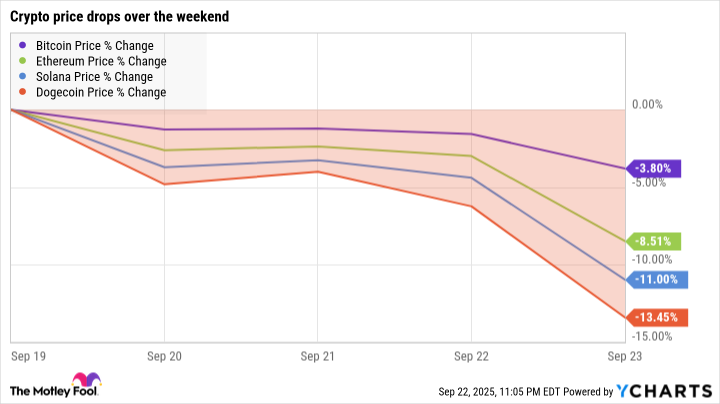

The machinery of the market, with its relentless gears of uncertainty, ground to a halt over the weekend. From Friday morning to Monday evening, Dogecoin (DOGE) depreciated 13.5%, Solana (SOL) 11%, Ethereum (ETH) 8.5%, and Bitcoin (BTC) 3.8%. The numbers, etched into the cold stone of blockchain ledgers, seemed less like losses and more like a bureaucratic decree: Value shall be subtracted, and none shall question the arithmetic.

Ethereum’s slide erased $46.4 billion from its total market value-a figure that dwarfed the entire worth of Dogecoin, as if the latter had been deemed insufficient in the grand accounting of capital. Bitcoin’s $87.8 billion haircut nearly equaled Solana’s total valuation, a grotesque symmetry in the ledger of despair.

The broad retreat was orchestrated by two interlocking cogs in the machine: first, the ritualistic cashing of profits by traders who had, for months, danced on the precipice of fortune; second, the avalanche of margin calls that reduced leveraged bets to ash. Coinglass’s data revealed a spike in liquidations on September 21, a figure so absurd it could only be a typo in the universe’s spreadsheet.

Is this the beginning of a new crypto winter? Or merely another bureaucratic correction in a system that thrives on chaos? Let us submit our inquiry for evaluation.

The Four-Year Cycle: A Halving of Hope

The crypto market, like a state apparatus, operates on cycles. Since 2012, Bitcoin’s halving events have dictated a four-year rhythm of inflation and collapse. This, the fourth iteration, commenced with the April 2024 halving, its gears greased by the ghosts of past booms and busts.

The previous cycle, birthed in the pandemic’s bureaucratic nightmare, peaked in 2021’s speculative euphoria, only to be buried in 2022’s avalanche of defaults. Terra Luna’s implosion and FTX’s funeral pyre were mere footnotes in the state’s report on systemic fragility. Perhaps this cycle, too, will diverge-but who are we to question the algorithm’s whims?

Consider the 2016 halving, when Bitcoin climbed from $660 to $17,760 in a year, only to be exiled to $4,000 by 2020. The first cycle, in 2012, is now a relic, its lessons lost to the fog of time and the SEC’s labyrinthine regulations.

Assuming this fourth cycle adheres to the template (a hypothesis as fragile as a candle in a hurricane), one might predict a boom in late 2025, followed by a winter that lingers until 2028’s halving. But such predictions are as useful as a passport stamped by a defunct state.

The Illusion of Novelty

To forecast markets via historical patterns is to consult a fortune-teller who speaks in riddles. The pandemic, the timing of ETF approvals, and the whims of regulators have all bent the crypto cycle into new shapes. The market, like a bureaucracy, follows rules that exist only in the minds of its architects.

Yet, there are whispers of bullish catalysts: ETFs granting institutional investors a bureaucratic seal of approval; corporations, inspired by Michael Saylor’s audacity, hoarding Bitcoin as if it were gold bars in a vault; and the SEC’s delayed rulings, which hang over altcoins like a guillotine. Meanwhile, Web3 applications-games, browsers, even a travel app from American Express-hint at a future where decentralization is less a revolution and more a compliance form.

These developments are promising, but they are also part of the machine. To trust them is to trust that the machine will not self-destruct, a belief as rational as trusting a bridge built by a committee.

The Risks: A State of Perpetual Uncertainty

The system, however, is not without flaws. Cryptocurrencies remain an unproven asset class, their value a bureaucratic fiction. Warren Buffett’s dismissal of them is not a critique but a bureaucratic decree: These coins hold no intrinsic value. Do not proceed.

And then there is the specter of quantum computing, a future bureaucracy that will render today’s encryption obsolete. Will Ethereum and Bitcoin adapt? Or will they become relics, their algorithms as useless as a passport from a dissolved state? The question lingers, unanswered, in the void.

The Weekend’s Drop: A Minor Correction or a Systemic Collapse?

In the grand ledger, the weekend’s losses appear as a minor correction. Ethereum has still gained 54% in a year; Bitcoin, 77%; Dogecoin, 122%. Solana, the reluctant participant, trails at 49%. These figures are not triumphs but bureaucratic obligations-proof that the machine, for now, continues to turn.

In the coming months, the balance of forces tilts cautiously toward optimism. Volatility is the market’s native tongue, and corrections are its bureaucratic pauses. Bitcoin, Ethereum, and Solana will endure, provided they navigate the system’s endless forms and avoid the guillotine of obsolescence.

Thus, I cannot confirm the absence of a looming downturn. But in the fall of 2025, it would be as unexpected as a snowstorm in a bureaucratic filing room. This is not winter. It is merely the system reminding us that the fridge door was left ajar. 🌀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Opendoor’s Stock Takes a Nose Dive (Again)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-23 16:44