The pursuit of fortune, a fever dream that has driven men to sail the oceans and build empires, now finds a curious echo in the realm of digital finance. We are told of ‘millionaire-making stocks,’ a phrase that rings with the hollow promise of effortless prosperity. One observes, with a certain detached amusement, the human tendency to seek shortcuts, to believe in the possibility of transforming modest sums into vast wealth with minimal exertion. Amazon, with its relentless expansion into every corner of commerce, and Apple, purveyors of beautifully crafted, yet ultimately transient, desires, stand as monuments to this ambition, testaments to the power of innovation and, perhaps, a touch of fortunate timing. But to assume that such triumphs are easily replicated is to misunderstand the very nature of enduring success.

It is a truth often obscured by the clamor of the market that not every ingenious undertaking blossoms into a financial windfall. Indeed, some of the most substantial gains accrue not from revolutionary breakthroughs, but from the steady accumulation of advantage in seemingly ordinary endeavors. This brings us to Robinhood Markets, a company that arrived upon the scene with the intention of democratizing access to the stock market, and whose recent performance has sparked a fervent, if perhaps premature, speculation about its potential to create a new class of wealthy investors.

The company’s trajectory has been undeniably impressive, a surge of nearly 200% from the depths of April’s market lull. Yet, to declare it a truly special entity requires a more discerning eye. The business model, stripped of its initial novelty, appears…unremarkable. A discount brokerage, offering a service readily available elsewhere, operates in a field where barriers to entry are practically nonexistent. Sustaining such rapid growth in the face of relentless competition seems, at best, a formidable challenge.

How Robinhood Came to Be

Launched in 2013, Robinhood entered a crowded marketplace dominated by established firms like Schwab and E*Trade. It distinguished itself, however, by focusing on mobile accessibility and, crucially, the elimination of commission fees. This was a clever maneuver, appealing to a new generation of investors eager to participate in the market without incurring traditional costs. By 2021, more than twenty million individuals were utilizing the app each month, a testament to its initial appeal.

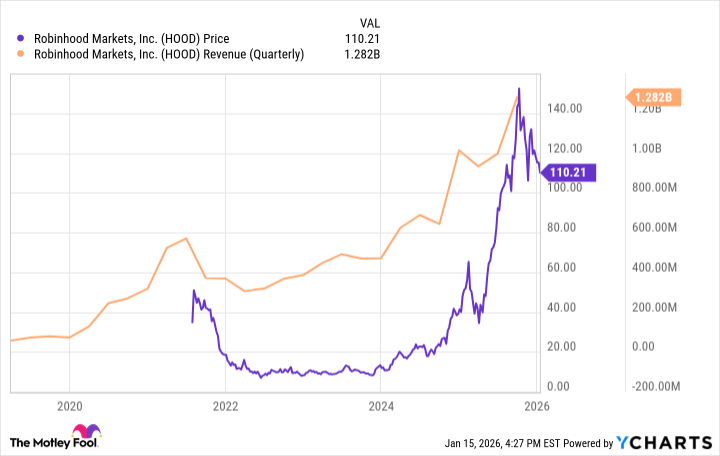

The company has since ceased reporting these monthly figures, a subtle indication, perhaps, that growth has begun to decelerate. As of the last quarter, however, 26.8 million customer accounts remain funded, and these customers, it must be admitted, are proving increasingly productive, generating revenue of $1.27 billion – a substantial sum, indeed, equivalent to $191 per user. This growth, while not entirely consistent, has mirrored the stock’s performance since its initial public offering. But to mistake momentum for permanence is a folly that many an investor has committed.

The challenge, as always, lies in maintaining this trajectory. Customer acquisition is slowing, and the company’s fortunes remain inextricably linked to market conditions and trading volume. Robinhood’s primary source of revenue is derived from directing trades to market makers, intermediaries who facilitate transactions. And as seasoned investors well know, trading activity is notoriously fickle, prone to dramatic swings and prolonged periods of quiescence.

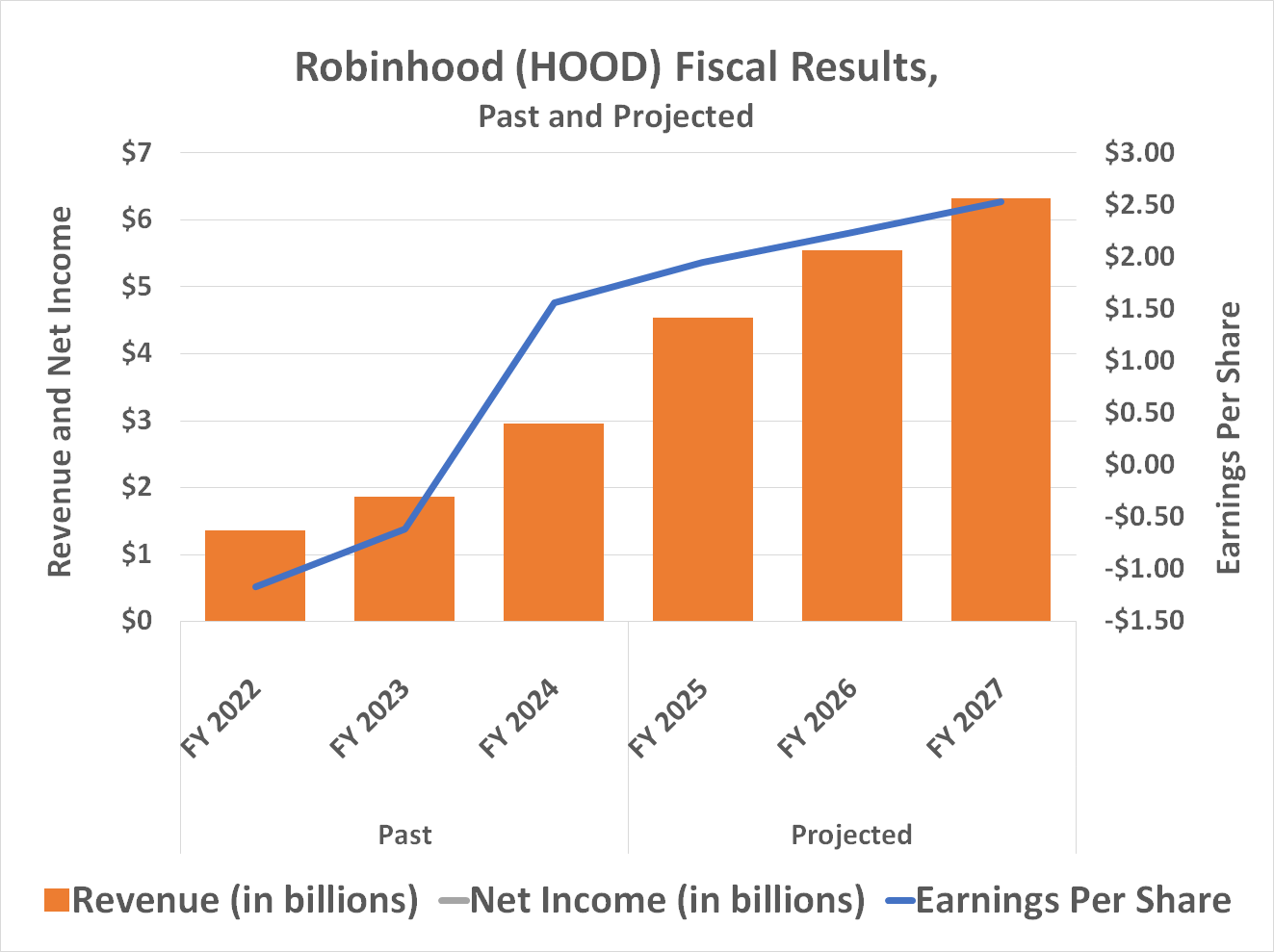

The company is attempting to diversify its revenue streams, venturing into banking services, offering credit cards, and even dabbling in private equity and prediction markets. These are ambitious undertakings, to be sure, but their success remains uncertain. They represent a gamble, a recognition that the core brokerage business will inevitably reach a plateau. The question is whether these new ventures will prove sufficiently profitable to offset the inevitable slowdown in trading revenue.

The Limits of Exponential Growth

One must acknowledge the company’s achievements. Robinhood identified a gap in the market and successfully built a mobile-specific trading app. It has also demonstrated a willingness to explore new opportunities beyond its core business. This adaptability is commendable, and it explains, in part, the recent surge in the stock price, a rally of over 1,200% from its late-2023 low.

However, this extraordinary ascent presents a problem. It raises expectations to an unsustainable level. While such gains may appear to herald a prolonged period of wealth creation, Robinhood’s businesses lack the unique qualities necessary to sustain such growth over the long term. There are no significant barriers to entry, and the company faces competition from much larger, more established players. These competitors will not simply stand aside and allow Robinhood to expand unchallenged. They will respond, and their response will inevitably exert downward pressure on the company’s valuation.

This brings us to the matter of valuation. While investors are often willing to pay a premium for growth, Robinhood’s shares are currently trading at nearly 50 times this year’s projected earnings. This is a substantial multiple, and it suggests that the market may have already priced in much of the company’s future growth. The stock’s recent weakness, beginning in October, is a reflection of this reality. The initial euphoria has begun to dissipate, and concerns about customer attrition are mounting. It appears that many of Robinhood’s retail customers are not inclined to remain loyal when the market offers fewer opportunities for quick profits.

A Measured Perspective

So, is Robinhood stock a millionaire-maker? From the vantage point of a discerning observer, the answer is…unlikely. It lacks the longevity and enduring competitive advantages that characterize companies like Amazon and Apple. The iPhone, for example, has maintained its dominance for over a decade, and Amazon’s e-commerce platform continues to expand its reach. Robinhood, by contrast, will inevitably encounter a growth ceiling, constrained by competition, market cycles, and the inherent limitations of its business model.

However, this does not mean that it cannot be a solid near-term growth holding. A prudent investor might consider acquiring shares during a market dip, as we have seen in recent weeks. But it is crucial to approach this investment with a realistic understanding of the risks involved, and to avoid the seductive illusion of instant wealth. For in the grand tapestry of financial history, the pursuit of effortless fortune has rarely led to lasting prosperity.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-19 15:53