Many years later, as the stock market’s pendulum swung toward the crescendo of artificial intelligence, the investors who had once whispered about the Magnificent Seven would remember how it all began-not with a bang, but with the quiet hum of servers and the metallic tang of ambition. By then, the S&P 500 had already danced to the tune of these seven titans: Alphabet, Meta, Microsoft, Nvidia, Apple, Amazon, and Tesla, each a colossus straddling the border between the tangible and the fantastical. They were not merely companies but modern-day oracles, their stock prices etched in the stars like constellations guiding the lost through the desert of volatility. Yet, in the shadow of their magnificence, two stood apart, their valuations as modest as a peasant’s bread, their potential as vast as the uncharted Amazon. Let the tale unfold, as it must, with the inevitability of rain in a drought.

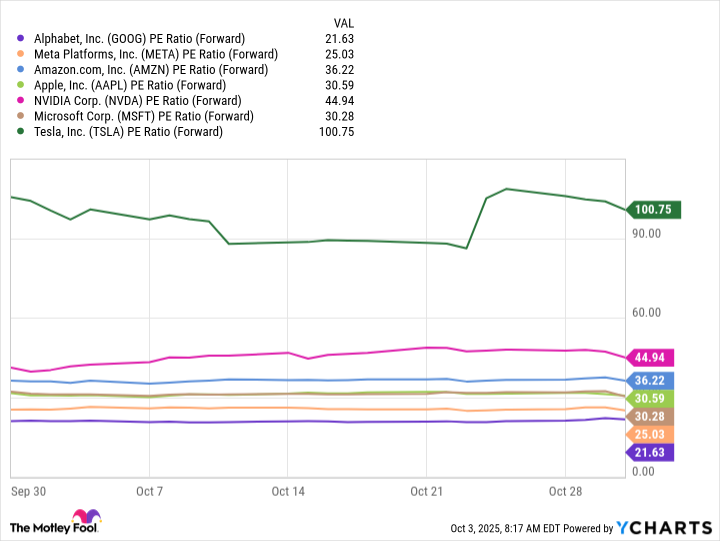

For those who had learned to read the language of markets-not the numbers on a screen, but the rhythm of innovation and the scent of opportunity in the air-two names emerged like mirages in the silicon sands. Alphabet, the keeper of the world’s secrets, and Meta, the weaver of digital destinies, were not just stocks to own but relics of an era where the line between man and machine blurred into a single, shimmering thread. Their forward earnings, a mere 21x and 25x, felt like a misprint in a world where growth stocks had long since abandoned gravity. But to the patient investor, they were invitations to a feast, served on platters of AI and cloud, garnished with the crumbs of antitrust reprieves and dividend gold.

1. Alphabet

In the beginning, there was Google Search, a creation so perfect it seemed plucked from the mind of a god who had grown tired of human ignorance. For years, it had consumed 90% of the world’s queries, a digital oracle answering the unanswerable. Yet, even gods must evolve. Alphabet, that sly alchemist of the internet, had turned its gaze to artificial intelligence, not as a sideshow but as the next great prophecy. Its servers, once content to sort keywords, now hummed with the poetry of neural networks, refining the art of search until it became indistinguishable from intuition. Advertisers, those weary merchants of attention, found their campaigns transformed by algorithms that predicted desires before they were born, their wallets growing fatter with every click.

But Alphabet’s ambitions stretched beyond the confines of search. In the shadow of its empire, Google Cloud rose like a phoenix, its wings dipped in the fire of AI demand. The unit, a titan in its own right, had grown to $13 billion in revenue, a number so large it made the GDP of small nations tremble. Here, in the labyrinth of data centers, Alphabet had forged its own large language model, a digital oracle that whispered secrets to Nvidia’s chips and spun them into gold. The recent antitrust verdict, a storm that had threatened to shatter its dominion, had passed like a mirage-leaving Alphabet unbroken, its future as certain as the morning sun.

To call Alphabet’s valuation a bargain would be as reductive as calling the ocean a puddle. At 21x forward earnings, it was a door left ajar in a house of locked treasures, an invitation to those who dared to dream beyond the noise of the market.

2. Meta Platforms

If Alphabet was the god of knowledge, Meta was the bard of human connection, its apps-Facebook, Instagram, WhatsApp-a symphony of voices echoing across the globe. Three billion souls logged in daily, their lives woven into the fabric of its digital kingdom. Yet, Meta’s story was never just about likes and shares. It was a tale of reinvention, of a company that had glimpsed the future in the fire of AI and chosen to become its architect. Where others saw social media, Meta saw a canvas for the next great revolution, its open-source models a gift to the world, a sowing of seeds that would one day grow into forests of innovation.

The recent quarterly report was not merely a set of numbers but a fable of triumph. Revenue surged past $47 billion, net income blooming into the billions like a flower in a war-torn field. With $47 billion in cash and a dividend payout of $1.33 billion, Meta was not just surviving-it was planting flags on uncharted territory, its AI glasses a glimpse into a future where reality and code became one. Investors who dismissed it as a relic of the past were like farmers who refused to plow, blind to the harvest waiting to be reaped.

At 25x forward earnings, Meta was the second-lowest priced of the Magnificent Seven, a price tag so absurd it could only be the work of a market distracted by its own reflection. For those with the patience to watch the slow burn of AI’s ascent, it was not a stock-it was a promise, written in code and ink, waiting to be fulfilled.

The market, that great and capricious beast, would not remain kind forever. But for now, the Magnificent Seven stood as they had in the beginning: titans, visionaries, and, for the discerning, treasures hidden in plain sight. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-10-06 03:25