On Thursday, stocks for Lucid Group, an electric vehicle manufacturer based in Silicon Valley, surged by over 36% after they secured a contract for a high-end robotaxi service with Uber Technologies, a leading ride-hailing company.

Upon reading the news, my initial reaction was something like, “Looks like another arrangement that’ll favor Nvidia (NVDA)!” Although Nvidia wasn’t explicitly named in the announcement, I was well aware of their involvement due to the Nvidia link.

First, let’s look at the Lucid-Uber deal and then see how Nvidia is poised to benefit.

The Uber-Lucid-Nuro partnership

This arrangement includes Uber purchasing Lucid Gravity SUVs outfitted with the Nuro Driver, a Level 4 autonomous system, for use in a top-tier robotaxi service they’re developing specifically for their Uber ride-sharing platform. Furthermore, Uber intends to invest significantly, in the range of hundreds of millions of dollars, in both Lucid and Nuro, an innovative self-driving technology company based in Silicon Valley.

Uber intends to introduce at least 20,000 Lucid self-driving vehicles, powered by the Nuro Driver, across many international markets over a six-year period. The initial rollout is planned for one significant American city, with the launch expected sometime towards the end of next year. Already, an early prototype of Uber’s robotaxi has been independently operating on Nuro’s test track in Las Vegas.

Nuro, a startup that has received venture capital funding, recently secured $106 million in their Series E funding round held in April. This new investment brings the company’s estimated worth to an impressive $6 billion. Notably, Nuro has changed its primary focus from designing delivery robots to licensing autonomous driving technology over the past year.

Absolutely, this deal presents a significant advantage for Lucid and Nuro, particularly considering the substantial funds they’ll obtain from Uber. The performance and comfort of Lucid’s vehicles, including the Air sedan and the latest Gravity SUV, are highly praised, boasting top-tier ranges within the industry. However, it’s challenging for new automobile companies to thrive due to the high overhead costs associated with vehicle manufacturing. Therefore, maintaining a strong financial position is crucial, which this deal seems to address.

By the close of Q1 in 2025, Lucid Group held approximately $3.61 billion in cash and short-term assets. However, their free cash flow for that quarter was a deficit of $589.9 million, meaning they spent more money than they brought in. This translates to an annual expenditure rate of around $2.36 billion. Given the current pace of spending, Lucid’s cash reserves and short-term investments would be depleted within approximately 1.5 years.

Why Nvidia is poised to benefit from the Uber-Lucid-Nuro robotaxi deal

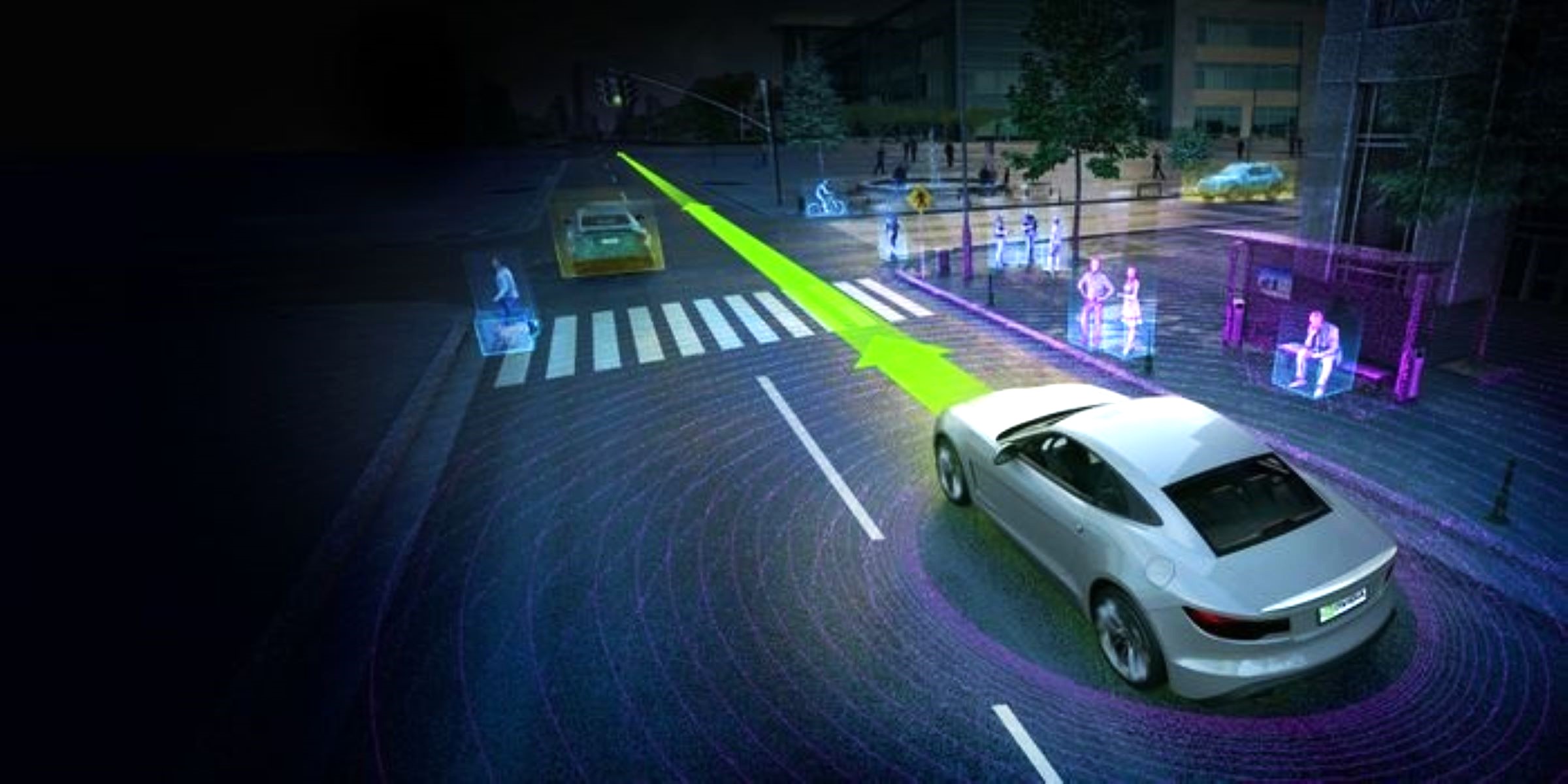

It’s not surprising that companies like Uber, Lucid, and Nuro are partnering with Nvidia in some capacity for driverless vehicle technology, given Nvidia’s significant role in advancing AI technology overall and specifically in the realm of self-driving cars. However, it’s the partnership between Nuro and Nvidia that could potentially benefit from any deal involving Uber and Lucid’s robotaxis.

According to a recent press statement, Lucid electric vehicles will feature the advanced Level 4 autonomy system from Nuro. This system is fueled by Nvidia’s artificial intelligence technology, as revealed at Nvidia’s GPU Technology Conference held in March 2024.

The Nuro Driver relies on NVIDIA’s comprehensive safety architecture for autonomous driving, which incorporates NVIDIA GPUs for cloud-based AI learning and an in-vehicle NVIDIA DRIVE Thor supercomputer running the NVIDIA DriveOS system. Essentially, this means that Nuro is leveraging Nvidia’s advanced AI technology for both the development and real-time operation of its self-driving vehicle system, with the NVIDIA DRIVE Thor serving as the ‘brain’ within the vehicle.

In addition to utilizing Nvidia’s data center AI solutions, which can be accessed through all significant cloud service providers, Nuro is required to purchase an Nvidia DRIVE Thor supercomputer for every vehicle it equips with its autonomous driving system. Given this requirement and Uber’s recent acquisition of Lucid vehicles for its new robotaxi service, it’s reasonable to infer that each of these Lucid vehicles will contain an Nvidia DRIVE Thor supercomputer. Furthermore, the partnerships between Uber, Lucid, and Nvidia in various capacities lend credence to this supposition.

In a nutshell, Tesla (TSLA) employs the AI technology from Nvidia for training its self-driving car system, known as FSD (Supervised), where FSD signifies full self-driving. Interestingly, Tesla does not incorporate the Nvidia DRIVE system within its vehicles. Instead, it deploys its own in-house technology, often referred to as an “AI chip,” inside its automobiles.

Last month, Tesla introduced a restricted version of its robotaxi service in Austin, Texas. The robotaxi service provided by Uber, Lucid Motors, and Nuro is preparing to challenge services run by both Tesla and Alphabet’s Waymo, the current frontrunner in the U.S. market for robotaxis.

With Uber’s expansive ride-sharing platform and substantial financial muscle (as its trailing-12-month free cash flow surpassed that of Tesla for the past year), their upcoming luxury autonomous taxi service could prove to be highly profitable. The greater the success of this new collaboration between Uber, Lucid Motors, and Nuro, the more profits Nvidia could potentially accrue.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-21 01:16