![]()

They call it “growth,” these pathetic little bubbles inflating in the silicon desert. A decade of easy money, of tech bros promising the moon, and now we’re supposed to believe in… more growth? Don’t make me laugh. Or do. I’m already halfway to a nervous breakdown just looking at these charts. But fine. The suits want “long-term holds,” so here are two companies that, against all reasonable expectations, might not completely vaporize your portfolio. Might.

1. Taiwan Semiconductor Manufacturing

TSMC. Taiwan Semiconductor. Sounds like a Bond villain’s front company, doesn’t it? And in a way, it is. They manufacture the little brains inside everything. Phones, laptops, toasters probably. The whole damn digital circus runs on chips they crank out. It’s a quiet kind of power, this… essential infrastructure. They don’t sell dreams, they sell the means of dreaming. And that, my friends, is a dangerous combination.

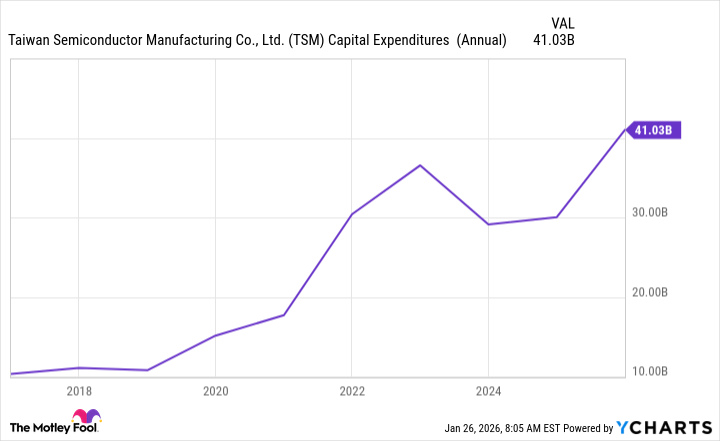

The “moat,” they call it. A lovely, quaint term for the sheer, terrifying cost of entry. Try building a chip fab. Go on. I’ll wait. Billions. Tens of billions. And then you have to actually make the damn things work, which is some kind of dark art involving lasers, vacuum chambers, and a workforce that probably requires hazard pay. It’s not easy, which is why these guys are still around. They’ve cornered the market on making other companies look foolish for trying to do it themselves. Nvidia, Apple, Amazon… they’re all addicted to TSMC’s supply. Like junkies, only with more lawyers. And the $52 to $56 billion they plan to spend on expansion? That’s not investment, that’s a declaration of war on anyone even thinking about challenging their dominance. A beautiful, ruthless, utterly predictable war.

2. CrowdStrike

Cybersecurity. The modern equivalent of selling locks to a burning city. Everyone’s paranoid, everyone’s a target, and everyone’s willing to pay a fortune to pretend they’re safe. It’s a racket, pure and simple. But a lucrative one. CrowdStrike, apparently, is one of the better purveyors of this particular brand of anxiety. They protect network-connected devices. Phones, laptops, tablets… the digital tentacles that have wrapped themselves around our lives. They’re good at it, or so they claim. And 300 of the Fortune 500 apparently believe them. Which, in this business, is about as close to a ringing endorsement as you’re going to get.

Growth is impressive, they say. Revenue, profit, earnings per share… the usual corporate catechism. But the real story is the lock-in. Once you’re hooked on their security software, switching providers is a nightmare. Expensive, complicated, and potentially catastrophic. It’s like ripping out your nervous system. So they’ve got you by the digital short hairs. And the cybersecurity industry is projected to hit $2 trillion? Good God. That’s enough to make a man question the very fabric of reality. CrowdStrike won’t get all of it, of course. But they’ll get a healthy slice. A very healthy slice.

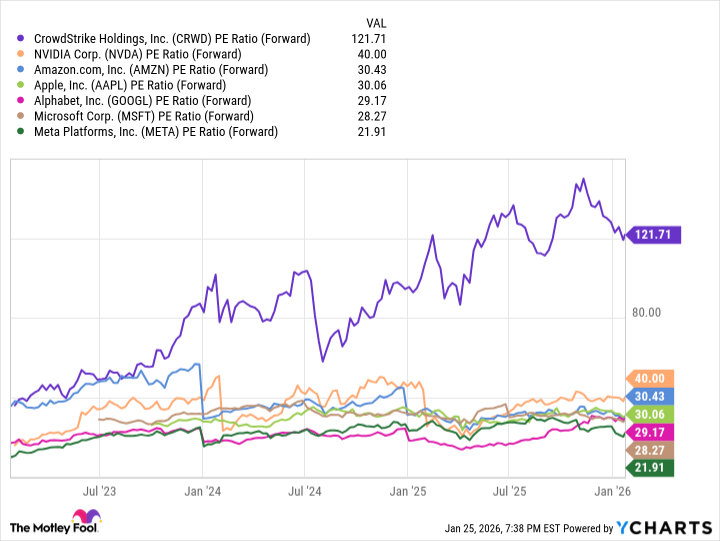

But here’s the kicker. The stock is trading at 121 times projected earnings. 121 times! That’s not a valuation, that’s a dare. A challenge to the market to prove everyone wrong. It’s a bubble waiting to burst, a house of cards built on hype and wishful thinking. If they miss a single quarterly target, the whole thing could come crashing down. But if you’re playing the long game, if you’re willing to stomach the volatility, it might just be worth the risk. Or it might be a complete disaster. Who the hell knows? I need a drink.

Dollar-cost averaging, they call it. Slowly but surely increasing your stake. A fancy term for spreading the pain. It’s a strategy for minimizing losses, not maximizing gains. But in this market, that’s probably the best you can hope for. Just don’t say I didn’t warn you.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Anime Series Hiding Clues in Background Graffiti

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2026-01-29 18:23