The very progress of innovation sparked a new anxiety – a suspicion that the old order, the established software empires, might crumble under the weight of disruption. Jensen Huang, that architect of silicon dreams, dismissed such fears as illogical. But logic, I’ve learned, is often the first casualty of market sentiment.

The result? The S&P 500, for the moment, is suspended in amber. A stillness that feels…ominous.

A Clear Sign of Something Big

And then it happened. A slight decline in the Shiller CAPE ratio. A mere tremor, yes, but a significant one. The first sign that the tide is turning. That the valuations, those inflated bubbles, are beginning to deflate. History, as I said, offers a pattern. When valuations fall, the S&P 500 tends to follow. A simple equation, really. Gravity always wins.

Does this signal the end of the bull market? Not necessarily. The market, like a wounded animal, can still summon surprising reserves of strength. But it does suggest a period of correction, a recalibration. A few weeks of decline, perhaps, or a prolonged period of stagnation. We must watch the economic reports, listen to the pronouncements of the Federal Reserve, and observe the performance of those growth companies. These are the clues that will reveal the near-term direction.

But here’s the most important truth, the one that sustains me through these cycles of boom and bust: The S&P 500 always recovers. It has done so time and time again. Invest in quality companies, hold on for the long term, and any short-term decline, any market crash, will ultimately prove insignificant. The seeds you plant today will blossom in the years to come. And that, in the end, is all that truly matters.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

2026-02-21 12:23