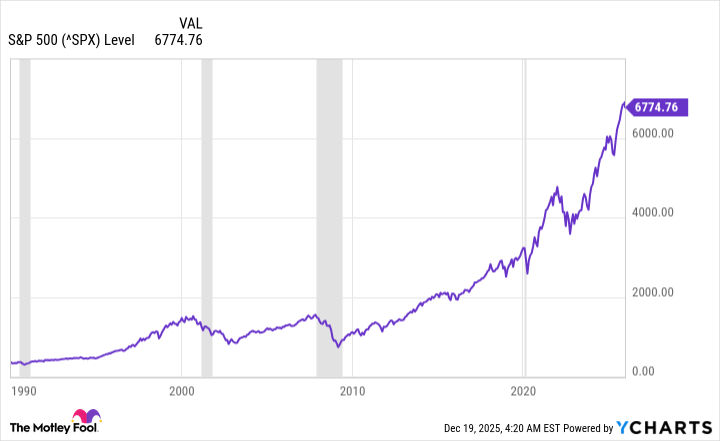

As the final days of the year unfurl, a quiet anticipation lingers over Wall Street, where the long-term investor, steadfast in their faith, watches the horizon. By the closing bell on December 18, the venerable Dow Jones Industrial Average (^DJI +0.38%), the widely revered S&P 500 (^GSPC +0.88%), and the visionary Nasdaq Composite (^IXIC +1.31%) had ascended by 13%, 15%, and 19% respectively. Yet, beneath this veneer of prosperity, the specter of volatility looms, whispered by the arcane language of economic metrics.

Investors, ever eager for the promise of artificial intelligence, quantum computing, and the Federal Reserve’s rate-easing cycle, may find their hopes tempered by a historical precedent. The M2 money supply, that ancient river of capital, has etched its warnings into the annals of economic history, hinting at a tempestuous year ahead.

The M2 Money Supply: A River Reversed

Though the past offers no guarantees, its echoes often reverberate through the halls of finance. Few metrics bear the weight of history as the U.S. money supply. M1, the swift current of cash and checking accounts, and M2, the broader stream encompassing savings and deposits, have long flowed in tandem with the nation’s fortunes. Yet, since 2022, M2 has deviated from its course, carving new channels through the landscape of economic history.

Usually, the M2 chart ascends with the steady rhythm of progress. A growing economy demands more liquidity, much as a river swells with the thaw of spring. But between April 2022 and October 2023, this current contracted by 4.76%, a reversal unseen since the Great Depression. The warning signs, as noted by Nick Gerli, echoed across the digital expanse: “The Money Supply is officially contracting. 📉 This has only happened four times in 150 years. Each time a Depression followed.” The past, it seems, is a mirror held up to the present.

Yet, like a river reborn, M2 surged to a record $22.3 trillion by October 2025. Such expansion, a hallmark of vitality, often heralds a favorable climate for markets. But as the old adage warns, not all that glitters is gold.

With a 4.08% increase over the past year, the Federal Reserve’s easing policy has reinvigorated the flow. Yet, historical patterns suggest caution. Growth rates between 1% and 4% have frequently preceded economic strife, their subtle decline a harbinger of turbulence. The 2008 crisis, the early 1990s recession-each bore the fingerprints of a faltering money supply.

The Stock Market’s Pendulum Swings

As the year draws to a close, the M2 expansion of 3.49% in 2024 and a projected 4% in 2025 cast a shadow over the market’s gilded facade. These figures, modest by historical standards, coincide with a landscape fraught with challenges: a divided Federal Reserve, an overvalued market, the specter of trade wars, and the inevitable burst of speculative bubbles. The stage is set for a tumultuous performance.

Though the past cannot dictate the future, the interplay of forces suggests a roller-coaster ride. The investor, ever the observer, must navigate this terrain with both hope and apprehension, for the market’s dance is as unpredictable as the seasons.

In the end, the M2 narrative is one of duality-a testament to resilience and a reminder of fragility. As the new year approaches, the question lingers: will the river of capital continue its steady course, or will it surge with the force of a storm? The answer, like the market itself, remains elusive.

Let us await the unfolding, with the patience of those who have seen history repeat itself, and the wisdom to recognize its lessons.

📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-12-22 11:22