February 26th. A date etched not in marble, but in the flickering screens of those who watch the market breathe. They speak of Nvidia, this behemoth of silicon and code, as if it holds the very pulse of the exchange. A single quarter’s report, they whisper, can lift or crush fortunes. It’s a grand drama, certainly, but one built on the backs of countless hours, of quiet desperation in workshops and dimly lit home offices, of dreams fueled by the promise of a rising tide. The tide, of course, rarely lifts all boats.

Nvidia, they say, is bullish. A fine word, “bullish.” It suggests strength, progress. But what does it mean for the man who assembles the boards, for the woman who writes the code, for the family hoping for a little security? The market doesn’t concern itself with such things. It cares only for numbers, for the relentless climb of the line on the graph. And Nvidia, weighted as it is – nearly a tenth of the S&P 500, a staggering thirteen percent of the Nasdaq – can make that line dance to its tune.

The Weight of Things

They point to the indices, these arbitrary measures of collective greed and fear. The S&P 500, the Nasdaq Composite, even the venerable Dow Jones. Nvidia is woven into their fabric, a vital organ in the market’s body. When it flexes, the whole system feels the strain. It’s a strange power, this ability to influence the fortunes of so many with a single announcement. A power born not of innovation alone, but of concentration, of the relentless pursuit of scale.

And the ripple effect, they say, will extend beyond Nvidia’s walls. Broadcom, AMD, Taiwan Semiconductor – these names are spoken with reverence, as if they are partners in some grand conspiracy of prosperity. A rising Nvidia lifts all boats, they claim. Perhaps. But the largest yachts, naturally, rise the highest. The small fishing vessels, clinging to the edges, may find themselves tossed about in the wake.

They speak of catalysts – AI spending, new chip architecture, a return to the Chinese market. Fine words, all of them. But beneath the surface, the same old story unfolds: the relentless drive for efficiency, the exploitation of resources, the widening gap between those who have and those who do not. It’s a machine, this market, and we are all cogs within it, grinding away in the hopes of a fleeting moment of comfort.

The Illusion of Cheapness

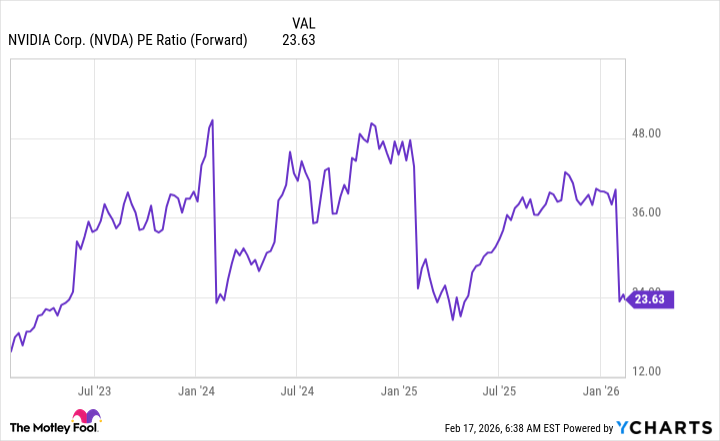

They call Nvidia “cheap” now, trading at a mere 23.6 times forward earnings. Compared to the broader market, they say, it’s a bargain. A curious notion, this idea of “cheapness” in a world awash in excess. It implies that value is measured solely in terms of potential profit, ignoring the human cost of its pursuit. The Nasdaq 100, bloated with tech stocks, averages 25.3 – a testament to the collective delusion that endless growth is both possible and desirable.

Analysts predict growth of 57% this year, 65% next. Impressive numbers, certainly. But what do they mean for the worker whose skills are rendered obsolete by the next technological leap? For the community displaced by the construction of yet another server farm? The machine demands sacrifice, and it rarely acknowledges the debt.

They say Nvidia is a good buy. Perhaps it is. But remember this: the market is not a benevolent benefactor. It is a ruthless judge, and it rewards only those who play by its rules. And the rules, as always, are written by those who hold the power. Look beyond the numbers, beyond the charts, and see the faces of those who toil in the shadows. They are the true measure of any market’s success.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Exit Strategy: A Biotech Farce

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

2026-02-21 16:22