Now, these “Magnificent Seven” companies… a rather grand name, wouldn’t you say? Like a troupe of circus performers, boasting and preening. They promised the moon, but 2025? A bit of a tumble, really. Most of them didn’t quite live up to the hype, did they? Like overripe plums, dropping from the tree. The S&P 500, that grumpy old judge, managed a respectable 16.4% return. But two of these fellows… two actually managed to do quite well. Let’s have a closer look, shall we?

There was Nvidia, a positively booming sort of company, up a whopping 38.9%. And then Alphabet, the Google people, who strolled ahead with a rather impressive 65.4%. Are these two worth a bit of your hard-earned cash this year? Well, for those who play the long game, the answer is a resounding… possibly. Let’s delve a little deeper, shall we?

Making the Case for Nvidia

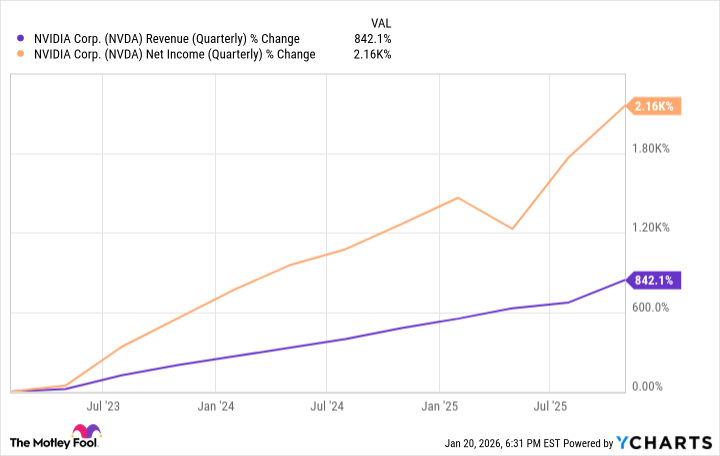

Nvidia. The name itself sounds like a villain in a penny dreadful. And, in a way, they are. A villain… to boredom, that is! This company, you see, is worth more than four and a half trillion dollars. An absurd amount, isn’t it? Enough to buy several small countries, I should think. And it all comes down to these… “artificial intelligences.” A rather frightening thought, if you ask me. Machines thinking for themselves!

Nvidia makes these “graphics processing units” – little boxes of wizardry – that are absolutely essential for training these artificial brains. They’re like the brain food for robots. For a while, Nvidia had a complete monopoly on these little boxes. A truly delicious position to be in. And, naturally, their price went sky high. It’s a bit like cornering the market on chocolate frogs, really.

Nvidia has become the king of the hardware side of this artificial intelligence business. If companies continue to build these digital brains, Nvidia will continue to profit. Though, beware! Companies like Amazon and Alphabet are beginning to build their own little boxes of wizardry. It’s a bit like a rival bakery opening down the street. Still, it’s not easy to switch providers when you’ve become accustomed to the best.

Now, Nvidia isn’t cheap. Trading at 38 times its projected earnings? That’s a hefty price tag. But if you’re a patient investor, consistently adding a little Nvidia to your portfolio isn’t a bad idea. Just expect a few bumps along the way. Like a rickety rollercoaster, it’ll have its ups and downs.

Making the Case for Alphabet

GOOGL“>

Alphabet’s Google advertising business is as reliable as an old grandfather clock. It continues to bring in the bulk of their revenue – more than 72% in the last quarter. But their cloud business is starting to look rather promising. It’s been their fastest-growing business in recent quarters.

Google Cloud is still trailing behind Amazon Web Services and Microsoft Azure, mind you. But it’s in a good position to capture a decent share of the growing demand for cloud services. Add to that the fact that Alphabet has its own data centers and is developing its own chips, and the company has a good path to a fully functional in-house artificial intelligence stack. A clever little operation, wouldn’t you say?

Alphabet, then, is a buy this year and going forward. A solid, dependable sort of company. Like a well-made pair of boots. You can rely on them to get you where you need to go.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- The Best Single-Player Games Released in 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-01-28 23:22