Apple (AAPL) and Palantir Technologies (PLTR) currently possess a combined market capitalization of $3.8 trillion. To surpass this monumental figure would require more than mere chance-it would be an endeavor that demands rare brilliance, an achievement so extraordinary that it would make even the most stalwart of investors pause in awe. Yet, within the tumultuous waves of this market, one figure stands poised to possibly achieve just that. And that figure, albeit undervalued in the eyes of many, may well prove to be one of the most astute investments of our time.

Alphabet (GOOG) (GOOGL) is a company whose vastness cannot be captured in simple financial metrics. It is not merely a conglomerate-it is a force whose direction is steered by a quiet yet insistent will, a will driven by ambition, by the ceaseless pursuit of what seems both unattainable and inevitable. To consider Alphabet as one of the market’s hidden treasures is, in many ways, to witness a rare moment in history where greatness is shrouded in modesty.

Turning the Winds of Change into Propulsion

At its core, Alphabet remains tethered to a singular entity: the Google Search engine. This engine, a modern-day oracle, has long been the engine of its prosperity, and for good reason. It has generated an overwhelming portion of Alphabet’s revenue-more than half in the second quarter of the year-showing how singular forces can shape the fate of entire enterprises. In this quiet reverence of Google’s search dominance, one might forget that change, like an uninvited guest, is always at the door.

And yet, within this very fact lies both a danger and an opportunity. The investing world is filled with whispers, murmurs about the inevitable rise of generative AI-the next great wave that could replace traditional internet search. Many are already making this transition, and one wonders how long it will take for others to follow. But is this truly a death knell for the beloved search engine? Perhaps not. For Google, in its wisdom, has found a way to merge the promise of generative AI with the tried and tested mechanisms of traditional search. It has incorporated AI-powered overviews-summaries borne of artificial intelligence that now grace the top of nearly every search result. This, according to the company’s leadership, has become a wildly popular feature, one that offers a glimpse of the future without erasing the past. Even more encouraging, this new feature seems to be generating nearly the same level of monetization as its predecessor, a factor that has, thus far, not disrupted its revenue streams.

Such advancements were clearly visible in the second quarter. The revenue from Google Search rose by 12% year over year-a respectable increase, especially given the maturity of the business. A lesser company would have seen stagnation, but Alphabet, with its disciplined vigor, continues to grow despite the forces of technological upheaval.

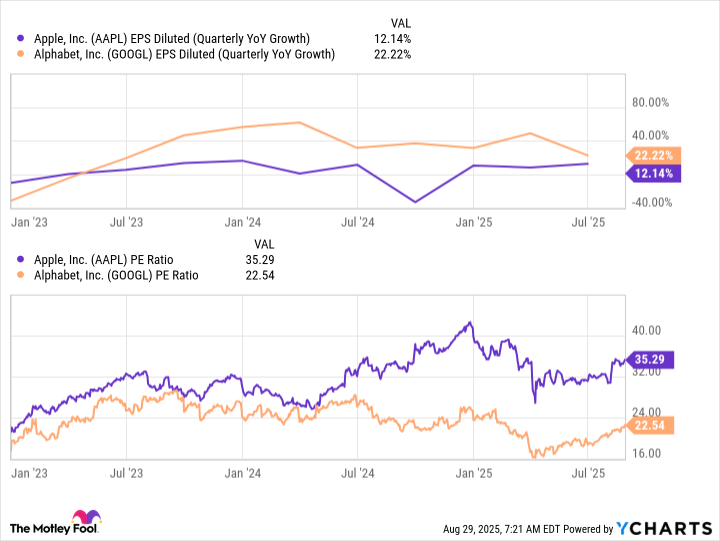

But this is but one facet of the complex jewel that is Alphabet. The company’s other ventures-such as Google Cloud and Waymo-continue to thrive, showing that Alphabet’s future does not depend solely on the fading star of search. With these and other divisions in play, Alphabet’s revenue for the second quarter increased by 14%, while its diluted earnings per share grew at a remarkable 22% rate. These are numbers that speak not just of success, but of a certain resilience-a determination to push forward even as others doubt.

And yet, despite these commendable achievements, the market continues to undervalue Alphabet. Here, we see the tension that lies at the heart of this drama. Though Alphabet grows in strength, its valuation remains stubbornly behind its more renowned peers.

The Epic Struggle for Market Dominance

If Alphabet is to surpass the combined might of Apple and Palantir by 2030, the markets must grant it the respect it has earned. Currently, Alphabet trades at 22.5 times its earnings, an impressive number in its own right, but one that has failed to match the earnings-per-share growth of Apple for nearly two years. This, it seems, is the paradox: Alphabet’s growth exceeds that of its competitors, yet it is not afforded the same prestige.

Had the market assigned Alphabet the same multiple as Apple, the results would be staggering. Alphabet, in this case, would be worth $4.1 trillion-far surpassing the combined market capitalization of Palantir and Apple. It would be a true David in the face of Goliaths, a quiet giant whose time has yet to come.

Alphabet’s case, then, is one of both patience and inevitability. It stands as an undervalued entity-its stock, though impressive in its growth, languishes under the weight of market misperception. But those who can see beyond the veil of the present may understand the depth of Alphabet’s potential. With the combination of an increasing valuation and continued strong earnings growth, the company may well be on a path to surpass the greatest titans of our time by 2030. And for those investors with a keen eye for opportunity, this stock presents a rare chance to build wealth through an array of avenues, each as varied and compelling as the technology that drives it.

In the world of investing, few things are certain-but if one were to look closely, Alphabet’s quiet ascent may well prove to be a force to be reckoned with in the coming decade. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- The Best Single-Player Games Released in 2025

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2025-09-02 12:59