In the vast library of corporate strategy, where every decision is a book written in shifting sands, few volumes are as intriguing as the one penned by Nvidia (NVDA). Its stock-propelled by the artificial intelligence boom-has risen 1,200% over five years, like a labyrinthine tower ascending into infinity. The reason for this ascent? Nvidia has become not merely a designer of AI chips but the very architect of dreams for those who seek to harness machine intelligence. It does not sell mere tools; it sells keys to unlock futures yet unwritten.

Such feats have yielded revenues that grow like fractals, doubling and redoubling with each passing quarter. The projections for AI investment stretch before us like an endless mirror corridor, reflecting possibilities that seem to multiply without end. And within this hall of mirrors stands Nvidia, poised to deliver earnings gains as inexorable as time itself. Yet even as investors marvel at its trajectory, another chapter unfolds: the company’s decision to repurchase $60 billion of its own shares-a sum so vast it echoes through the corridors of finance like the footfalls of some mythic creature.

A Treasury of Reflections

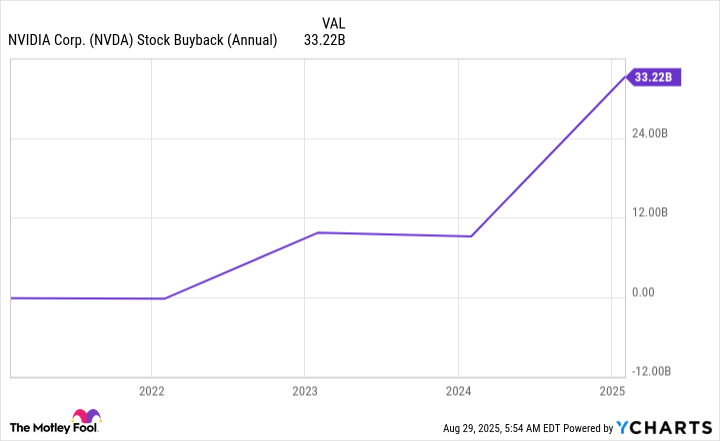

Nvidia’s buybacks are no new phenomenon. They form part of a grander narrative, wherein companies return wealth to shareholders much as ancient librarians returned forgotten manuscripts to their rightful shelves. In the first half of this year alone, Nvidia returned $24 billion to investors via repurchases and dividends. Consider the chart below, which depicts these transactions not as mere numbers but as constellations in the night sky of capital.

This act of self-purchase places Nvidia among titans such as Apple, Alphabet, and JPMorgan Chase, all of whom have announced billions in share repurchases. Together, they have pushed total repurchases past $1 trillion by August-a figure so colossal it resembles the infinite library dreamed by Borges himself, where every possible combination of letters exists simultaneously.

Share buybacks, when viewed through the lens of metaphor, appear as acts of confidence. By reducing the number of shares in circulation, management creates a paradoxical effect: fewer shares mean greater value per remaining unit, akin to removing pages from a book to make each remaining page more precious. But beware the shadow cast by this light. Some critics argue that buybacks artificially inflate earnings per share, creating illusions rather than realities. Others lament that funds might better serve innovation or expansion-like scholars who prefer new books over restored ones.

The Architecture of AI

Let us now turn our gaze to Nvidia’s role in the construction of AI infrastructure-a labyrinth whose walls are built of silicon and circuits. Though its growth has slowed from triple digits to double, it remains robust, promising solid earnings far into the future. Nvidia envisions $4 trillion in AI data center spending this decade, and as the preeminent supplier of chips, it will inevitably reap rewards from this torrent of investment.

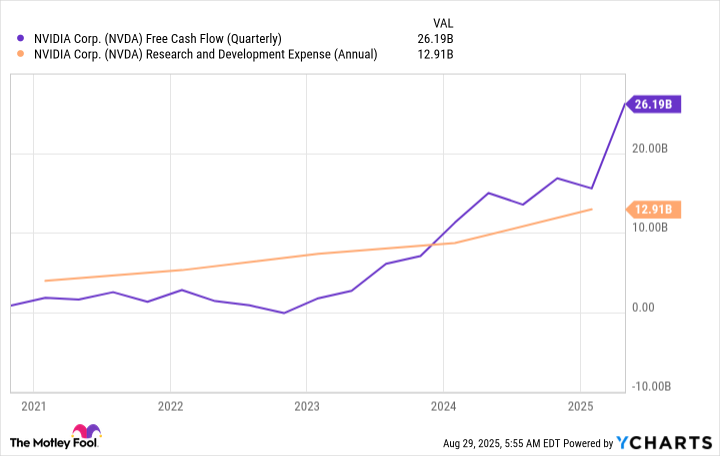

Meanwhile, Nvidia continues to invest heavily in research and development, ensuring its technological edge remains sharp. Its Blackwell architecture, unveiled last year, already boasts updates, while whispers speak of Rubin, its successor, waiting just beyond the horizon. Free cash flow rises steadily, suggesting that Nvidia navigates its labyrinthine finances with the precision of a master cartographer.

Thus, Nvidia’s decision to repurchase shares appears less as folly and more as affirmation-a declaration that its path forward is clear despite the mazes of uncertainty surrounding it. For seasoned investors, this signals opportunity. To hold Nvidia stock is to hold a fragment of an infinite library, where each page reveals new wonders. As we close this volume, let us remember: the labyrinth is not to be feared but embraced 🌌.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-09-01 03:37