It is a curious habit of the market to seek saviors. Mr. Michael Burry, once lauded for anticipating the predictable collapse of the housing bubble, now proposes another unlikely redemption. This time, the object of his faith is not the exposure of folly, but the apparent reinvention of GameStop.

The company, once a purveyor of plastic discs, is now presented as a potential analogue to Berkshire Hathaway. This claim warrants scrutiny, not celebration. Mr. Burry’s recent purchase of GameStop shares, while perhaps motivated by a genuine belief in its leadership, feels less like shrewd investment and more like a desperate search for a narrative.

The Cohen Experiment

The reasoning, as presented, rests almost entirely on the character of Mr. Ryan Cohen, GameStop’s Chief Executive. He is, it is said, a latter-day Warren Buffett. The comparison is, frankly, preposterous. Mr. Buffett built his empire on a foundation of patient, value-driven investment in established, profitable businesses. Mr. Cohen has, thus far, remade a failing retailer. There is a difference, a substantial one.

He has, admittedly, introduced digital commerce and dabbled in collectibles, even venturing into the volatile world of Bitcoin. These are gestures, not strategies. They are attempts to appear innovative, to distract from the fundamental weakness of the underlying business. The purchase of Bitcoin, while generating headlines, is a negligible investment for a company of GameStop’s size and ambition. It is a flourish, not a foundation.

Mr. Cohen’s most significant investment remains GameStop stock itself. He holds a substantial stake, and may acquire more. This is not a sign of confidence, but of a lack of opportunity. A true investor seeks external ventures, diversifying risk and expanding horizons. To invest primarily in one’s own company is to admit that one sees no better prospects elsewhere.

The Illusion of Value

To equate Mr. Cohen with Mr. Buffett is to ignore the decades of disciplined investing that built Berkshire Hathaway. Mr. Buffett’s purchases of American Express and Coca-Cola were not gambles on potential, but acquisitions of established, profitable companies with enduring competitive advantages. GameStop possesses none of these qualities.

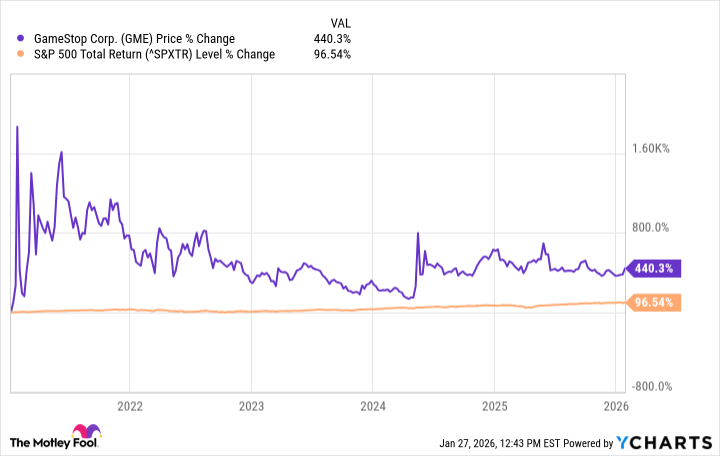

The market, it seems, is easily seduced by narratives of transformation. A failing company, skillfully rebranded, can appear remarkably attractive. But appearances can be deceiving. The core business remains fragile, dependent on fickle consumer trends and susceptible to disruption. The outperformance of the S&P 500 is a temporary phenomenon, a consequence of market speculation, not sustainable growth.

The claim that GameStop could become a conglomerate is, at best, wishful thinking. Mr. Cohen has demonstrated an ability to manage a turnaround, but building a diversified empire requires a different set of skills, a different temperament. It requires patience, prudence, and a deep understanding of value. These qualities have yet to be convincingly demonstrated.

A Cautionary Note

The question is not whether GameStop can continue to outperform the market in the short term, but whether it can build a sustainable, profitable business over the long term. The answer, I suspect, is no. The current valuation is based on hope, not reality. Investors who purchase GameStop stock at these levels are not investing in a company, but in a story.

It is a dangerous game, this pursuit of transformative narratives. The market is littered with the wreckage of companies that promised too much and delivered too little. A prudent investor should approach GameStop with skepticism, not enthusiasm. Speculative positions may be justified, but aggressive purchases are a folly. The illusion of transformation is a powerful force, but it is rarely a source of lasting value.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-01 14:23