Ah, Wall Street! That grand bazaar of human folly and ambition, where men in tailored suits worship at the altar of numbers rising and falling like the chest of a consumptive patient. The year is 2025, and what a spectacle it has been! One moment, the market tumbles like a drunken nobleman down marble stairs; the next, it soars like an overfed pigeon startled by a carriage horn.

Consider, if you will, that most revered of benchmarks – the S&P 500 (^GSPC). In early April, it suffered a decline so precipitous that one might think all America’s businesses had simultaneously forgotten how to turn a profit. A 10.5% drop in two days! Numbers like these make even the stoutest broker reach for his flask and smelling salts.

And yet, like some phoenix rising from the ashes of its own ridiculousness, the market rebounded with such vigor that it reached new heights scarcely imaginable during those dark days of spring. The Nasdaq Composite (^IXIC), that favorite plaything of speculative gentlemen, breached 21,000 points – a number so large it might as well represent the grains of sand on Coney Island. The Dow Jones Industrial Average (^DJI), that dignified elder statesman of indexes, stood a mere four points from glory.

The reasons? Artificial intelligence, they say – as if machines could possess wit! Trade deals struck by the Trump administration – as if commerce between nations were some new invention! These explanations flutter about like rumors in a provincial town.

But I digress… for I must tell you of a most peculiar forecasting tool…

A Most Reliable Harbinger of Doom

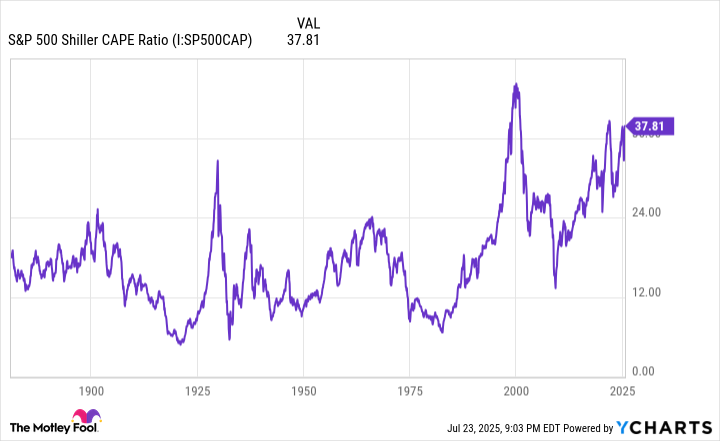

Let it be known that nothing in this world is certain – not death, not taxes, and certainly not stock returns. And yet there exists a valuation metric with a track record as flawless as a bureaucrat’s collection of rubber stamps. I speak, of course, of the Shiller P/E Ratio, also known to scholars of finance as the CAPE Ratio.

Unlike common P/E ratios that look only twelve months into the past like some myopic shopkeeper counting yesterday’s receipts, the Shiller P/E examines ten years – adjusting for inflation with all the precision of a St. Petersburg tax assessor measuring a merchant’s warehouse. This methodology smooths away temporary disturbances like economic crises, wars, and that time in 2020 when everyone forgot how to make toilet paper.

As of late July, this ratio stood at 38.79 – a figure so high it brings to mind the price of cucumbers in Moscow during Lent. Only twice before has it been higher: during that delightful period when internet companies were valued based on how many cats their websites could display (1999), and just before the 2022 bear market when investors realized perhaps growth couldn’t continue forever.

History shows that whenever this ratio surpassed 30 – on five previous occasions – the market subsequently collapsed like a poorly constructed chicken coop. The declines ranged from 20% (merely painful) to 89% (the sort of loss that makes a man take up beet farming).

To reach a more reasonable Shiller P/E of 27 – still hardly a bargain – the S&P 500 would need to shed about 30% of its value. Imagine! Nearly a third of all those carefully hoarded gains disappearing like vodka at a government function!

The Patient Investor’s Salvation

But take heart, dear reader! While markets may rise and fall like the hems of fashionable ladies’ dresses, time remains the investor’s staunchest ally. Consider the research of those diligent fellows at Crestmont, who examined 106 rolling 20-year periods from 1900 onward. Every single one produced positive returns – even those that included world wars, depressions, and the invention of disco.

Bespoke Investment Group’s research reveals an even more comforting truth: bear markets average less than 10 months – barely enough time to properly break in a new pair of boots – while bull markets persist for years, like gossip about the mayor’s daughter.

Should this Shiller P/E prophecy come to pass – should the market indeed surrender 30% of its value – the wise investor will not panic like a provincial seeing his first locomotive. Instead, he will recognize opportunity, knowing that time favors those who wait, while speculators inevitably end up like that unfortunate man in Kiev who bet his entire fortune on turnip futures.

After all, in investing as in life, patience is the virtue recognized by every sensible person, practiced by none, and rewarded by providence. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2025-07-26 10:19