The age has brought forth marvels, yes, but also anxieties previously unknown. We speak now of artificial intelligence, a force lauded as progress, yet one which simultaneously breeds a new and insidious class of peril. The digital realm, once a frontier of boundless opportunity, is becoming a battlefield, and the skirmishes are escalating with a speed that chills even the most seasoned observer. Unit 42, a division devoted to charting these treacherous currents, reports that the most grievous breaches now occur with fourfold haste compared to a mere year prior. Less than an hour, they say, is now sufficient for the skillful predator to penetrate defenses and lay claim to valuable data. It is a sobering thought, and one that speaks to the vanity of believing we can truly master the forces we unleash.

And the proliferation of these ‘intelligent’ chatbots and ‘agents’—these digital mimics of human interaction—have created fresh vulnerabilities. Each new line of code, each attempt to automate convenience, introduces a potential avenue for exploitation. It is as if, in constructing ever more elaborate fortresses, we have unwittingly left open secret passages for the enemy. These risks were scarcely conceivable a few years past, and yet they are now the daily bread of those who dwell in the digital world. One cannot help but wonder if we are not building our own gilded cages.

Palo Alto Networks, a company positioning itself as a bulwark against these rising tides, offers its services to those who would seek protection. Its fortunes have risen of late, yet its stock, curiously, has experienced a decline – nearly thirty percent from its peak. This, in a market obsessed with fleeting valuations, presents a peculiar opportunity. A share can now be acquired for less than one hundred and sixty dollars, a sum that seems paltry when weighed against the potential cost of a successful breach. But let us not mistake a temporary dip in price for a genuine bargain. The market, after all, is a fickle mistress, prone to both irrational exuberance and unwarranted despair.

The Promise and Peril of Automated Defense

Palo Alto Networks, a large enterprise, has staked its claim in the realm of cybersecurity, offering a multitude of products across three principal domains: cloud security, network security, and security operations. It now attempts to infuse these offerings with the very intelligence it seeks to defend against, automating the security stack in a desperate attempt to match the speed of the attackers. It is a logical, if somewhat unsettling, response – fighting fire with fire, as the saying goes. But one cannot help but ponder the implications of ceding more and more control to algorithms, of entrusting our security to machines that lack the nuance and judgment of a human mind.

The Cortex XSIAM platform, for instance, purports to automate threat detection and incident response, reducing the need for human intervention. The company claims that sixty percent of its XSIAM customers now remediate threats in under ten minutes, a marked improvement over the days or weeks it once took. Such efficiency is commendable, of course, but it also raises the specter of a world where security is reduced to a series of automated responses, devoid of critical thinking or genuine understanding. It is a world where the illusion of safety is easily mistaken for true security.

The platform has indeed found favor, boasting six hundred customers, a threefold increase over the previous year, each spending nearly a million dollars annually. Such figures are impressive, but they also reveal a troubling trend – the increasing concentration of power in the hands of a few large corporations. And while these corporations may offer effective solutions, they are ultimately driven by profit, not by a genuine concern for the well-being of society.

Palo Alto Networks also proposes a strategy of ‘platformization,’ urging customers to consolidate their security spending with a single vendor. This, it argues, will fill the gaps that hackers constantly seek to exploit. It is a seductive argument, but one that overlooks the inherent risks of putting all one’s eggs in a single basket. A unified suite may offer convenience, but it also creates a single point of failure, a vulnerability that a determined attacker could exploit to devastating effect.

Historically, cybersecurity firms specialized in specific areas, forcing businesses to piece together their defenses from multiple sources. This fragmented approach was admittedly inefficient, but it also provided a degree of resilience. In the age of chatbots and agents, however, this approach is no longer viable. These autonomous applications move seamlessly between internal systems, requiring a unified security suite to track their movements. Palo Alto Networks has positioned itself to provide such a solution, but let us not mistake a technological fix for a genuine solution to the underlying problem.

The Illusion of Growth

In the most recent quarter, Palo Alto Networks generated two point six billion dollars in revenue, a fifteen percent increase over the previous year. More significantly, its ‘next-generation security’ portfolio – which includes its AI-powered products – grew at more than twice that rate. The company boasts six point three billion dollars in annual recurring revenue, a figure that is undoubtedly impressive. But such numbers are easily manipulated, and one must always approach them with a healthy dose of skepticism.

The company has also revised its forecast for the full year, now expecting eleven point three billion dollars in revenue, a twenty-three percent increase. This, it claims, is a testament to the success of its AI-powered products and its platformization strategy. But one cannot help but wonder if this is merely a temporary surge, driven by fear and uncertainty. The market, after all, is notoriously fickle, and what is hailed as progress today may be dismissed as a fad tomorrow.

The company reports that one thousand five hundred and fifty of its customers are now ‘platformed,’ up thirty-five percent from the previous year. These customers, it claims, have a net revenue retention rate of one hundred and nineteen percent, meaning they are spending nineteen percent more money than they were a year ago. Such loyalty is commendable, but it also raises questions about the company’s pricing practices. Are these customers truly satisfied with the value they are receiving, or are they simply locked into a long-term contract?

In essence, when customers entrust all their cybersecurity needs to Palo Alto Networks, they are more likely to remain loyal and spend increasing amounts of money over time. This, the company argues, is a sign of its success. But one cannot help but wonder if it is merely a sign of its power.

A Question of Valuation

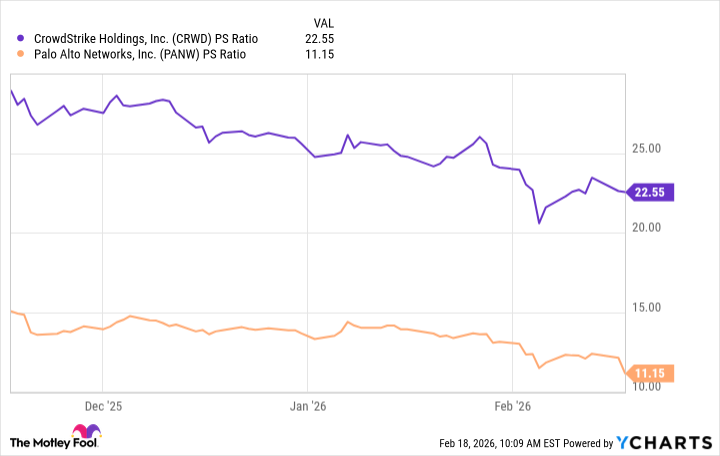

The stock of Palo Alto Networks currently trades at a price-to-sales ratio of eleven point one, a fifty percent discount to that of its rival, CrowdStrike. This, some might argue, presents a buying opportunity. But one must always consider the underlying reasons for the discrepancy. CrowdStrike, after all, is a more established player, with a proven track record of success. And while its valuation may be higher, it is also justified by its superior growth prospects.

The valuation gap does indeed seem unwarranted, particularly given that Palo Alto Networks’ next-generation security segment alone generates more annual recurring revenue than CrowdStrike’s entire business. And while Palo Alto Networks’ next-generation security segment grew by thirty-three percent in the recent quarter, CrowdStrike’s annual recurring revenue increased by only twenty-three percent. But these numbers, as we have already noted, are easily manipulated. And one must always consider the qualitative factors, such as management quality and competitive landscape.

I do not suggest that Palo Alto Networks’ stock should trade at the same valuation as CrowdStrike’s. But I believe there is a strong possibility that it will close at least some of the valuation gap, considering the momentum in its business. After all, management believes it can triple the company’s next-generation security annual recurring revenue to twenty billion dollars by fiscal 2030. But such projections are always subject to uncertainty. And one must always remember that the market is a fickle mistress, prone to both irrational exuberance and unwarranted despair. The future, as always, remains shrouded in mystery.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

2026-02-22 19:22