The term “Magnificent Seven,” a rather grandiose label coined by a television pundit, now circulates freely amongst investors. It denotes a cluster of technology companies – Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta Platforms, and Tesla – that have come to dominate market sentiment. The concentration of influence within so few entities is, in itself, a development deserving of quiet scrutiny.

- Nvidia (NVDA)

- Microsoft (MSFT)

- Apple (AAPL)

- Amazon (AMZN)

- Alphabet (GOOG) (GOOGL)

- Meta Platforms (META)

- Tesla (TSLA)

Recent financial disclosures offer a mixed picture, compelling a degree of circumspection rather than unbridled enthusiasm. The notion that all seven present compelling investment opportunities strikes one as, at best, optimistic. A more sober assessment suggests a division: some warrant consideration, while others demand watchful waiting.

Apple and Tesla: Clouds on the Horizon

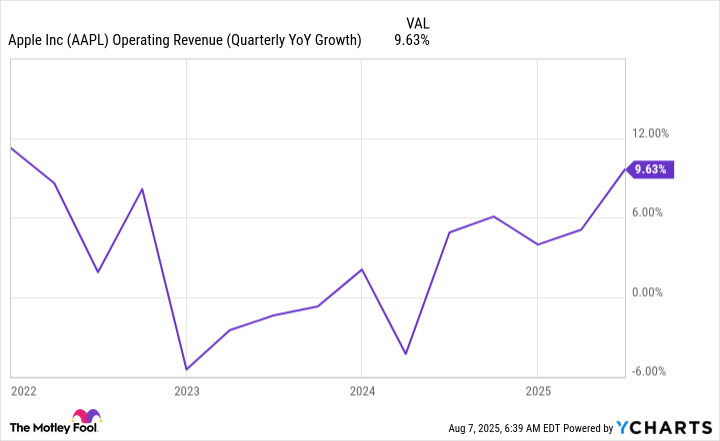

For years, these companies enjoyed the benefits of an expanding market, a tide that lifted all boats. Apple, however, has been a relative laggard. Its recent return to double-digit growth – a modest 10% increase in the third quarter of its fiscal year 2025 – is a welcome sign, but hardly a justification for unrestrained confidence. The fundamental question remains: can Apple genuinely innovate, or will it be overtaken by competitors in the crucial field of artificial intelligence?

Tesla’s situation is perhaps more troubling. A 16% decline in year-over-year revenue during the second quarter speaks to a weakening position. The phasing out of electric vehicle subsidies and regulatory credits adds further pressure. To consider Tesla merely an electric car manufacturer is to fundamentally misunderstand its valuation. The company’s worth is predicated on future successes in robotics, artificial intelligence, and autonomous vehicles – all highly speculative ventures. Prudence dictates a period of observation before committing capital.

The Remaining Five: Reasons for Optimism

The remaining members of the group – Nvidia, Microsoft, Amazon, Alphabet, and Meta – present a more encouraging picture. Each exhibits demonstrable growth, though the reasons behind that growth vary considerably.

Meta Platforms reported a revenue increase of 22% in the second quarter, exceeding even its own projections. This recovery is attributable, in part, to the effectiveness of its advertising business and the integration of artificial intelligence to refine ad targeting. It would be unwise, however, to assume this trajectory will continue indefinitely. Markets are rarely so accommodating.

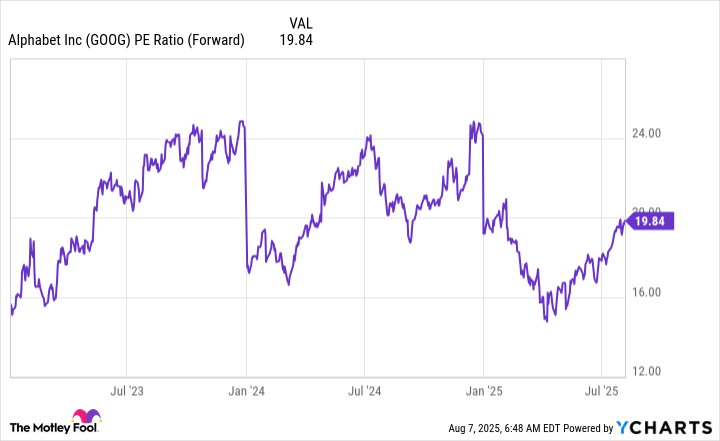

Alphabet, too, experienced strong advertising revenue, dispelling concerns about the potential disruption of its search engine by emerging artificial intelligence technologies. Google Search revenue rose 12% year over year, a testament to its enduring dominance. The company’s overall revenue increased by 14%, with diluted earnings per share rising 22%. Moreover, Alphabet currently trades at a relatively modest 20 times forward earnings, making it, arguably, the most rationally priced of the seven.

Microsoft continues to defy expectations, delivering substantial growth despite its already immense size. Revenue increased by 18% year over year, driven primarily by the performance of Azure, its cloud computing platform. Azure’s revenue surged by 39%, reflecting the escalating demand for computing power required by artificial intelligence development. This momentum is likely to persist.

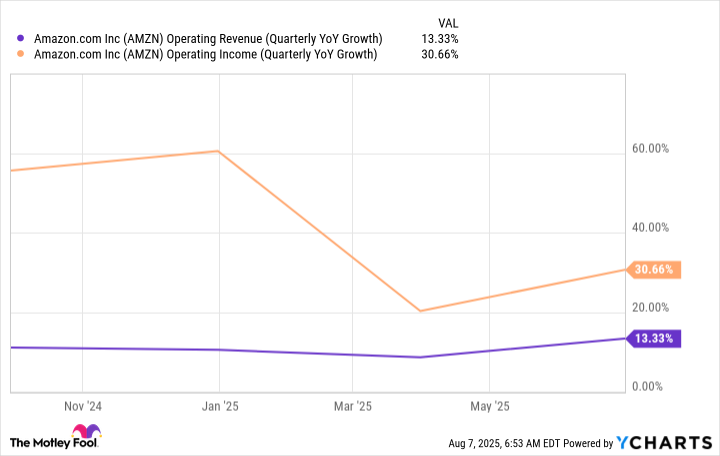

Amazon’s recent financial report triggered a negative market reaction, but the pessimism appears overblown. The company’s profitability continues to outpace revenue growth, fueled by high-margin businesses such as advertising and Amazon Web Services (AWS). While it is essential to acknowledge the inherent volatility of the market, Amazon’s long-term prospects remain favorably aligned.

Finally, Nvidia, while yet to release its earnings report, stands to benefit from the increased capital expenditure announced by its peers, all of whom are investing heavily in data center infrastructure. The company is poised to capture a significant share of this investment, and the reinstatement of its export license to China will provide an additional boost. An anticipated “blowout” earnings report on August 27th may well be justified. However, even a company showing this promise should not be viewed as invulnerable.

The concentration of power within this “Magnificent Seven” invites comparison to earlier periods of monopolistic dominance. While these businesses are, undoubtedly, innovative, it is our duty – as investors and as citizens – to observe, question, and remain vigilant. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

2025-08-11 03:08