Right. The S&P 500.1 A collection of five hundred companies, mostly American, vying for dominance in the great game of commerce. It’s a bit like a particularly fractious committee, except instead of arguing about stationery, they’re arguing about, well, everything. And people, bless their optimistic hearts, invest in it. In funds about the fund. It’s layers all the way down, isn’t it?

Now, these funds, these Exchange Traded Things – ETFs, they call them – are generally quite sensible. But there’s a creeping imbalance, a subtle shift in the magical energies that govern the market, and it’s all down to the tech giants. It’s not that they’re bad, you understand. It’s just… a lot of the index is now, shall we say, enthusiastically populated by companies whose business models involve convincing people they need things they didn’t know existed five minutes ago.

The Rise of the Silicon Gods

Most of these ETFs weigh things by ‘market capitalisation’. A fancy term for ‘whoever has the most gold gets the biggest say’. This isn’t inherently wrong. It’s just that the biggest piles of gold are increasingly concentrated in the hands of a few companies. Nvidia, Apple, Microsoft… they’re not just companies, they’re practically sovereign states.2 Combined, they account for a worrying proportion of the entire index. Twenty percent, give or take a few digital dragons.

Tech stocks can be lucrative, of course. They can also be… excitable. Volatile, the market analysts call it. A polite way of saying they tend to swing wildly between ‘assured success’ and ‘impending doom’. And a lot of them are deeply involved in the development of Artificial Intelligence. Which, let’s be honest, sounds less like a technological revolution and more like a very complicated way to automate being annoyed.

The problem isn’t that tech is bad. The problem is putting all your eggs in one, increasingly digital, basket. It’s a bit like building a castle on a particularly enthusiastic cloud. Solid enough, until the wind changes.

A More… Equitable Distribution of Risk

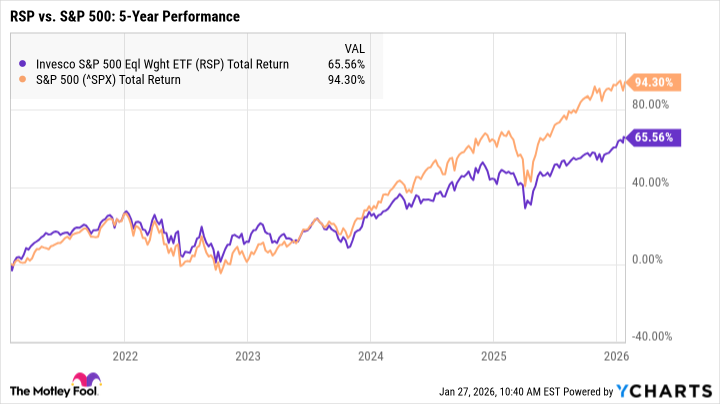

Now, there are alternatives. S&P 500 ETFs are still perfectly good investments, if you enjoy a bit of calculated risk. But if you’re looking for something a little less… concentrated, there’s the equal-weighted S&P 500 ETF. The Invesco S&P 500 Equal Weight ETF (RSP 0.04%) to be precise. It still holds all 500 companies, but gives them all roughly the same amount of influence. It’s a bit like giving every member of the committee an equal vote, regardless of how much gold they have.

The advantage is diversification. No single company can drag the whole fund down with it. The downside is that it might not grow as quickly. It’s a bit like a well-balanced diet. It won’t give you a sugar rush, but it will keep you alive longer.

Over the past five years, the standard S&P 500 has outperformed the equal-weighted version. Not surprising, given the tech boom. But in 2022, during the market downturn, the equal-weighted ETF fared significantly better. It didn’t escape unscathed, of course. Nothing does. But it didn’t plummet quite as dramatically. It’s a bit like having a slightly thicker mattress. It doesn’t prevent you from falling, but it softens the landing.

So, if you’re worried about market turbulence, an equal-weighted ETF might be worth considering. Just remember that less exposure to tech stocks can sometimes mean lower long-term returns. It’s a trade-off. Everything is a trade-off. Even existence, if you think about it.

1 The S&P 500. A benchmark index. Essentially, a list of companies that everyone agrees are important. Or at least, important enough to be on a list. The criteria for inclusion are complex and involve a lot of accountants. And accountants, as everyone knows, are the true masters of the universe.

2 These companies have more resources than many countries. They lobby governments, influence policy, and generally behave like… well, like very large, very powerful entities. It’s not necessarily a bad thing. But it’s something to be aware of. Especially when you’re entrusting them with your savings.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-01-28 21:03