In the illustrious annals of investment, few stocks have commanded as much attention as Altria (MO 0.29%). Historically entwined with Philip Morris International, this venerable entity has promised, and often delivered, an annualized return of twenty percent over the span of half a century, largely due to its robust margins and the undeniable allure of its somewhat notorious product. The company’s steadfast dedication to enhancing its dividend-a veritable jewel in the crown of dividend investors-has strengthened its reputation as a reliable source of income.

Yet, as we cast our gaze upon more recent developments, it becomes apparent that the stock now finds itself ensnared in a rather precarious position. The decline in domestic cigarette sales, coupled with the company’s faltering attempts to embrace next-generation products, has rendered its prospects somewhat dimmed, akin to a once-bright star now obscured by clouds.

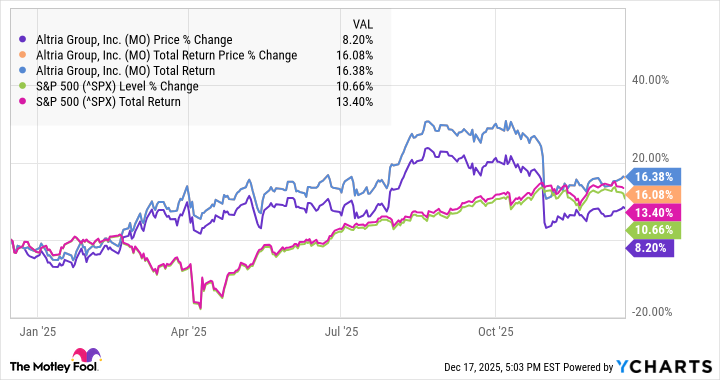

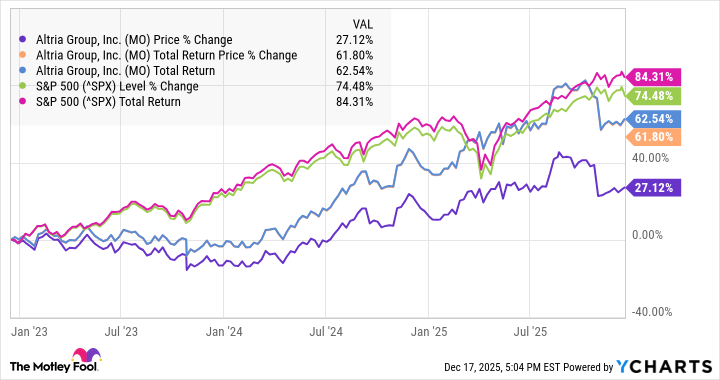

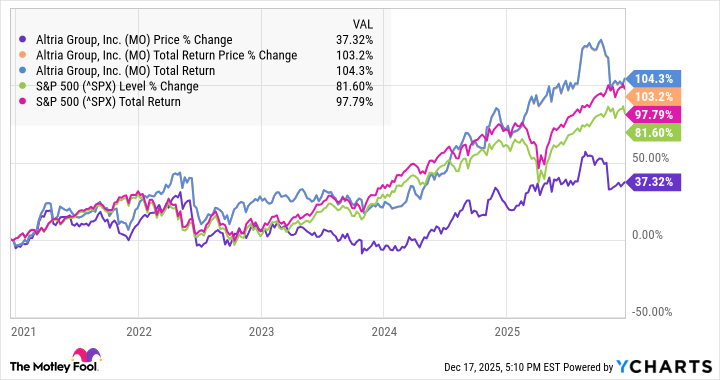

When one reflects upon the performance of this stock over the past year, three years, and indeed five years, it is clear that Altria has not outshone the esteemed S&P 500 in terms of price appreciation. However, it may still boast a modicum of success, having surpassed the broader market index on a total-return basis for both the past year and over five years, which, one might argue, reveals a certain resilience amidst adversity. The accompanying charts elucidate this comparison with clarity.

Altria vs S&P 500 1-year chart:

Altria vs S&P 500 3-year chart:

Altria vs. S&P 500 5-year chart:

Indeed, one can observe that while Altria’s stock performance may be considered modest in the grand tapestry of investment returns, its devotion to dividends remains commendable. Notably, the company has witnessed a most unfortunate turn of events regarding its $12.8 billion investment in Juul, which has, alas, been rendered nearly defunct by regulatory measures. Furthermore, its dalliance with cannabis grower Cronos Group has proven equally unfruitful, casting further shadows upon its otherwise illustrious portfolio.

Has Altria paid off for investors?

For many discerning investors, Altria’s charm lies not merely in the subtleties of its stock performance but rather in the generous dividends it bestows upon its faithful shareholders. With a historical propensity for yielding substantial dividends and a commendable record of annual increases-sixty times over the last fifty-six years to be precise-it is no wonder that the current dividend yield hovers at an impressive 7.2%. This confounding combination of yield and reliability renders it a most attractive proposition for the dividend-seeking investor.

As we gaze into the horizon of potential future developments, one must consider that although the sales of traditional cigarettes continue to wane, Altria intends to stimulate its profits through judicious price increases and the introduction of novel products. Noteworthy among these are Njoy, a vaporizer brand acquired post-Juul, and On!, an oral nicotine pouch set to challenge the likes of Philip Morris’s Zyn.

Presently, Altria’s trading at a lowly price-to-earnings ratio of 11.3 evokes a sense of opportunity for the sagacious investor. Should it succeed in garnering growth from its innovative offerings, one might anticipate not only the possibility of price appreciation but also the continued gratification of a robust dividend. Thus, the prudent investor may find that amidst uncertainty, Altria still holds the promise of financial rewards, albeit with an air of cautious optimism. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2025-12-18 17:03