In the year 1999, a fictional scholar named Alaric von Babel published what he called The Infinite Ledger, an incomplete treatise on the stock market as a labyrinthine library where every share represents a book whose pages are rewritten daily by invisible hands. Among these volumes, one stood out in his cryptic annotations: Nvidia (NVDA), a company whose story seemed less like commerce and more like myth.

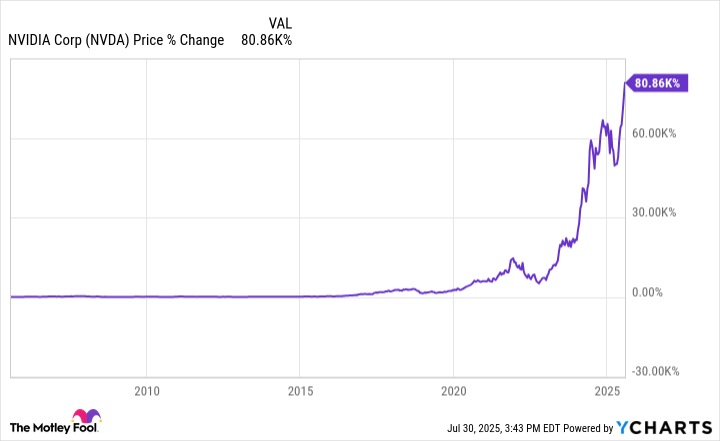

Imagine, if you will, that two decades ago, you had placed $3,000 within this particular tome. Today, your modest investment would have transformed into a veritable fortune of $2.3 million—a sum so vast it might tempt even the most stoic librarian to abandon their shelves for the chaos of Wall Street. And should you have chosen to reinvest dividends along the way, your wealth would swell further still, reaching nearly $2.5 million. An annualized return of 39.5%, contrasted against the S&P 500’s respectable yet pedestrian 9.22%, suggests not merely growth but something closer to alchemy.

Yet do not chide yourself too harshly if such prescience eluded you. As von Babel noted, “To predict the future is to navigate a mirror maze where every reflection distorts reality.” Indeed, were one to survey a hundred investors in 2005, perhaps not a single soul could claim they foresaw Nvidia’s ascent from a niche purveyor of gaming chips to the architect of artificial intelligence’s very foundations.

This transformation resembles nothing so much as a recursive dream, wherein each iteration amplifies the original vision. For years, Nvidia was known chiefly for its prowess in crafting semiconductors tailored to gamers—a pursuit both intricate and arcane. But in recent times, its dominion has expanded to encompass data centers, those modern temples of computation driven by the insatiable demands of AI. In this sense, Nvidia’s trajectory mirrors the infinite regress of a fractal pattern, endlessly unfolding new layers of potential.

A New Chapter or a Familiar Page?

Is it too late to inscribe your name upon this ledger? Perhaps not. Though the opportunity to acquire shares at 2005 prices has long since vanished, the narrative of Nvidia remains unfinished. Recent valuations place its forward price-to-earnings ratio at 38—a figure neither conspicuously high nor low when juxtaposed with its five-year average of 39. Meanwhile, its latest quarterly report reveals a revenue surge of 69%, accompanied by forecasts of continued double-digit growth.

If we accept von Babel’s assertion that markets are libraries, then Nvidia occupies a volume whose chapters are yet unwritten. Should the proliferation of AI continue unabated—and all signs point to such an outcome—then the demand for data centers and their attendant chips shall only deepen. To invest in Nvidia today is to wager on the continuation of this grand saga, one whose ending remains shrouded in the mists of speculation.

Thus, dear reader, whether you approach this labyrinth as a cautious cartographer or a daring explorer, remember that wealth-building is itself a form of storytelling. Each decision etches another line into the infinite ledger, shaping not just fortunes but destinies. 🧩

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-01 18:24