In the grand, perhaps labyrinthine, archives of financial discourse, there are certain figures whose names evoke more than mere recognition; they are symbols of a very specific, almost mythical, narrative. Warren Buffett, to the untrained eye, might seem like a shrewd investor with an uncanny ability to discern hidden treasures in the vast expanse of the stock market. Yet, if one were to study him under the peculiar lens of skepticism, one might suspect that his celebrated wisdom lies not in finding riches, but in fabricating the illusion of such riches. As we delve deeper into his latest investment-a stock that, to the undiscerning observer, appears “ridiculously cheap”-one must wonder if the supposed treasure is merely a cleverly designed mirage.

Buffett’s recent enthusiasm for Pool Corp. (POOL), the world’s largest distributor of swimming pool products, may at first seem like the discovery of a financial Atlantis, yet one must question whether it is truly an unspoiled oasis or merely another reflection in the glass of economic vanity. After all, we are confronted with a corporate structure whose competitive advantage, neatly framed like a well-placed mirror, seems, upon closer inspection, to be little more than an illusion of permanence-a reflection of long-standing dominance over a relatively modest niche.

The Mirage of Stability

Consider, if you will, the notion of Pool Corp. as an emblem of stability. With over 450 sales centers scattered across North America, Europe, and Australia, the company has entrenched itself as the gatekeeper of the pool industry, providing everything from construction materials to maintenance services. But the question arises: Is this truly a moat, or merely a well-trodden path that, once scrutinized, leads only to the familiar, yet unremarkable shores of predictable market behavior?

Buffett, in his latest foray, has made his stance clear, increasing his holdings in Pool Corp. by over 750% in the span of a year. And yet, it is worth pondering whether this move is the result of a calculated masterstroke, or simply the result of an investment strategy that has, for decades, succeeded in capitalizing on the inertia of stocks that are, as it were, comfortably numb. Pool’s dominance in the market is unquestionable, but one cannot help but wonder if its continued success lies in its ability to adapt to the growing pressure of external forces-interest rates, economic cycles, and the whims of nature.

The allure of Pool as an investment comes not from its potential for explosive growth, but from its position as a relatively stable player in a market that, like a stagnant pond, churns only minimally. But herein lies the rub: for all its talk of steady growth, there are underlying risks that cannot be easily ignored. Economic downturns, unpredictable weather patterns, and the unyielding pressures of interest rates are but a few of the labyrinthine complexities that could unravel the company’s carefully constructed facade.

The Language of Earnings

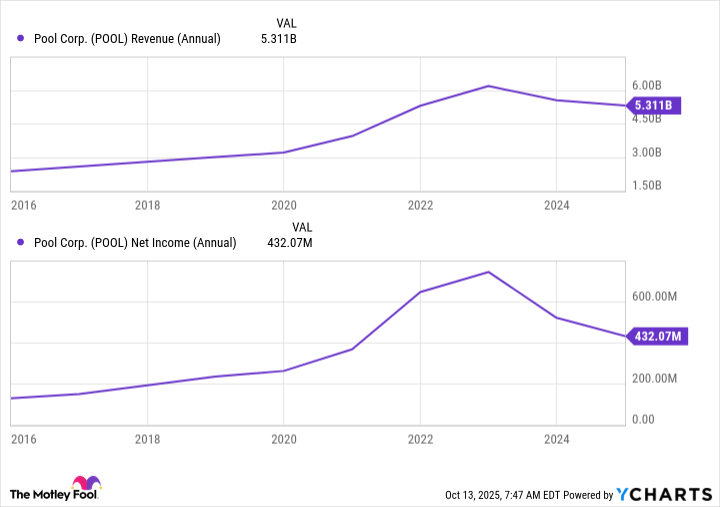

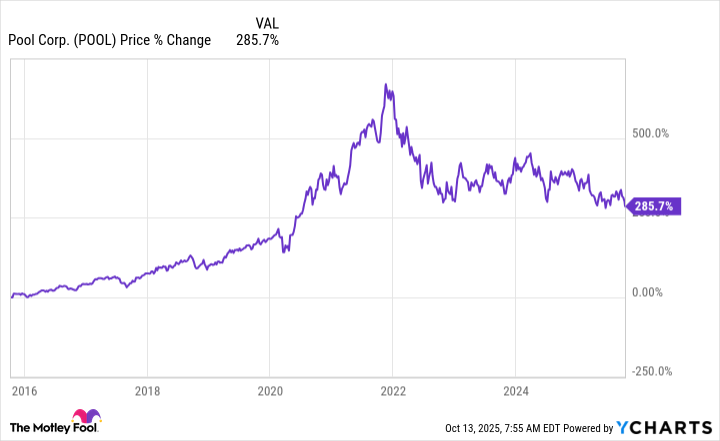

In the cryptic language of finance, words like “progressive growth” are often employed to describe stocks that are expected to climb, inch by calculated inch, like the relentless progression of a clock. Over a period of ten years, Pool has indeed seen its revenue and earnings grow-a modest, albeit notable, achievement. The figures below, though impressive in their numerical certainty, offer little in the way of surprise: triple-digit gains in revenue and net income over the past decade have propelled the stock price upwards by more than 200%. One might wonder, however, whether this growth is simply a reflection of the cyclical nature of markets, a mere step in the infinite dance of numbers that makes up the world of investing.

But can one truly speak of growth when the conditions that have fostered it are so deeply tied to the vagaries of economic cycles? Perhaps. But perhaps not. And as with all such uncertainties, one must turn to the greater mysteries of the market, where causality is often as elusive as the mirror image of oneself in an infinitely recursive pool.

The company’s most recent performance-modest increases in sales and earnings-reveals a certain resilience, but can resilience truly be equated with success? One might argue that resilience is merely the ability to survive when the world around you falls apart. It is a survival tactic, not an innovative breakthrough. Nevertheless, Buffett, with his characteristic optimism, seems content to allow this notion of resilience to serve as a cornerstone of his investment thesis.

The Echo of the Future

Looking ahead, one imagines that Pool Corp. will continue to benefit from favorable conditions-lower borrowing costs, perhaps a return to consumer confidence, and a renewed appetite for pool-related luxuries. Yet, the real question is whether such conditions, if they materialize, will be sufficient to propel the company into a new era of growth, or whether they will merely reinforce its place in the market as a slow-moving, yet steady, presence.

The stock trades at a relatively modest 26x forward earnings, down from over 35x the previous year. This decline in valuation, while perhaps suggesting a more attractive entry point for the discerning investor, is also a reminder that all markets are subject to the capricious forces of time. What was once priced as a beacon of opportunity now seems merely a potential stepping stone for those willing to venture into the uncertain future. But, as with all things in the mirror world of investing, one can never be entirely sure if the reflection is reality-or simply another layer of the illusion.

And so, as we peer into the depths of the market’s labyrinth, we are left with the familiar paradox: to invest, or not to invest? The answer, as always, is not a simple one, for it lies in the interplay between the known and the unknown, the visible and the hidden, the predictable and the unpredictable. And perhaps, in the end, that is the true nature of the market-a vast, eternal riddle that will never be fully solved, yet continues to beckon those brave enough to engage in its ceaseless game. 🌿

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ETH PREDICTION. ETH cryptocurrency

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Games That Faced Bans in Countries Over Political Themes

2025-10-14 16:22